1095 C Form 2016

What is the 1095 C Form

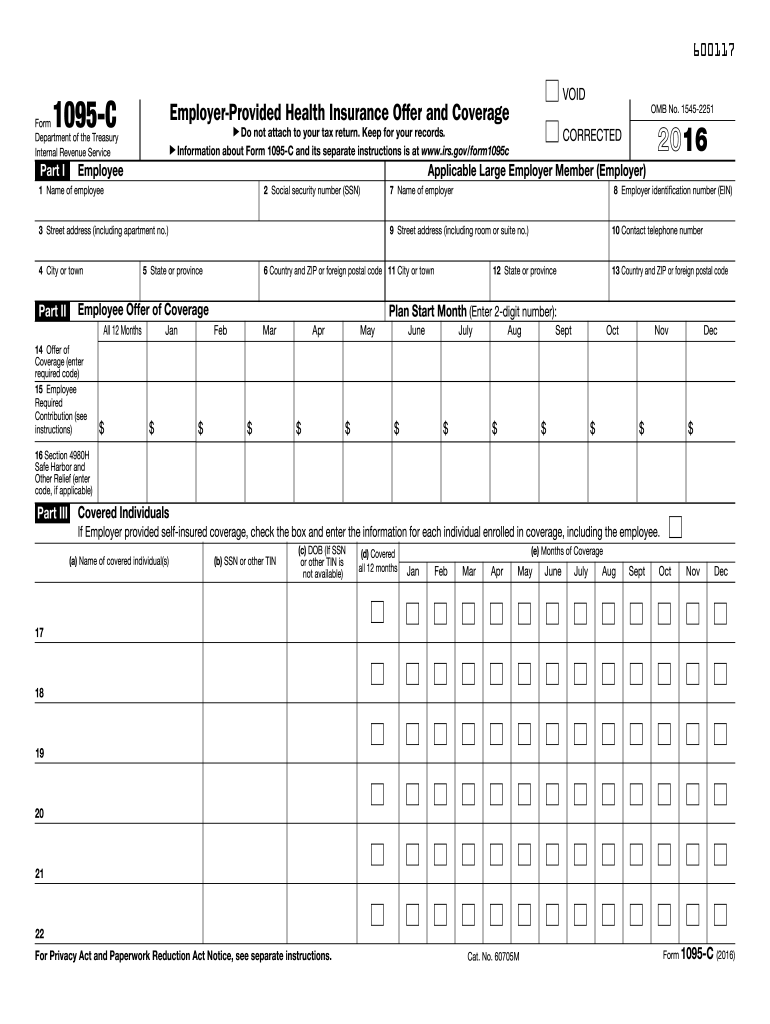

The 1095 C Form is a crucial document used in the United States to report information about health insurance coverage provided by applicable large employers (ALEs). This form is part of the Affordable Care Act (ACA) requirements, ensuring that employers comply with health care coverage mandates. It includes details such as the type of coverage offered, the months of coverage, and information about the employees who were eligible for health insurance during the year.

How to use the 1095 C Form

The 1095 C Form serves multiple purposes for both employers and employees. Employers use it to report compliance with the ACA, while employees may use the information to complete their tax returns. When filling out your tax return, you may need to reference the information on the 1095 C Form to confirm that you had health coverage for the entire year, which can affect your eligibility for premium tax credits.

Steps to complete the 1095 C Form

Completing the 1095 C Form involves several key steps:

- Gather necessary information about your health coverage and eligible employees.

- Fill out Part I with your employer information, including name, address, and Employer Identification Number (EIN).

- Complete Part II to provide details about the coverage offered, including the type of coverage and the months it was available.

- Fill in Part III if you have any employees who were covered under the health plan, providing their information and the months they were covered.

- Review the completed form for accuracy before submission.

