1095c Form 2018

What is the 1095-C Form

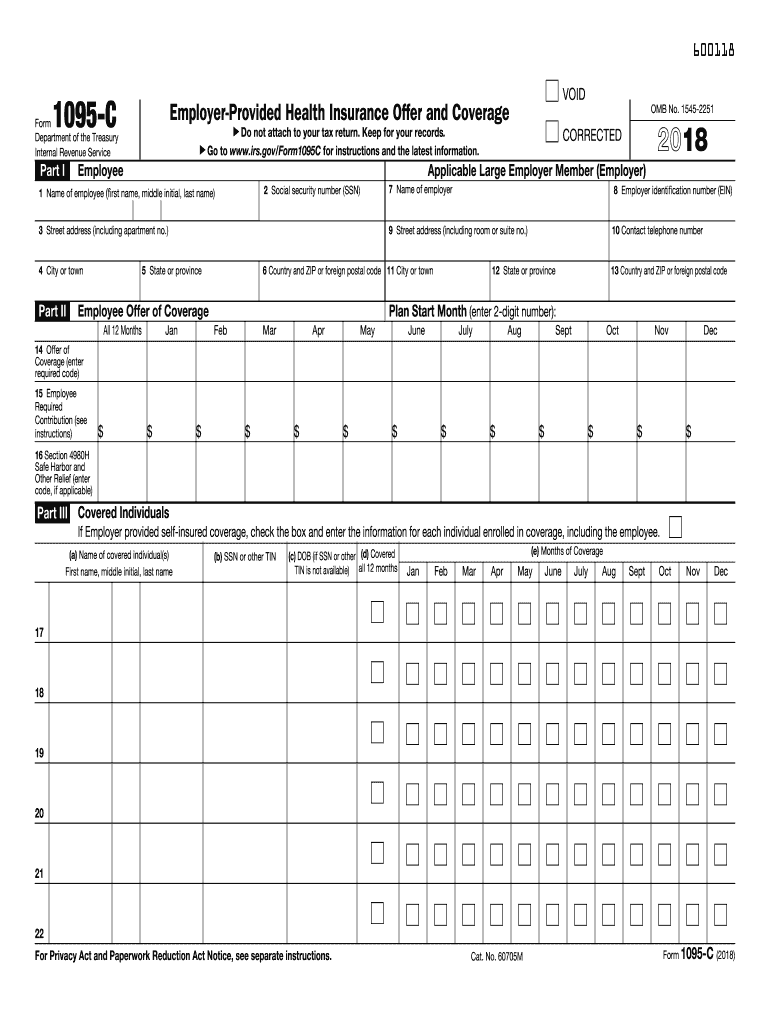

The 1095-C form is a tax document provided by applicable large employers (ALEs) to their employees. This form reports information about the health insurance coverage offered to employees under the Affordable Care Act (ACA). It includes details such as the type of coverage, the months it was available, and the employee's share of the lowest-cost monthly premium. The Internal Revenue Service (IRS) uses this information to determine compliance with the ACA's employer mandate.

How to Obtain the 1095-C Form

To obtain the 1095-C form, employees should check with their employer, as ALEs are responsible for providing this form. Employers are required to send the form to employees by mail or electronically. If an employee has not received their form by early March, they should reach out to their human resources department or benefits administrator. Additionally, employees can access the form through their employer's online portal if available.

Steps to Complete the 1095-C Form

Completing the 1095-C form requires careful attention to detail. Here are the steps to fill it out:

- Review the form for accuracy, ensuring all personal information is correct.

- Check the sections that outline the health coverage offered, including the months of coverage.

- Verify the employee's share of the lowest-cost premium for self-only coverage.

- Make sure to include any applicable codes that indicate the type of coverage provided.

- Sign and date the form if required before submission.

Legal Use of the 1095-C Form

The 1095-C form is legally required for compliance with the ACA. Employers must accurately complete and distribute this form to avoid penalties. Employees use the information on the form when filing their tax returns to demonstrate compliance with the health coverage mandate. Failing to file or providing incorrect information can result in penalties for both employers and employees.

