Form 1095 C Employer Provided Health Insurance Offer and Coverage 2021

What is the Form 1095-C Employer Provided Health Insurance Offer and Coverage

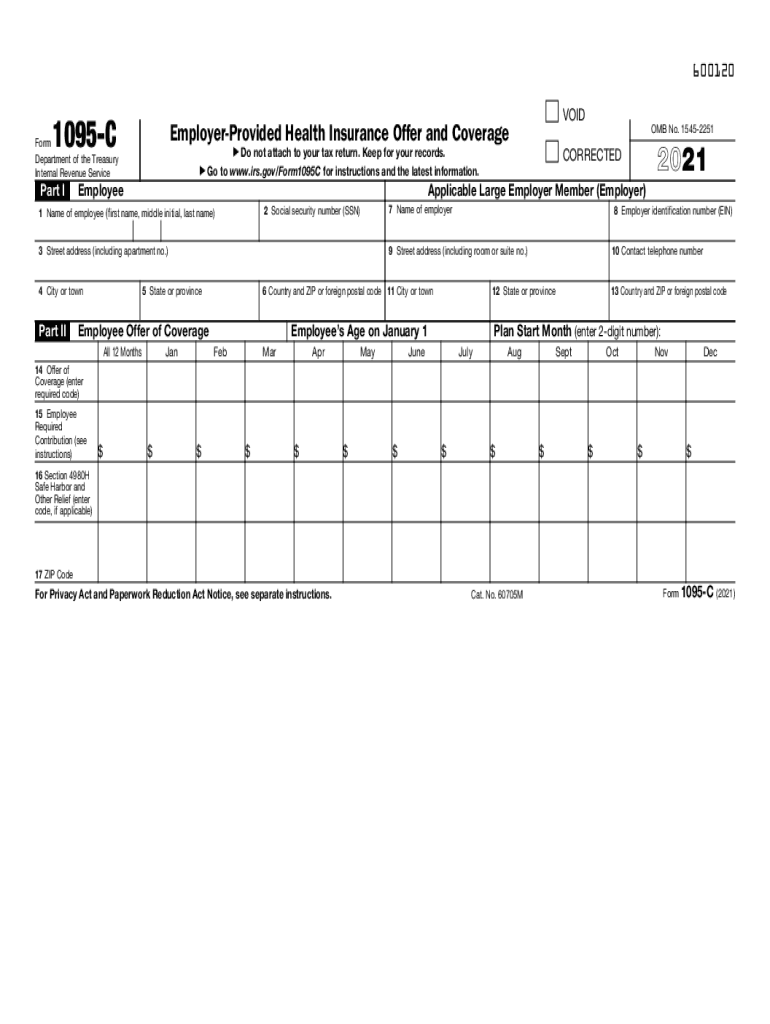

The Form 1095-C is a crucial document used by employers to report information about health insurance coverage offered to employees. This form is part of the Affordable Care Act (ACA) requirements, ensuring that employers provide adequate health coverage to their employees. It includes details such as the type of coverage offered, the months of coverage, and the employee's share of the lowest-cost monthly premium for self-only coverage. This information helps the IRS determine compliance with the ACA's employer mandate.

Steps to Complete the Form 1095-C Employer Provided Health Insurance Offer and Coverage

Completing the Form 1095-C involves several key steps:

- Gather necessary information about the employee, including their name, address, and Social Security number.

- Identify the type of health coverage offered during the year, including whether it was self-only or family coverage.

- Document the months the coverage was available to the employee.

- Calculate the employee's share of the lowest-cost monthly premium for self-only coverage.

- Ensure all information is accurate and complete before submission.

Legal Use of the Form 1095-C Employer Provided Health Insurance Offer and Coverage

The Form 1095-C serves as a legal document that employers must provide to employees and the IRS. It plays a significant role in demonstrating compliance with the ACA. Employers are required to issue this form to all full-time employees and to file it with the IRS. Failure to provide accurate information can result in penalties, making it essential for employers to ensure the form is completed correctly and submitted on time.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines regarding the Form 1095-C. Typically, the form must be provided to employees by January 31 of the following year. Additionally, it must be filed with the IRS by February 28 if submitting on paper, or by March 31 if filing electronically. Staying informed about these deadlines is crucial to avoid penalties and ensure compliance with federal regulations.

