Form 943 Employer's Annual Federal Tax Return for 2021

What is the Form 943 Employer's Annual Federal Tax Return For

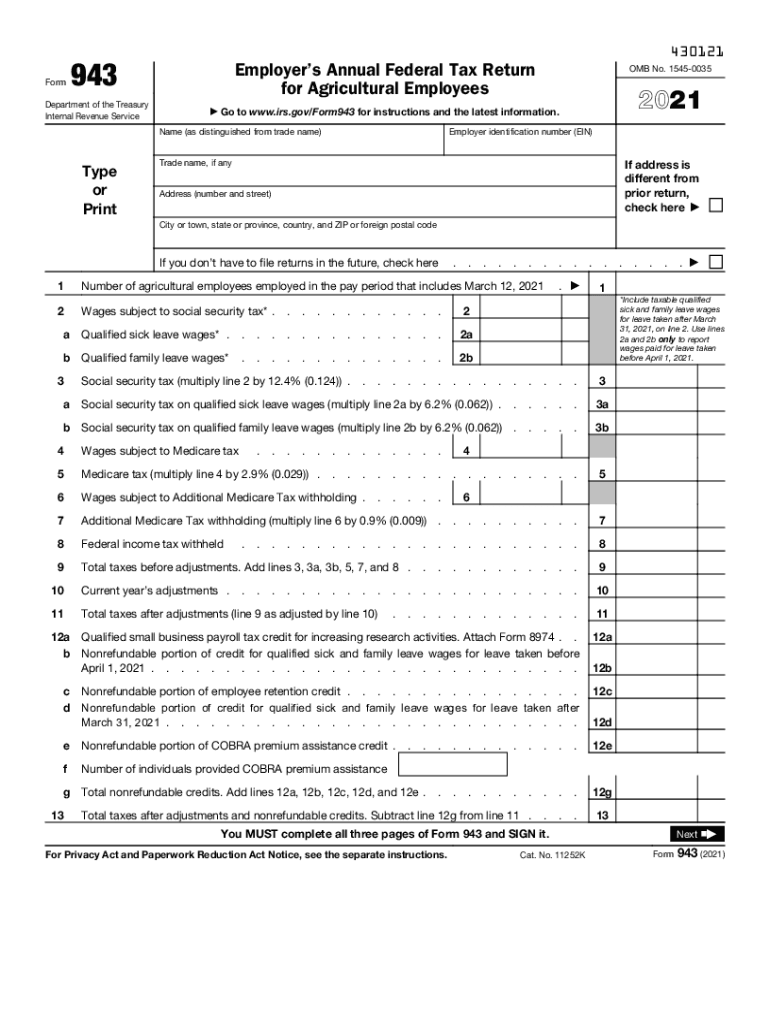

The Form 943, also known as the Employer's Annual Federal Tax Return for Agricultural Employees, is a tax form used by employers in the agricultural sector to report income taxes withheld from their employees' wages. This form is specifically designed for agricultural businesses that pay wages to farmworkers and is crucial for reporting federal income tax, Social Security tax, and Medicare tax. Understanding the purpose of this form is essential for compliance with federal tax regulations and ensuring that all necessary taxes are accurately reported to the IRS.

Steps to complete the Form 943 Employer's Annual Federal Tax Return For

Completing the Form 943 involves several key steps to ensure accuracy and compliance. First, gather all relevant payroll records for the tax year, including total wages paid to agricultural employees and any taxes withheld. Next, fill out the form by entering the employer's information, including name, address, and Employer Identification Number (EIN). Report the total wages paid and the amount of federal income tax withheld. Finally, review the completed form for accuracy before submitting it to the IRS. It is important to keep a copy of the submitted form for your records.

Filing Deadlines / Important Dates

The filing deadline for the Form 943 is typically January 31 of the year following the tax year being reported. For example, the 2018 Form 943 must be filed by January 31, 2019. If this date falls on a weekend or holiday, the deadline may be adjusted. Employers should also be aware of any additional deadlines related to tax payments, as failure to meet these deadlines can result in penalties. Staying informed about these important dates is crucial for maintaining compliance with IRS regulations.