Filing Deadlines / Important Dates

Employers must provide the 1095-C form to employees by March 2 of the year following the tax year. The forms must also be filed with the IRS by February 28 if filing by paper, or March 31 if filing electronically. It is crucial for both employers and employees to adhere to these deadlines to ensure compliance and avoid potential penalties.

Who Issues the Form

The 1095-C form is issued by applicable large employers, defined as those with fifty or more full-time employees or full-time equivalent employees. These employers are responsible for reporting the health insurance coverage they provide to their employees. Smaller employers may not be required to issue this form, but they may still provide similar documentation for their employees.

Quick guide on how to complete 1095 c form 2018

Discover the easiest method to complete and endorse your 1095c Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and endorse your 1095c Form and similar forms for public services. Our advanced electronic signature solution provides all the tools you require to handle paperwork swiftly and in line with official standards - comprehensive PDF editing, managing, securing, signing, and sharing features all available in a user-friendly interface.

Only a few steps are needed to complete and endorse your 1095c Form:

- Insert the fillable template into the editor by clicking the Get Form button.

- Review what information is required in your 1095c Form.

- Navigate through the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Edit the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Select Sign to generate a legally binding electronic signature using your preferred method.

- Include the Date next to your signature and finalize your task with the Done button.

Store your completed 1095c Form in the Documents folder in your profile, download it, or send it to your chosen cloud storage. Our solution also provides adaptable form sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - do so via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 1095 c form 2018

FAQs

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How many candidates applied for IBPS RRB 2018?

Fill rti you will come to know.

Create this form in 5 minutes!

How to create an eSignature for the 1095 c form 2018

How to generate an electronic signature for the 1095 C Form 2018 in the online mode

How to make an electronic signature for the 1095 C Form 2018 in Google Chrome

How to generate an electronic signature for putting it on the 1095 C Form 2018 in Gmail

How to make an eSignature for the 1095 C Form 2018 from your mobile device

How to generate an eSignature for the 1095 C Form 2018 on iOS

How to make an eSignature for the 1095 C Form 2018 on Android OS

People also ask

-

What is a 1095c Form and why is it important?

The 1095c Form is a tax document that provides information about health insurance coverage offered by employers. It is important because it helps employees report their health coverage on their tax returns and verifies compliance with the Affordable Care Act. Understanding the 1095c Form can ensure that businesses and employees meet their tax obligations.

-

How can airSlate SignNow help with 1095c Form management?

airSlate SignNow simplifies the process of managing the 1095c Form by providing an easy-to-use platform for document signing and distribution. With our eSigning features, businesses can quickly send, sign, and store 1095c Forms securely, ensuring compliance and efficiency in document handling.

-

What features does airSlate SignNow offer for 1095c Form preparation?

airSlate SignNow offers a variety of features for 1095c Form preparation, including customizable templates, automated workflows, and real-time tracking. These features streamline the creation and distribution of 1095c Forms, making it easy for businesses to manage their reporting requirements seamlessly.

-

Is airSlate SignNow cost-effective for handling 1095c Forms?

Yes, airSlate SignNow is a cost-effective solution for handling 1095c Forms. Our pricing plans are designed to fit the needs of businesses of all sizes, ensuring that you can manage your document signing and compliance without breaking the bank.

-

Can airSlate SignNow integrate with other software for 1095c Form processing?

Absolutely! airSlate SignNow offers integrations with various software solutions, making it easy to incorporate your 1095c Form processes into existing systems. This integration capability enhances efficiency and ensures that you can manage all your documentation needs in one place.

-

What are the benefits of using airSlate SignNow for 1095c Forms?

Using airSlate SignNow for 1095c Forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround and ensures that all sensitive information is protected, giving you peace of mind during tax season.

-

How secure is my data when using airSlate SignNow for 1095c Forms?

Security is a top priority for airSlate SignNow. When handling 1095c Forms, your data is protected with advanced encryption and compliance with industry standards, ensuring that all information remains confidential and secure throughout the signing process.

Get more for 1095c Form

Find out other 1095c Form

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form