Form IRS 1095 C Fill Online, Printable, Fillable, Blank 2022

What is the 2018 Form 1095-C?

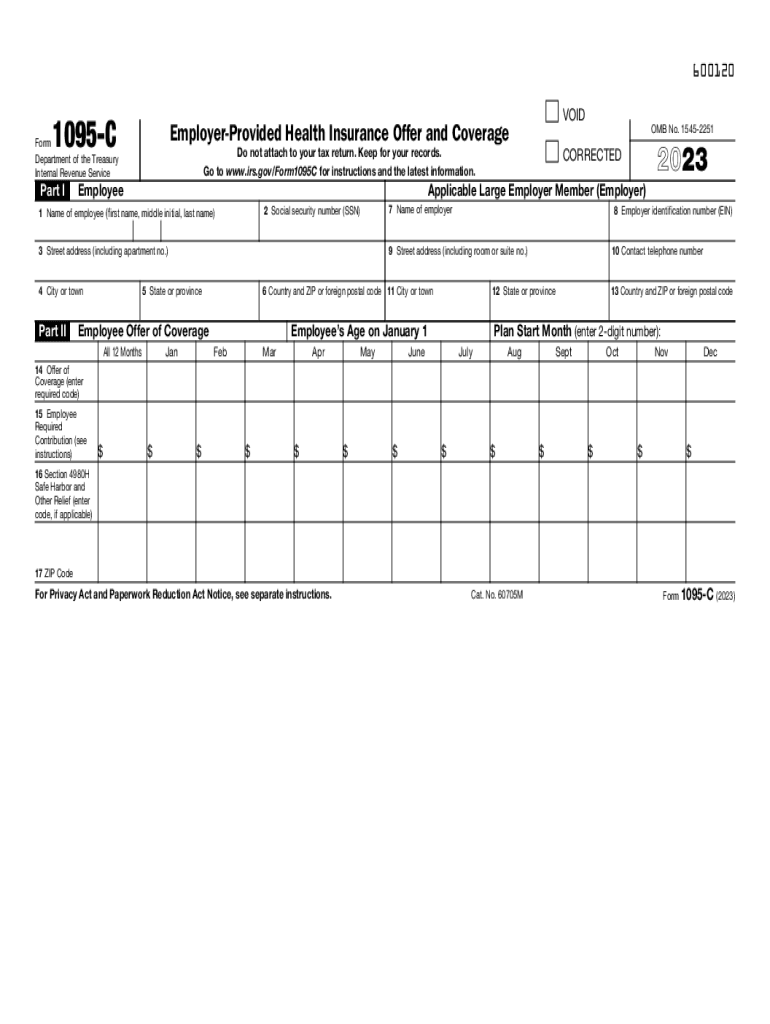

The 2018 Form 1095-C is a tax document provided by applicable large employers (ALEs) to their employees. It serves as proof of health insurance coverage offered to employees and their dependents. This form is essential for individuals who need to report their health coverage status when filing their federal tax returns. The form includes information about the coverage offered, the months during which coverage was available, and the employee's share of the lowest-cost monthly premium for self-only coverage.

Key Elements of the 2018 Form 1095-C

The 2018 Form 1095-C contains several important sections:

- Employer Information: This section includes the name, address, and Employer Identification Number (EIN) of the employer.

- Employee Information: This section provides details about the employee, including their name, address, and Social Security Number (SSN).

- Coverage Information: This section outlines the type of coverage offered, the months it was available, and the cost to the employee for the lowest-cost plan.

- Section 4980H: This section indicates whether the employer met the requirements for providing health coverage under the Affordable Care Act.

Steps to Complete the 2018 Form 1095-C

Completing the 2018 Form 1095-C involves several steps:

- Gather necessary information about the employer and employee, including names, addresses, and identification numbers.

- Determine the type of health coverage offered to the employee and the months it was available.

- Fill out each section of the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines for the 2018 Form 1095-C

Employers are required to provide the 2018 Form 1095-C to employees by January 31, 2019. Additionally, the form must be filed with the IRS by February 28, 2019, if filing by paper, or by April 1, 2019, if filing electronically. Meeting these deadlines is crucial to avoid potential penalties.