Legal use of the 1095 C Form

The 1095 C Form is legally binding and must be completed accurately to comply with federal regulations. Employers are required to provide this form to eligible employees and submit it to the IRS. Failure to comply with these requirements can result in penalties for the employer. The form also serves as proof of health coverage, which may be necessary for employees when filing their taxes.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 1095 C Form. Employers must provide the form to employees by January 31 of the year following the coverage year. Additionally, the form must be submitted to the IRS by February 28 if filing by paper, or by March 31 if filing electronically. Keeping track of these dates helps ensure compliance and avoids potential penalties.

Who Issues the Form

The 1095 C Form is issued by applicable large employers, which are defined as businesses with fifty or more full-time employees or full-time equivalent employees. These employers are responsible for providing the form to their employees and submitting it to the IRS. Smaller employers may use the 1095 B Form instead, which is designed for employers who do not meet the large employer threshold.

Quick guide on how to complete 1095 c 2016 form

Manage 1095 C Form easily on any device

Digital document handling has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage 1095 C Form from any device using the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to modify and electronically sign 1095 C Form effortlessly

- Locate 1095 C Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that task.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device of your preference. Modify and electronically sign 1095 C Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1095 c 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1095 c 2016 form

How to make an electronic signature for the 1095 C 2016 Form online

How to create an electronic signature for the 1095 C 2016 Form in Chrome

How to make an electronic signature for signing the 1095 C 2016 Form in Gmail

How to generate an electronic signature for the 1095 C 2016 Form from your smart phone

How to create an eSignature for the 1095 C 2016 Form on iOS devices

How to generate an eSignature for the 1095 C 2016 Form on Android devices

People also ask

-

What is a 1095 C Form and why is it important?

The 1095 C Form is a tax document that employers must provide to their employees, detailing the health coverage offered to them. It is crucial for reporting compliance with the Affordable Care Act (ACA) and helps employees understand their health insurance eligibility and coverage. Using airSlate SignNow, you can easily manage and eSign your 1095 C Forms, ensuring compliance and accuracy.

-

How can airSlate SignNow help with 1095 C Form management?

AirSlate SignNow streamlines the process of managing 1095 C Forms by allowing businesses to send, sign, and store these documents securely online. The platform offers easy-to-use tools for customization and tracking, ensuring that all forms are completed and submitted in compliance with IRS regulations. Simplifying the management of your 1095 C Forms can save time and reduce errors.

-

Is there a cost to use airSlate SignNow for 1095 C Forms?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options for managing 1095 C Forms. The cost is competitive and includes features such as unlimited document signing, cloud storage, and integrations with other software. Investing in airSlate SignNow ensures a cost-effective solution for handling your 1095 C Forms efficiently.

-

Can I integrate airSlate SignNow with other software to manage 1095 C Forms?

Absolutely! AirSlate SignNow seamlessly integrates with a variety of software applications, allowing you to streamline the management of 1095 C Forms within your existing workflow. Whether you're using HR software, CRMs, or financial systems, these integrations enhance productivity and simplify document handling.

-

What features does airSlate SignNow offer for 1095 C Form eSigning?

AirSlate SignNow provides robust features for eSigning 1095 C Forms, including customizable templates, advanced security protocols, and real-time status tracking. Users can easily invite others to sign via email, ensuring a quick turnaround while maintaining compliance with electronic signature laws. This makes managing and signing 1095 C Forms both efficient and secure.

-

How does airSlate SignNow ensure the security of my 1095 C Forms?

AirSlate SignNow prioritizes security by employing bank-level encryption, secure cloud storage, and compliance with industry standards such as GDPR and HIPAA. This ensures that your 1095 C Forms and other sensitive documents are protected from unauthorized access and bsignNowes. You can trust that your data is safe while using airSlate SignNow.

-

What is the turnaround time for processing 1095 C Forms with airSlate SignNow?

The turnaround time for processing 1095 C Forms using airSlate SignNow largely depends on the number of forms and recipients involved. However, the platform’s intuitive eSigning process signNowly speeds up the completion of documents, often reducing processing time to just hours instead of days. This allows you to meet deadlines efficiently.

Get more for 1095 C Form

Find out other 1095 C Form

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement