Dor Mo Govforms149149 Sales and Use Tax Exemption Certificate 2021

What is the Missouri Sales and Use Tax Exemption Certificate?

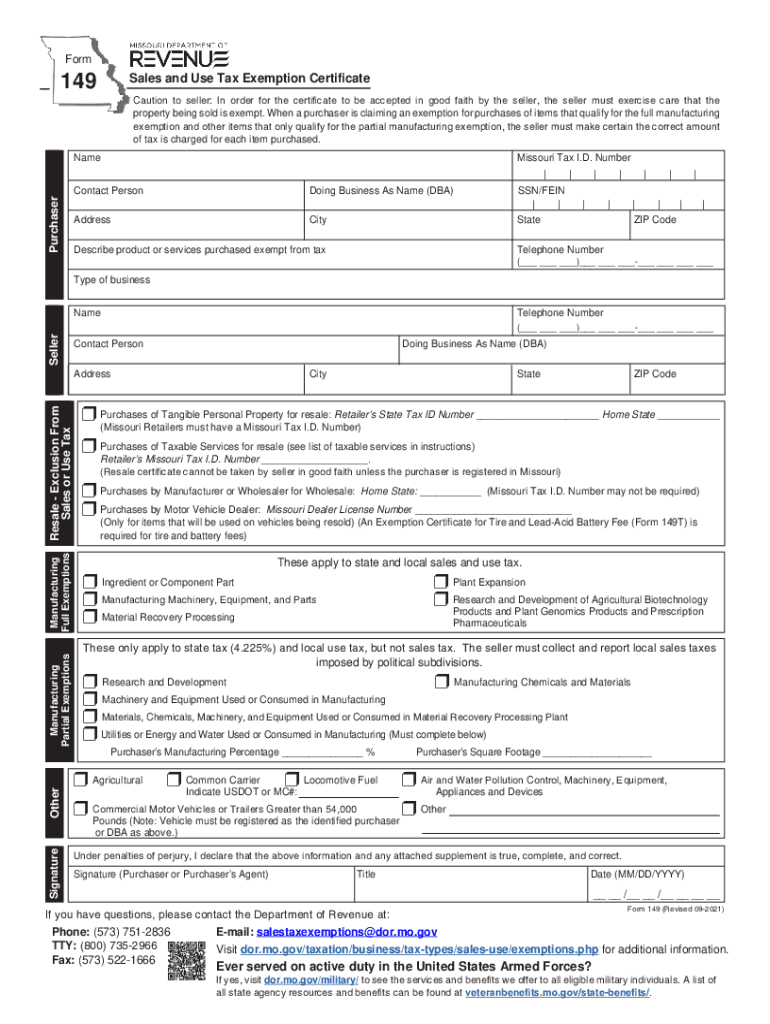

The Missouri Sales and Use Tax Exemption Certificate, commonly known as the MO Form 149, is a crucial document used by businesses and individuals to claim exemption from sales and use tax on certain purchases. This certificate is particularly relevant for purchases made for resale or for specific exempt purposes, such as manufacturing or charitable activities. It serves as proof that the purchaser is not liable for sales tax on the items listed on the certificate, provided they meet the criteria set forth by Missouri tax laws.

How to Use the Missouri Sales and Use Tax Exemption Certificate

To effectively use the Missouri Sales and Use Tax Exemption Certificate, the purchaser must complete the form accurately and present it to the seller at the time of purchase. The seller retains the certificate for their records, ensuring compliance with state tax regulations. It is important to note that the certificate should only be used for qualifying purchases; misuse can lead to penalties or tax liabilities for both the buyer and seller.

Steps to Complete the Missouri Sales and Use Tax Exemption Certificate

Completing the Missouri Sales and Use Tax Exemption Certificate involves several straightforward steps:

- Obtain a copy of the MO Form 149 from the Missouri Department of Revenue website or through authorized channels.

- Fill in the required information, including the purchaser's name, address, and the reason for the exemption.

- Clearly list the items being purchased under the exemption.

- Sign and date the certificate to validate it.

Once completed, present the form to the seller during the transaction.

Eligibility Criteria for the Missouri Sales and Use Tax Exemption Certificate

Eligibility for using the Missouri Sales and Use Tax Exemption Certificate is determined by the intended use of the purchased items. Common eligibility categories include:

- Items purchased for resale by retailers.