Who Issues the Form 1095-C

The Form 1095-C is issued by applicable large employers (ALEs), which are defined as employers with fifty or more full-time employees, including full-time equivalent employees. These employers are responsible for providing this form to their employees and the IRS to report the health coverage offered. Smaller employers may not be required to complete this form but should be aware of their obligations under the ACA.

Examples of Using the Form 1095-C Employer Provided Health Insurance Offer and Coverage

The Form 1095-C can be used in various scenarios, such as:

- Employees using the form to verify their health coverage when filing their taxes.

- Employers demonstrating compliance with ACA requirements during audits.

- Health insurance providers using the information to determine eligibility for premium tax credits.

Quick guide on how to complete 2021 form 1095 c employer provided health insurance offer and coverage

Effortlessly complete Form 1095 C Employer Provided Health Insurance Offer And Coverage on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your forms swiftly without delays. Manage Form 1095 C Employer Provided Health Insurance Offer And Coverage on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Form 1095 C Employer Provided Health Insurance Offer And Coverage effortlessly

- Obtain Form 1095 C Employer Provided Health Insurance Offer And Coverage and click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the specific tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your alterations.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Form 1095 C Employer Provided Health Insurance Offer And Coverage and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1095 c employer provided health insurance offer and coverage

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1095 c employer provided health insurance offer and coverage

The way to generate an e-signature for a PDF file online

The way to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

What is the 2016 form 1095 C and why is it important?

The 2016 form 1095 C is a tax document provided by applicable large employers that reports health insurance coverage offered to employees. It is essential for compliance with the Affordable Care Act, ensuring employees understand their health coverage and tax obligations.

-

How can airSlate SignNow help with the 2016 form 1095 C?

airSlate SignNow offers an easy-to-use platform that allows businesses to send, receive, and eSign the 2016 form 1095 C securely. With efficient document management features, you can streamline the process of distributing these important forms to your employees.

-

Is there a cost to use airSlate SignNow for the 2016 form 1095 C?

airSlate SignNow provides cost-effective pricing plans suitable for businesses of all sizes. You can choose a plan that fits your needs, ensuring you have access to all the necessary features to handle the 2016 form 1095 C without budget concerns.

-

What features does airSlate SignNow offer for managing the 2016 form 1095 C?

With airSlate SignNow, you gain access to numerous features including customizable templates, automation tools, and electronic signatures, all tailored for the 2016 form 1095 C. These features simplify the document preparation and signing process, enhancing your workflow.

-

Can airSlate SignNow integrate with other software for the 2016 form 1095 C?

Yes, airSlate SignNow easily integrates with various software solutions, allowing you to manage the 2016 form 1095 C seamlessly alongside your other systems. This integration capability enhances efficiency and ensures all your data remains consistent across platforms.

-

What benefits can businesses expect when using airSlate SignNow for the 2016 form 1095 C?

Using airSlate SignNow for the 2016 form 1095 C provides businesses with increased efficiency, reduced paper usage, and faster processing times. The platform enables quick access to signed documents, making it easier for businesses to stay compliant with tax regulations.

-

How secure is airSlate SignNow for handling the 2016 form 1095 C?

airSlate SignNow prioritizes the security of your documents, including the 2016 form 1095 C, with robust encryption and compliance with industry standards. You can trust that all your sensitive information remains protected throughout the signing and storage process.

Get more for Form 1095 C Employer Provided Health Insurance Offer And Coverage

- Colorado show cause 497300399 form

- Verbal emergency protection order issued pursuant to section 13 14 103 crs colorado form

- Colorado protection order form

- Instructions for protected person motion to modify dismiss protection order colorado form

- Motion dismiss order form

- Protection order application form

- Civil restraining order colorado form

- Instructions for obtaining a civil protection order spanish colorado form

Find out other Form 1095 C Employer Provided Health Insurance Offer And Coverage

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement