1095 Form 2014

What is the 1095 Form

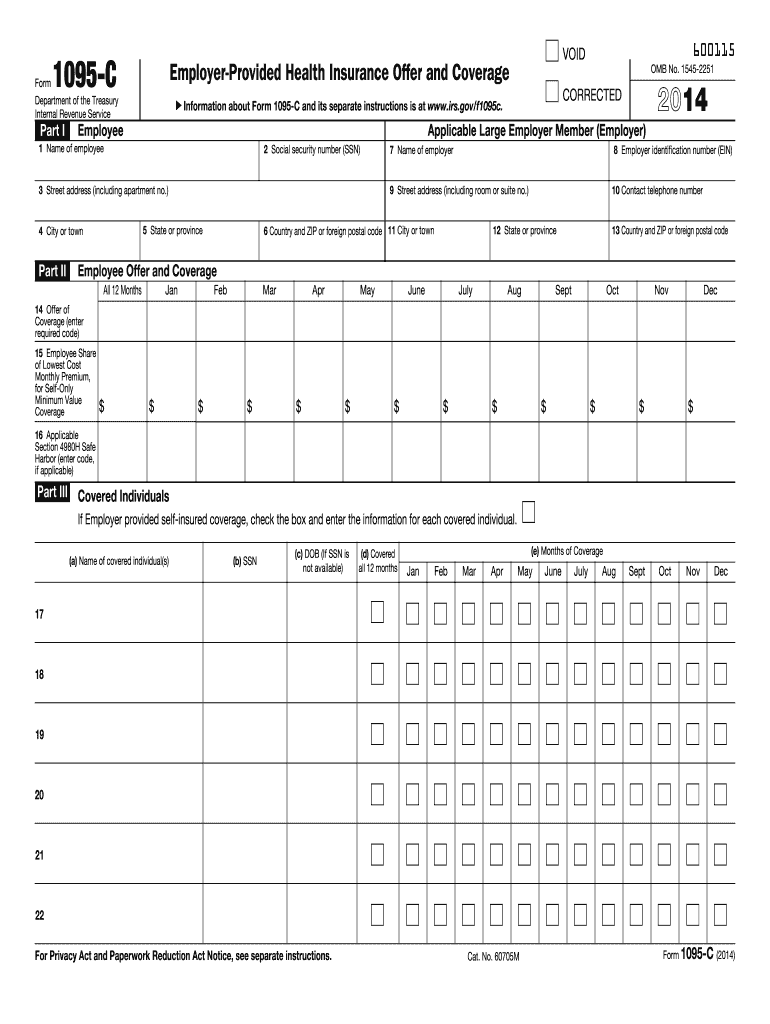

The 1095 form, specifically the 2-C, is a tax document used by employers to report health insurance coverage offered to employees. This form is part of the Affordable Care Act (ACA) requirements and is essential for individuals to demonstrate compliance with the health insurance mandate. It provides detailed information about the coverage provided, including the months of coverage, the type of coverage, and the individuals covered under the plan.

How to use the 1095 Form

Using the 2-C form involves several steps. First, employees should receive this form from their employer, typically by the end of January each year. Once received, individuals should review the information for accuracy, ensuring that all covered months and dependents are correctly listed. This form is then used when filing federal tax returns, as it helps to determine eligibility for premium tax credits and compliance with the ACA requirements.

Steps to complete the 1095 Form

Completing the 2-C form requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including your personal details and health coverage details.

- Review the form for any pre-filled information provided by your employer.

- Verify that all covered individuals and months of coverage are accurately reported.

- Make any necessary corrections or additions before submission.

Legal use of the 1095 Form

The 2-C form is legally binding when properly completed and submitted. It serves as proof of health insurance coverage, which is essential for compliance with the ACA. Employers are required to provide this form to employees, and failure to do so can result in penalties. Additionally, individuals must retain this form for their records and present it when filing taxes to avoid penalties for not having health coverage.

Filing Deadlines / Important Dates

For the 2-C form, employers must provide the form to employees by January 31 of the following year. Additionally, employers must file the form with the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Keeping track of these deadlines is crucial to ensure compliance and avoid potential penalties.

Who Issues the Form

The 2-C form is issued by applicable large employers (ALEs), which are defined as those with fifty or more full-time employees. These employers are responsible for providing this form to their employees to report the health insurance coverage offered. If you are an employee, you should receive this form directly from your employer, typically through mail or electronically.

Quick guide on how to complete 2014 1095 form

Effortlessly prepare 1095 Form on any device

Online document management has gained popularity among both organizations and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely save them online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Manage 1095 Form across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Edit and eSign 1095 Form with ease

- Obtain 1095 Form and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form—via email, SMS, an invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow encompasses all your document management needs with just a few clicks from your chosen device. Edit and eSign 1095 Form and guarantee excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1095 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1095 form

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the 2014 1095 C form and why is it important?

The 2014 1095 C form is an IRS document that employers must provide to employees to report health insurance coverage. This form is crucial for compliance with the Affordable Care Act, as it helps individuals identify whether they qualify for health coverage exemptions.

-

How can airSlate SignNow help with the 2014 1095 C process?

airSlate SignNow streamlines the process of sending and signing the 2014 1095 C form electronically. Our platform allows businesses to easily deliver these documents, ensuring timely signatures and compliance with IRS regulations without the hassle of paper forms.

-

What features does airSlate SignNow offer for managing the 2014 1095 C forms?

With airSlate SignNow, businesses can take advantage of advanced features such as customizable templates for the 2014 1095 C, secure eSigning, automatic reminders, and document tracking. These features ensure that you can manage your forms efficiently and stay compliant with tax laws.

-

Is airSlate SignNow cost-effective for handling the 2014 1095 C documentation?

Yes, airSlate SignNow offers a cost-effective solution for handling the 2014 1095 C documentation. By reducing the need for physical paper and manual processing, businesses can save both time and money while remaining compliant with IRS requirements.

-

Does airSlate SignNow integrate with other software for the 2014 1095 C?

Absolutely! airSlate SignNow seamlessly integrates with various HR and payroll systems, allowing for effortless import and submission of the 2014 1095 C data. This integration minimizes errors and provides a more streamlined workflow for your business.

-

How secure is the data when signing the 2014 1095 C with airSlate SignNow?

Data security is a top priority at airSlate SignNow. When signing the 2014 1095 C forms, your information is protected with industry-standard encryption and secure data storage, ensuring that all sensitive employee information remains confidential.

-

Can multiple employees sign the 2014 1095 C forms using airSlate SignNow?

Yes, airSlate SignNow allows multiple employees to sign the 2014 1095 C forms simultaneously. This feature accelerates the signing process and ensures that all necessary signatures are collected in a timely manner.

Get more for 1095 Form

- Accreditation council for genetic counseling form

- Annuity owner transfer request aaa life insurance company form

- Preceptor packet form

- Cancer center palo alto and cancer network stanford health care form

- Fax 3125414472 mail ascp webcasts 3462 eagle way form

- Meningococcal consent form

- Sentara authorization to disclose form

- Qualcare waiver form

Find out other 1095 Form

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile