Form 943 Employer's Annual Federal Tax Return for Agricultural Employees 2020

What is the Form 943 Employer's Annual Federal Tax Return For Agricultural Employees

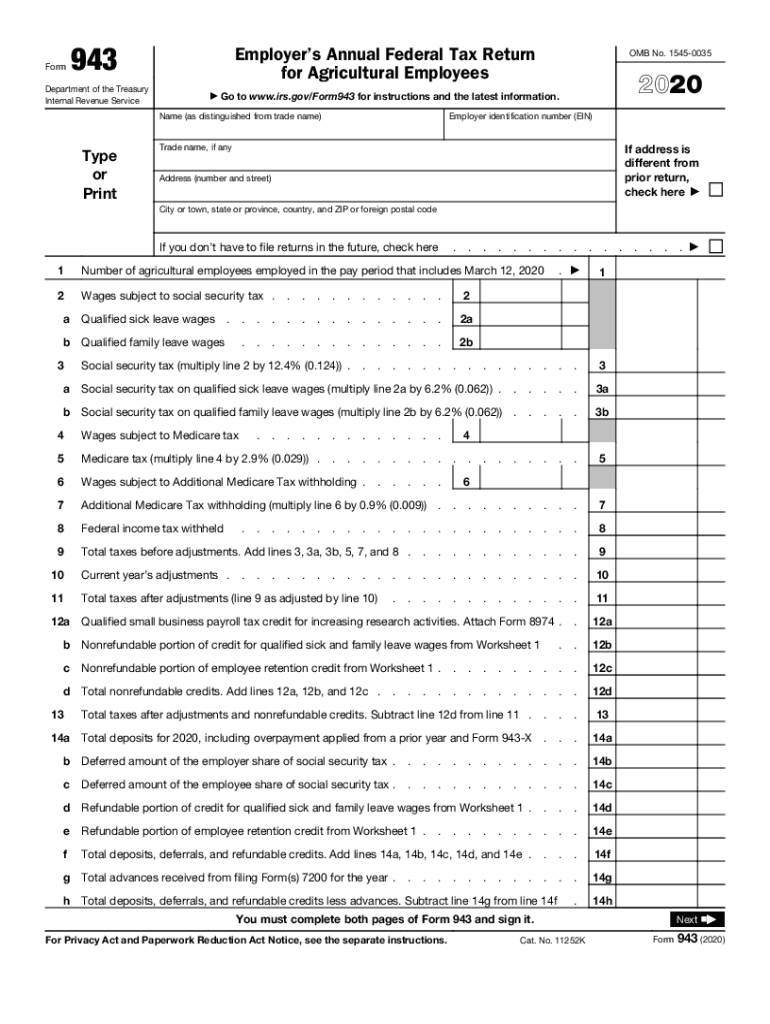

The Form 943 is a tax document required by the Internal Revenue Service (IRS) for employers in the agricultural sector. It is specifically designed for reporting annual wages paid to agricultural employees, along with the associated federal income tax and social security contributions. This form is essential for ensuring compliance with federal tax obligations related to agricultural employment.

Steps to Complete the Form 943 Employer's Annual Federal Tax Return For Agricultural Employees

Completing the Form 943 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total wages paid to employees and the amount of federal taxes withheld. Next, fill out the form by entering the employer's details, employee information, and the calculated tax amounts. It is crucial to double-check all entries for accuracy before submission. Finally, sign and date the form to validate it before filing.

Filing Deadlines / Important Dates

The filing deadline for the Form 943 typically falls on January 31 of the following year for the tax year being reported. Employers must ensure that the form is submitted by this date to avoid penalties. If January 31 falls on a weekend or holiday, the deadline extends to the next business day. Staying informed about these deadlines is essential for maintaining compliance with IRS regulations.

Legal Use of the Form 943 Employer's Annual Federal Tax Return For Agricultural Employees

The legal use of the Form 943 is governed by IRS regulations, which stipulate that agricultural employers must accurately report wages and taxes withheld. This form serves as a declaration of compliance with federal tax laws, and improper use or inaccuracies can lead to penalties. Employers should ensure that they understand the legal implications of filing this form, including the requirement to maintain accurate records of all employee payments and tax withholdings.