Legal use of the Form 943 Employer's Annual Federal Tax Return For

The legal use of the Form 943 is governed by IRS regulations, which stipulate that employers must accurately report all wages paid and taxes withheld from agricultural employees. This form serves as an official record of compliance with federal tax laws and is essential for avoiding penalties. Additionally, the form must be signed and dated by an authorized representative of the business to validate its legal standing. Employers should ensure that they adhere to all legal requirements when completing and submitting the form to protect their business interests.

How to obtain the Form 943 Employer's Annual Federal Tax Return For

Employers can obtain the Form 943 from the IRS website, where it is available for download in PDF format. Additionally, the form can be requested by calling the IRS directly or by visiting a local IRS office. It is important to ensure that you are using the correct version of the form for the specific tax year, as there may be updates or changes in the requirements. Keeping a supply of the form on hand can help streamline the filing process each year.

Penalties for Non-Compliance

Failure to file the Form 943 on time or inaccuracies in reporting can lead to significant penalties imposed by the IRS. These penalties may include fines for late filing, as well as additional charges for underreporting wages or taxes owed. Employers may also face interest charges on any unpaid taxes. To avoid these penalties, it is essential to file the form accurately and on time, ensuring all information is complete and correct.

Quick guide on how to complete form 943 employers annual federal tax return for

Complete Form 943 Employer's Annual Federal Tax Return For effortlessly on any device

Online document management has become increasingly popular among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 943 Employer's Annual Federal Tax Return For on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and eSign Form 943 Employer's Annual Federal Tax Return For with ease

- Find Form 943 Employer's Annual Federal Tax Return For and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 943 Employer's Annual Federal Tax Return For and ensure flawless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 943 employers annual federal tax return for

Create this form in 5 minutes!

How to create an eSignature for the form 943 employers annual federal tax return for

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the IRS 943 2018 form used for?

The IRS 943 2018 form is used by employers in agriculture to report annual income tax withheld from their employees' wages. It provides the IRS with essential data on employment tax liabilities for the year, ensuring compliance and accurate reporting.

-

How can airSlate SignNow help with the IRS 943 2018 form?

airSlate SignNow simplifies the process of managing and eSigning important documents like the IRS 943 2018 form. With our user-friendly platform, you can quickly send, sign, and store your tax documents securely, reducing paper waste and enhancing workflow efficiency.

-

What features does airSlate SignNow offer for IRS 943 2018 filings?

AirSlate SignNow offers features like document templates, in-person signing, and integration with various document management systems, all tailored to support the IRS 943 2018 filing process. These features streamline and simplify document handling for employers.

-

Is airSlate SignNow cost-effective for small businesses filing IRS 943 2018?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to file the IRS 943 2018 form. Our competitive pricing plans ensure that even small operations can access professional-level eSignature services without straining their budget.

-

Can I integrate airSlate SignNow with my current accounting software for IRS 943 2018?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing for easy transfer of document data related to IRS 943 2018 filings. This integration simplifies the overall process, ensuring that your financial records and tax documents are always in sync.

-

What are the benefits of using airSlate SignNow for IRS 943 2018 eSigning?

Using airSlate SignNow for your IRS 943 2018 eSigning provides numerous benefits such as enhanced security, faster turnaround times, and a fully digital workflow. With our platform, you can ensure confidentiality while expediting the signing process, improving overall operational efficiency.

-

Is it easy to track the status of IRS 943 2018 forms with airSlate SignNow?

Yes, airSlate SignNow offers easy tracking features that allow you to monitor the status of your IRS 943 2018 forms in real-time. You’ll receive notifications at each stage of the signing process, ensuring you stay updated without having to check manually.

Get more for Form 943 Employer's Annual Federal Tax Return For

- Order appointing guardian 497300072 form

- Affidavit acceptance form

- Trust registration statement colorado form

- Colorado amended form

- Petition claims form

- Petition claims 497300077 form

- Notice to unborn or unascertained persons through notice to known persons having substantially identical interests colorado form

- Final accounting form

Find out other Form 943 Employer's Annual Federal Tax Return For

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online