Form 1040 SR U S Tax Return for Seniors 2023

What is the Form 1040 SR U S Tax Return For Seniors

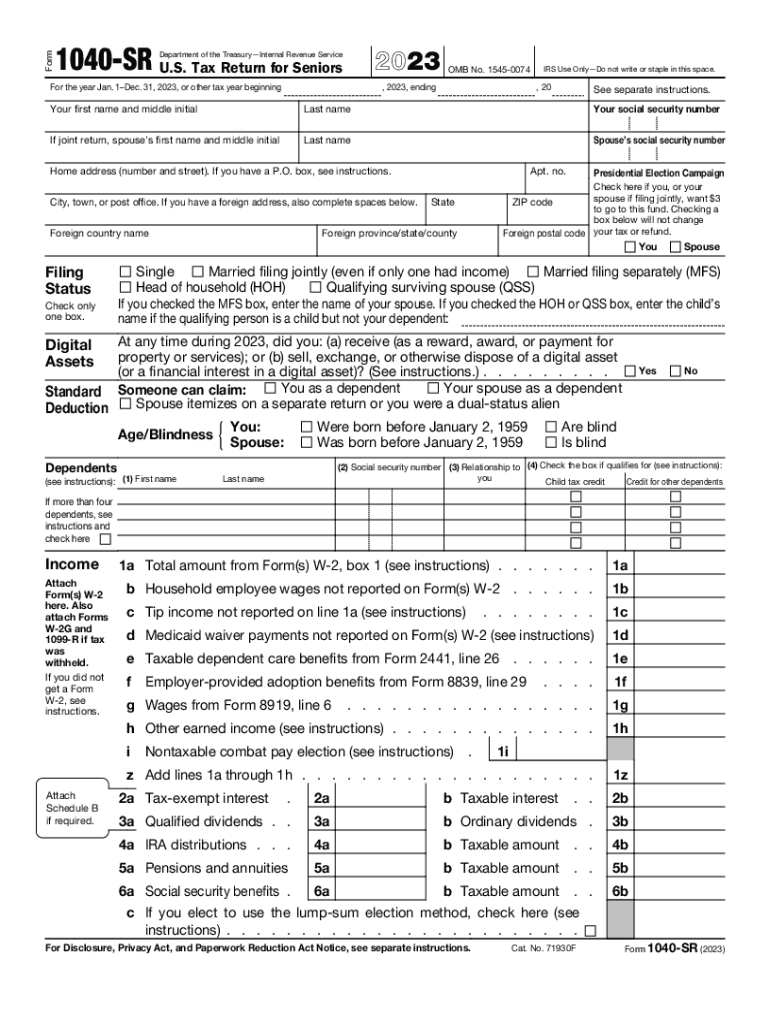

The Form 1040 SR is a simplified tax return designed specifically for seniors aged sixty-five and older. This form allows eligible taxpayers to report their income, claim deductions, and calculate their tax liability in a straightforward manner. The 1040 SR is similar to the standard Form 1040, but it includes larger print and a more user-friendly layout, making it easier for seniors to read and complete. It accommodates various income types, including pensions, Social Security benefits, and interest income, ensuring that seniors can accurately report their financial situation.

How to obtain the Form 1040 SR U S Tax Return For Seniors

To obtain the 2023 IRS Form 1040 SR, taxpayers can visit the official IRS website, where the form is available for download in PDF format. Additionally, physical copies of the form can be requested by calling the IRS or visiting local IRS offices. Many libraries and community centers also provide access to tax forms during the tax season. It is advisable to ensure that the correct version for the tax year is being used, as forms may vary from year to year.

Steps to complete the Form 1040 SR U S Tax Return For Seniors

Completing the Form 1040 SR involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as name, address, and Social Security number at the top of the form.

- Report income in the designated sections, ensuring all sources are included.

- Claim deductions and credits applicable to your situation, which can help reduce taxable income.

- Calculate total tax liability and any refund or amount owed.

- Sign and date the form before submitting it.