How to Obtain the Form 943 Employer's Annual Federal Tax Return For Agricultural Employees

The Form 943 can be obtained directly from the IRS website or through authorized tax preparation software. Employers may also request a physical copy by contacting the IRS or visiting a local IRS office. It is important to ensure that the correct version of the form is used, as updates may occur annually.

Key Elements of the Form 943 Employer's Annual Federal Tax Return For Agricultural Employees

Key elements of the Form 943 include sections for reporting total wages, federal income tax withheld, social security and Medicare taxes, and any adjustments. Employers must also provide their employer identification number (EIN) and details about their business operations. Understanding these elements is crucial for accurate reporting and compliance with tax obligations.

Quick guide on how to complete 2020 form 943 employers annual federal tax return for agricultural employees

Effortlessly Prepare Form 943 Employer's Annual Federal Tax Return For Agricultural Employees on Any Device

Digital document management has become increasingly popular among organizations and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to access the required form and securely save it online. airSlate SignNow provides all the resources necessary to generate, modify, and electronically sign your documents quickly without interruptions. Handle Form 943 Employer's Annual Federal Tax Return For Agricultural Employees on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The Simplest Way to Edit and eSign Form 943 Employer's Annual Federal Tax Return For Agricultural Employees with Ease

- Locate Form 943 Employer's Annual Federal Tax Return For Agricultural Employees and then click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Choose how you would like to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the frustration of lost or disorganized files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 943 Employer's Annual Federal Tax Return For Agricultural Employees and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 943 employers annual federal tax return for agricultural employees

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 943 employers annual federal tax return for agricultural employees

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2018 943 form used for?

The 2018 943 form is primarily used by employers to report the wages and withheld taxes for agricultural employees. Using airSlate SignNow, you can easily eSign and send this document securely, ensuring compliance and accuracy.

-

How can airSlate SignNow help me with the 2018 943?

With airSlate SignNow, you can streamline the process of filling out and signing the 2018 943 form. Our platform allows for quick access to templates, digital signatures, and easy sharing with your accounting team.

-

Is there a cost associated with using airSlate SignNow for the 2018 943?

AirSlate SignNow offers competitive pricing plans that cater to different business needs. By choosing our solution, you will save both time and money while ensuring that the 2018 943 form is processed efficiently.

-

Can I integrate airSlate SignNow with my existing software for processing the 2018 943?

Yes, airSlate SignNow seamlessly integrates with various software solutions, allowing you to automate your workflow for the 2018 943 form. This integration enhances efficiency and reduces the manual workload for your team.

-

What are the benefits of using airSlate SignNow for signing the 2018 943?

Using airSlate SignNow for the 2018 943 offers numerous benefits, including enhanced security, improved turnaround times, and a user-friendly interface. Our solution ensures that all signatures are legally binding and stored securely.

-

How can I send the 2018 943 form using airSlate SignNow?

To send the 2018 943 form using airSlate SignNow, simply upload the document, add the necessary recipients for signing, and send it via email. Our platform tracks all interactions, making it easy to follow up.

-

Are there templates available for the 2018 943 in airSlate SignNow?

Yes, airSlate SignNow provides templates for the 2018 943 form, allowing users to easily fill and customize as needed. This feature saves time and ensures that all necessary fields are properly completed.

Get more for Form 943 Employer's Annual Federal Tax Return For Agricultural Employees

- 50 hour driving log sheet ohio form

- Data structures and algorithms using c by r s salaria pdf download form

- Stat dec form

- Kpop audition form

- In place of this form you can submit authorization

- Msjhs schedule change form

- Www pdffiller com58761668 agedivision waiver form fillable online agedivision waiver form fax email print

- Additional information is shown on the back of this application

Find out other Form 943 Employer's Annual Federal Tax Return For Agricultural Employees

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template