Legal Use of the 2018 Form 1095-C

The 2018 Form 1095-C is legally required for applicable large employers under the Affordable Care Act. It must be provided to all full-time employees, regardless of whether they enrolled in the offered health coverage. This form helps the IRS determine compliance with health coverage mandates and is essential for employees when filing their taxes.

Who Issues the 2018 Form 1095-C?

The 2018 Form 1095-C is issued by applicable large employers, which are generally those with fifty or more full-time employees. These employers must provide this form to their employees to report the health insurance coverage they offered during the year. It is important for employees to receive this form to accurately complete their tax returns and demonstrate compliance with health coverage requirements.

Quick guide on how to complete form irs 1095 c fill online printable fillable blank

Effortlessly prepare Form IRS 1095 C Fill Online, Printable, Fillable, Blank on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and safely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hold-ups. Manage Form IRS 1095 C Fill Online, Printable, Fillable, Blank on any platform using airSlate SignNow's Android or iOS applications and simplify your document processes today.

How to modify and electronically sign Form IRS 1095 C Fill Online, Printable, Fillable, Blank with ease

- Find Form IRS 1095 C Fill Online, Printable, Fillable, Blank and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all details carefully, then click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form IRS 1095 C Fill Online, Printable, Fillable, Blank to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form irs 1095 c fill online printable fillable blank

Create this form in 5 minutes!

How to create an eSignature for the form irs 1095 c fill online printable fillable blank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form 1095 C and why is it important?

The 2018 form 1095 C is a tax document provided by applicable large employers that outlines the health coverage offered to employees. It's important as it helps employees understand their health insurance options and whether they qualify for premium tax credits.

-

How can airSlate SignNow help with the 2018 form 1095 C?

airSlate SignNow facilitates the electronic signing and distribution of the 2018 form 1095 C, making the process quicker and more efficient. This ensures that employees receive their crucial tax documents in a timely manner, which helps them comply with tax regulations.

-

What features does airSlate SignNow offer for managing tax forms like the 2018 form 1095 C?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage, which streamline the handling of tax forms like the 2018 form 1095 C. These features enhance organizational efficiency and help maintain compliance.

-

Is there a cost associated with using airSlate SignNow for the 2018 form 1095 C?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those needing to process the 2018 form 1095 C. The pricing is competitive, providing a cost-effective solution compared to traditional methods.

-

Can I integrate airSlate SignNow with other software for handling the 2018 form 1095 C?

Absolutely! airSlate SignNow integrates seamlessly with various software applications such as CRM systems and accounting software, which can enhance your workflow when managing the 2018 form 1095 C. This integration simplifies data transfer and improves operational efficiency.

-

What benefits does airSlate SignNow offer for eSigning the 2018 form 1095 C?

With airSlate SignNow, eSigning the 2018 form 1095 C is not only quick but also legally compliant. The platform ensures a secure eSignature process that saves time and reduces the need for physical paperwork, allowing for a more streamlined operation.

-

How does airSlate SignNow ensure the security of the 2018 form 1095 C?

airSlate SignNow places a strong emphasis on security, utilizing industry-standard encryption and compliance with regulations to protect the 2018 form 1095 C. This helps safeguard sensitive employee information throughout the signing and management process.

Get more for Form IRS 1095 C Fill Online, Printable, Fillable, Blank

- Financial affidavit illinois form

- Kansasjudicialcouncil form

- Petition for protection from stalking order et seq kansasjudicialcouncil form

- Connecticut notice of lease termination eformscom

- In the circuit court of county kansas kansas judicial council kansasjudicialcouncil form

- Sample of docketing statement civil appeal kansas form

- General information kansas judicial council kansasjudicialcouncil

- Summons and notice of hearing for protection order pdf fpdf kansasjudicialcouncil form

Find out other Form IRS 1095 C Fill Online, Printable, Fillable, Blank

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe