943 Form 2012

What is the 943 Form

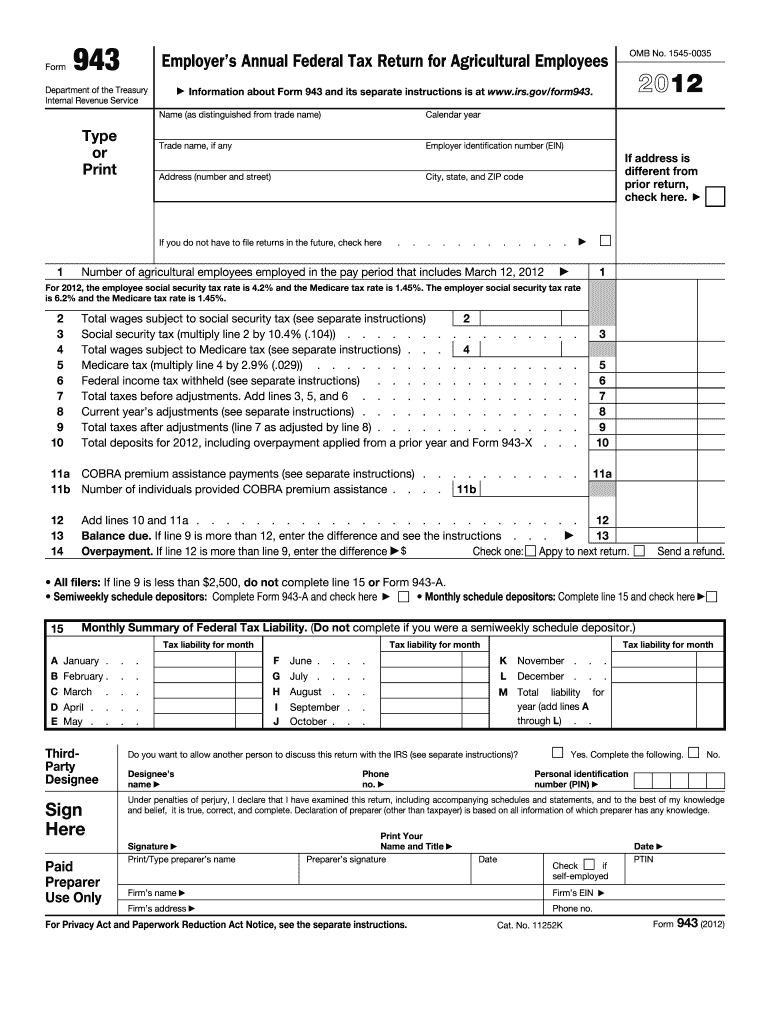

The 943 Form is a tax document used by agricultural employers to report wages paid to their employees. This form is specifically designed for employers who pay wages to farmworkers and is essential for accurately reporting income and withholding taxes. It is part of the IRS requirements for employers in the agricultural sector, ensuring compliance with federal tax laws.

How to use the 943 Form

To use the 943 Form, employers must first gather all necessary information about their employees, including wages paid and any taxes withheld. The form must be filled out accurately, reflecting the total wages for the year. Employers should submit the completed form to the IRS, ensuring that all information is correct to avoid penalties. It is important to keep a copy of the form for your records.

Steps to complete the 943 Form

Completing the 943 Form involves several key steps:

- Gather employee information, including names, Social Security numbers, and total wages.

- Calculate the total amount of federal income tax withheld from each employee.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the designated deadline.

Legal use of the 943 Form

The legal use of the 943 Form is crucial for agricultural employers to comply with IRS regulations. This form must be filed annually and accurately reflects the wages paid to employees in the agricultural sector. Failure to file the form or inaccurate reporting can lead to penalties and legal issues. Employers should ensure they understand the requirements and maintain proper documentation to support their filings.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the 943 Form. Typically, the form is due by January 31 of the following year for the wages paid in the previous calendar year. It is essential to mark this date on your calendar to ensure timely submission and avoid potential penalties for late filing.

Required Documents

When completing the 943 Form, employers should have the following documents ready:

- Employee records, including names and Social Security numbers.

- Wage records detailing the total payments made to each employee.

- Documentation of any federal income tax withheld from wages.

Who Issues the Form

The 943 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Employers can obtain the form directly from the IRS website or through authorized tax preparation services.

Quick guide on how to complete 943 form 2012

Manage 943 Form seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers all the tools you require to create, edit, and electronically sign your documents swiftly and without interruptions. Handle 943 Form across any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign 943 Form effortlessly

- Find 943 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact confidential information using the tools that airSlate SignNow specifically offers for this purpose.

- Craft your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign 943 Form to ensure excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 943 form 2012

Create this form in 5 minutes!

How to create an eSignature for the 943 form 2012

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the 943 Form and why is it important?

The 943 Form is used by agricultural employers to report wages paid to farmworkers and calculate their federal employment tax liabilities. Understanding how to complete the 943 Form accurately is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

-

How can airSlate SignNow help me with the 943 Form?

airSlate SignNow streamlines the process of completing and sending the 943 Form by providing easy-to-use templates and electronic signature capabilities. This efficiency helps save time and increases accuracy in preparing your tax documents.

-

Is airSlate SignNow cost-effective for managing the 943 Form?

Yes, airSlate SignNow offers competitive pricing plans designed to suit businesses of all sizes. By choosing our service, you can reduce costs associated with paper processing and improve the overall efficiency of handling the 943 Form.

-

What features does airSlate SignNow offer for the 943 Form?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSigning, all specifically tailored to make handling the 943 Form easier. These tools enable businesses to manage their documents more effectively and ensure compliance.

-

Can I integrate airSlate SignNow with other software for the 943 Form?

Absolutely! airSlate SignNow supports integration with various accounting and payroll software, making it seamless to synchronize data needed for the 943 Form. This integration streamlines your workflow and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for the 943 Form?

Using airSlate SignNow for the 943 Form provides numerous benefits, including reduced turnaround times, improved document security, and enhanced collaboration among team members. These advantages lead to a more efficient filing process and greater peace of mind.

-

How secure is my information when using airSlate SignNow for the 943 Form?

airSlate SignNow prioritizes data security by employing advanced encryption methods and compliance with industry standards. Your information related to the 943 Form will be protected, ensuring it remains confidential and secure.

Get more for 943 Form

Find out other 943 Form

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online