Legal use of the Form 1040 SR U S Tax Return For Seniors

The Form 1040 SR is legally recognized by the IRS for seniors to file their annual income tax returns. It complies with federal tax laws and regulations, ensuring that seniors can fulfill their tax obligations accurately and on time. Using the correct form is crucial, as filing with an incorrect form can lead to delays in processing and potential penalties. Taxpayers should retain copies of their completed forms and any supporting documents for their records.

Eligibility Criteria

To qualify for using the Form 1040 SR, taxpayers must be at least sixty-five years old by the end of the tax year. Additionally, the form is intended for individuals or couples whose income falls within certain limits. It is designed for those who do not need to file schedules for additional income types, such as self-employment income. Understanding these eligibility criteria helps ensure that seniors select the appropriate form for their tax filing needs.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 1040 SR. The form can be filed electronically using IRS-approved e-filing software, which often simplifies the process and speeds up refunds. Alternatively, seniors can print the form and mail it to the IRS, ensuring that it is sent to the correct address based on their state of residence. For those who prefer in-person assistance, local IRS offices may offer help with filing, although appointments may be necessary.

Quick guide on how to complete form 1040 sr u s tax return for seniors

Complete Form 1040 SR U S Tax Return For Seniors with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1040 SR U S Tax Return For Seniors on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest method to alter and eSign Form 1040 SR U S Tax Return For Seniors effortlessly

- Find Form 1040 SR U S Tax Return For Seniors and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 1040 SR U S Tax Return For Seniors and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sr u s tax return for seniors

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sr u s tax return for seniors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 IRS Form 1040 SR printable?

The 2023 IRS Form 1040 SR printable is a simplified tax form designed specifically for seniors. It allows individuals aged 65 and older to file their federal income tax returns easily. This version features larger print and eliminates the need for some additional schedules, making the filing process more straightforward.

-

How can I access the 2023 IRS Form 1040 SR printable?

You can easily access the 2023 IRS Form 1040 SR printable through the IRS website or by using e-signing platforms like airSlate SignNow. These platforms allow users to download the form directly and provide a secure environment to fill it out electronically. This ensures your filing is both quick and efficient.

-

Are there any costs associated with using the 2023 IRS Form 1040 SR printable?

The 2023 IRS Form 1040 SR printable itself is free to download from the IRS website. However, if you use services like airSlate SignNow for additional features such as e-signing and document management, there may be associated fees. These costs often provide signNow time savings and convenience.

-

What features does airSlate SignNow offer for the 2023 IRS Form 1040 SR printable?

airSlate SignNow offers a variety of features for the 2023 IRS Form 1040 SR printable, including easy document uploading, customizable templates, and secure e-signing. With these tools, users can manage their tax documents seamlessly, ensuring compliance and reducing the likelihood of errors. It's an ideal solution for both individuals and businesses.

-

Can I integrate airSlate SignNow with other tax software for filing the 2023 IRS Form 1040 SR printable?

Yes, airSlate SignNow can integrate with various tax software solutions, streamlining the process of filing the 2023 IRS Form 1040 SR printable. This allows users to import data directly into their forms, saving time and reducing manual entry errors. Such integration enhances efficiency, especially during tax season.

-

What are the benefits of using airSlate SignNow for the 2023 IRS Form 1040 SR printable?

Using airSlate SignNow for the 2023 IRS Form 1040 SR printable offers numerous benefits, including time savings, convenience, and enhanced security. With e-signature capabilities, you can quickly send, sign, and manage documents from any device. This modern approach to tax filing simplifies the entire process.

-

Is the 2023 IRS Form 1040 SR printable available in multiple formats?

Yes, the 2023 IRS Form 1040 SR printable is available in various formats, including PDF, which is widely used for official tax documents. This versatility ensures that you can fill it out digitally or print it for handwritten submissions. airSlate SignNow also supports these formats to facilitate seamless document handling.

Get more for Form 1040 SR U S Tax Return For Seniors

- Justificantepersonal estudiaen form

- Assist questionnaire form

- Systems of equations and inequalities project form

- How to fill format 404

- Ups shipping label template form

- Vsp out of network reimbursement form blue cross of idaho

- County of san diegochild health and disability pre form

- Golf registration form pdf ceaescrow

Find out other Form 1040 SR U S Tax Return For Seniors

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online