- Goods used in manufacturing or processing.

- Purchases made by non-profit organizations for exempt purposes.

It is essential for purchasers to ensure that their use qualifies under Missouri tax law to avoid potential penalties.

Legal Use of the Missouri Sales and Use Tax Exemption Certificate

The legal use of the Missouri Sales and Use Tax Exemption Certificate is governed by state tax regulations. The certificate must be used in accordance with the specific exemptions outlined in Missouri law. Misuse of the certificate, such as claiming exemptions for non-qualifying purchases, can result in significant penalties, including back taxes and fines. Therefore, it is crucial for both buyers and sellers to understand the legal implications of using the certificate.

Form Submission Methods for the Missouri Sales and Use Tax Exemption Certificate

The Missouri Sales and Use Tax Exemption Certificate does not require formal submission to the state; instead, it is presented at the point of sale. Sellers must keep the certificate on file for audit purposes. However, if a business needs to report or clarify its exempt status, it may need to provide additional documentation to the Missouri Department of Revenue upon request.

Quick guide on how to complete dormogovforms149149 sales and use tax exemption certificate

Complete Dor mo govforms149149 Sales And Use Tax Exemption Certificate effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Dor mo govforms149149 Sales And Use Tax Exemption Certificate on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Dor mo govforms149149 Sales And Use Tax Exemption Certificate with ease

- Obtain Dor mo govforms149149 Sales And Use Tax Exemption Certificate and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize crucial sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Dor mo govforms149149 Sales And Use Tax Exemption Certificate to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dormogovforms149149 sales and use tax exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the dormogovforms149149 sales and use tax exemption certificate

The way to make an e-signature for a PDF file online

The way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

How to make an e-signature for a PDF document on Android devices

People also ask

-

What is the Missouri tax exemption and how does it apply to businesses?

The Missouri tax exemption allows businesses to avoid paying certain taxes on eligible purchases and services. This can signNowly reduce operating costs, making it a valuable benefit for those who qualify. Understanding the requirements and guidelines for the Missouri tax exemption is essential for maximizing your savings.

-

How can airSlate SignNow assist with the Missouri tax exemption process?

airSlate SignNow simplifies the document signing process, enabling businesses to efficiently handle the paperwork associated with the Missouri tax exemption. With our user-friendly platform, you can quickly generate and send the necessary documents for approval. This streamlines the process, saving you time and effort.

-

What features does airSlate SignNow offer for businesses seeking Missouri tax exemption?

AirSlate SignNow offers several features tailored for businesses seeking Missouri tax exemption, including customizable templates and automated workflows. Our platform facilitates fast document preparation and electronic signing, making compliance easier. These features enhance efficiency and help ensure that the exemption process is seamless.

-

Is there a cost associated with using airSlate SignNow for Missouri tax exemption documents?

While airSlate SignNow offers various pricing plans, the costs are designed to be budget-friendly for businesses of all sizes. Investing in our services can ultimately save you money by accelerating the Missouri tax exemption documentation process. We provide transparent pricing so you can choose the best plan for your needs.

-

Can airSlate SignNow integrate with other tools for managing Missouri tax exemption?

Yes, airSlate SignNow offers integrations with a variety of business tools, making it easier to manage your documentation for the Missouri tax exemption. Whether you're using accounting software or customer relationship management (CRM) systems, our platform can connect seamlessly. This enhances your overall efficiency and organization.

-

What are the benefits of using airSlate SignNow for electronic signatures related to Missouri tax exemption?

Using airSlate SignNow allows you to securely eSign documents related to the Missouri tax exemption quickly and easily. This eliminates the need for physical signatures, streamlining your workflow and enhancing security. Our platform also ensures compliance with state and federal eSignature laws.

-

How quickly can I complete the Missouri tax exemption documentation with airSlate SignNow?

With airSlate SignNow, you can complete and send your Missouri tax exemption documentation within minutes. Our intuitive interface allows for quick edits and signatures, ensuring a fast turnaround. This efficiency can substantially reduce the time required to obtain necessary approvals.

Get more for Dor mo govforms149149 Sales And Use Tax Exemption Certificate

Find out other Dor mo govforms149149 Sales And Use Tax Exemption Certificate

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed