Form 943 for 2016

What is the Form 943 For

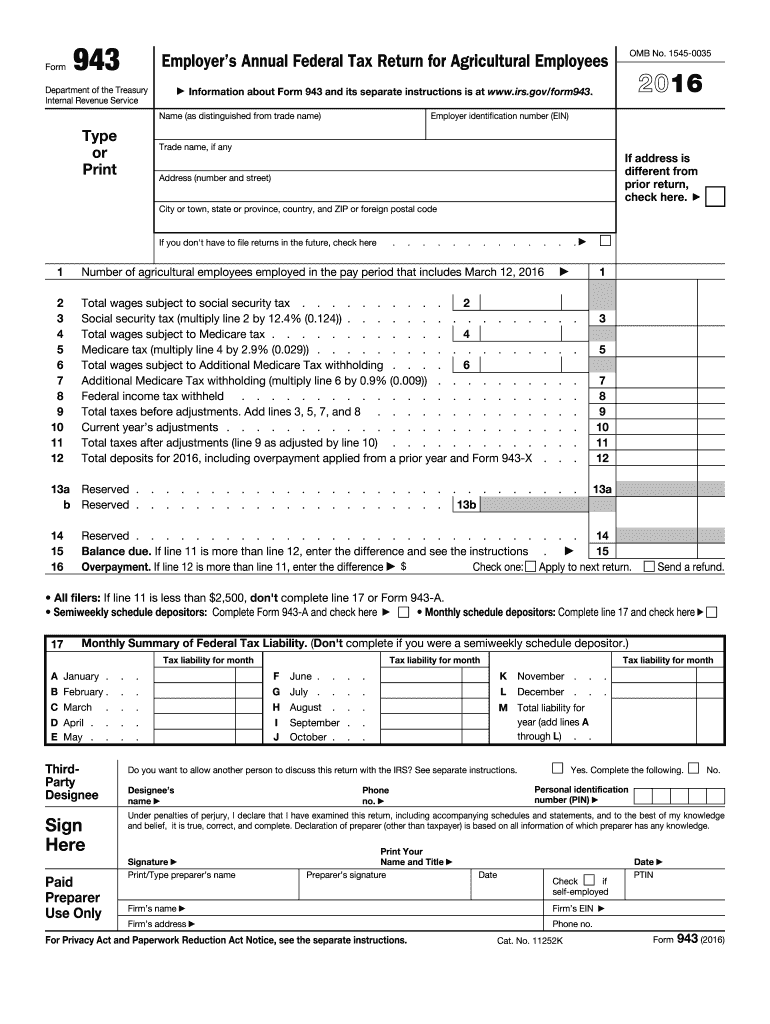

The Form 943 is specifically designed for agricultural employers in the United States to report annual wages paid to their employees and the associated federal income tax withheld. This form is essential for those who operate farms and are subject to federal employment tax regulations. It helps ensure compliance with IRS requirements and enables employers to accurately report their tax liabilities for the year.

How to use the Form 943 For

To utilize Form 943 effectively, employers must first gather all necessary payroll information for the tax year, including total wages paid and federal income tax withheld. The form requires detailed reporting of employee information, including Social Security numbers and the amounts withheld for each employee. Once completed, the form should be submitted to the IRS, either electronically or via mail, depending on the employer's preference and the IRS guidelines.

Steps to complete the Form 943 For

Completing Form 943 involves several key steps:

- Gather payroll records for the tax year, including total wages and tax withheld.

- Fill in the employer information, including name, address, and Employer Identification Number (EIN).

- Report the total wages paid to employees and the total federal income tax withheld.

- Provide detailed information for each employee, including their Social Security number and the amount of wages paid.

- Review the form for accuracy before submission.

Legal use of the Form 943 For

Form 943 is legally binding when filled out correctly and submitted according to IRS regulations. It must comply with the requirements set forth by the IRS, including accurate reporting of wages and taxes. Employers should ensure that they keep copies of submitted forms and any supporting documentation, as these may be necessary for audits or inquiries from the IRS.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with Form 943. Generally, the form is due by January thirty-first of the year following the tax year being reported. If the due date falls on a weekend or holiday, the deadline extends to the next business day. Timely submission is crucial to avoid penalties and ensure compliance with federal tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Form 943 can be submitted through various methods, offering flexibility for employers. The IRS allows electronic filing for those who prefer a quicker submission process. Alternatively, employers can mail the completed form to the designated IRS address based on their location. In-person submission is generally not an option for Form 943, as the IRS encourages electronic or mail submissions for efficiency.

Quick guide on how to complete form 943 for 2016

Effortlessly prepare Form 943 For on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without holdups. Manage Form 943 For on any system with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Form 943 For with ease

- Acquire Form 943 For and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 943 For to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 943 for 2016

Create this form in 5 minutes!

How to create an eSignature for the form 943 for 2016

How to generate an eSignature for your Form 943 For 2016 online

How to generate an electronic signature for your Form 943 For 2016 in Chrome

How to create an eSignature for putting it on the Form 943 For 2016 in Gmail

How to create an electronic signature for the Form 943 For 2016 from your mobile device

How to create an electronic signature for the Form 943 For 2016 on iOS

How to generate an electronic signature for the Form 943 For 2016 on Android

People also ask

-

What is Form 943 For and how can it benefit my business?

Form 943 For is a tax form used by agricultural employers to report wages paid to farmworkers and the associated payroll taxes. Utilizing airSlate SignNow allows you to easily eSign and send Form 943 For electronically, speeding up the submission process and ensuring compliance with IRS regulations. This streamlined approach can save your business time and reduce paperwork.

-

How does airSlate SignNow simplify the process of filling out Form 943 For?

airSlate SignNow simplifies the process of completing Form 943 For by allowing users to fill out, sign, and send the document digitally. Our user-friendly interface ensures that all necessary fields are completed accurately, reducing the chances of errors. This efficiency not only saves time but also minimizes the hassle associated with traditional paper forms.

-

Are there any costs associated with using airSlate SignNow for Form 943 For?

Yes, there are costs associated with using airSlate SignNow, but we offer a variety of pricing plans to fit your business needs. Each plan provides access to features that make handling Form 943 For and other documents efficient and cost-effective. You can choose the plan that best aligns with your volume of documents and required features.

-

What features does airSlate SignNow offer for managing Form 943 For?

airSlate SignNow offers numerous features for managing Form 943 For, including customizable templates, automated workflows, and secure eSignature capabilities. These features help ensure that your documents are completed accurately and efficiently. Additionally, you can track the status of your forms in real-time, providing transparency throughout the process.

-

Can I integrate airSlate SignNow with other software for managing Form 943 For?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications such as Google Workspace, Salesforce, and Microsoft Office. This means you can easily sync your data and manage Form 943 For alongside your existing workflows. Integration enhances productivity and ensures a smooth experience across platforms.

-

What security measures does airSlate SignNow implement for Form 943 For?

airSlate SignNow prioritizes the security of your documents, including Form 943 For, by employing advanced encryption and secure data storage practices. We adhere to strict compliance standards to protect sensitive information. This commitment to security ensures your documents are safe from unauthorized access during the signing and submission process.

-

How do I get started with airSlate SignNow for Form 943 For?

Getting started with airSlate SignNow for Form 943 For is easy! Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start creating or uploading your forms. Our intuitive platform guides you through the process of eSigning and sending your Form 943 For quickly and efficiently.

Get more for Form 943 For

- What is new dection about 212a3b form

- Ndot ms4 nv0023329 2010 permit form

- Death certificate format in hindi

- Borrower certification and authorization form

- Admission form for examination of pharmacy technician supplementary

- Rula smart form

- Bereavement leave claim form for reimbursement from fringe reserve cfao

- Jury duty claim form for reimbursement fom fringe reserve

Find out other Form 943 For

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy