Form 149 Sales and Use Tax Exemption Certificate PDF 2024

What is the Form 149 Sales And Use Tax Exemption Certificate pdf

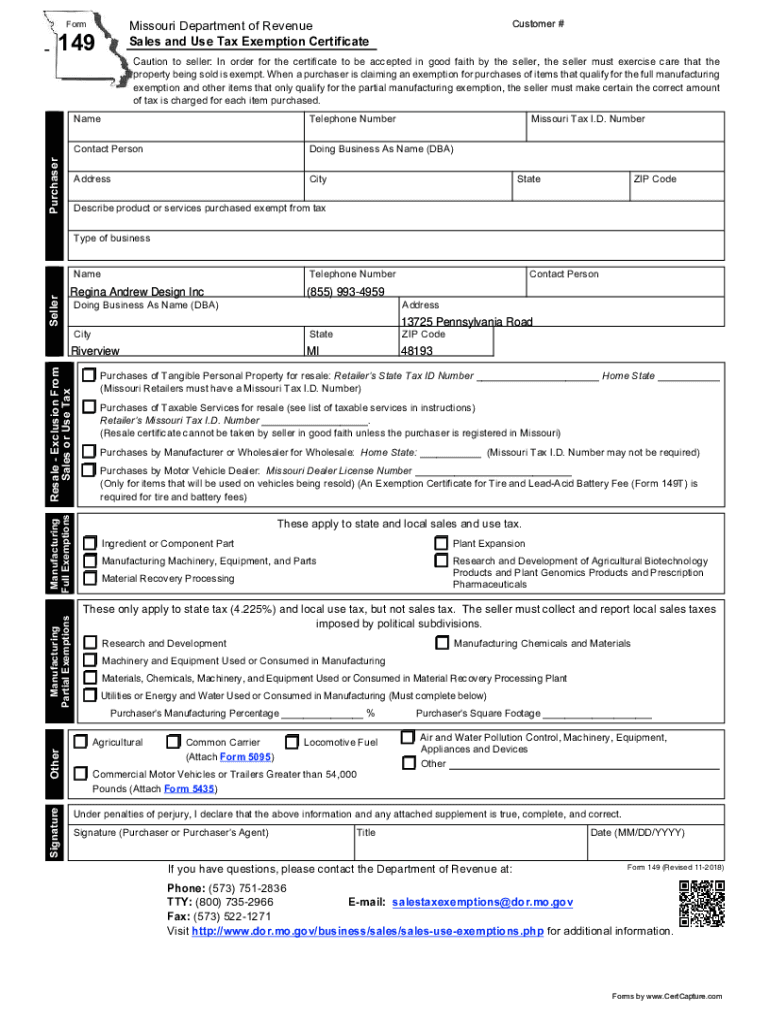

The Form 149 Sales And Use Tax Exemption Certificate is a crucial document used in the United States to claim exemption from sales and use tax. This form is typically utilized by organizations or individuals who purchase goods or services that are exempt from taxation under specific circumstances. The certificate serves as proof that the buyer is not liable for sales tax on qualifying purchases, thus enabling businesses to save on costs associated with tax payments.

How to use the Form 149 Sales And Use Tax Exemption Certificate pdf

To effectively use the Form 149 Sales And Use Tax Exemption Certificate, the buyer must complete the form accurately and present it to the seller at the time of purchase. The seller retains the certificate for their records, ensuring compliance with tax regulations. It's essential that the buyer provides all required information, including their name, address, and the reason for the exemption, to avoid any issues during tax audits.

Steps to complete the Form 149 Sales And Use Tax Exemption Certificate pdf

Completing the Form 149 Sales And Use Tax Exemption Certificate involves several straightforward steps:

- Obtain the Form 149 from a reliable source.

- Fill in your name and address in the designated fields.

- Specify the type of exemption being claimed.

- Provide details about the purchase, including the seller's information.

- Sign and date the form to validate it.

Once completed, present the form to the seller to claim the tax exemption.

Legal use of the Form 149 Sales And Use Tax Exemption Certificate pdf

The Form 149 Sales And Use Tax Exemption Certificate must be used in accordance with state laws governing sales tax exemptions. Legal use requires that the buyer qualifies for the exemption based on the nature of their purchase and the applicable tax regulations. Misuse of the form can lead to penalties, including fines or back taxes owed, so it is important to ensure compliance with all legal requirements.

Key elements of the Form 149 Sales And Use Tax Exemption Certificate pdf

Key elements of the Form 149 include:

- Purchaser Information: Name and address of the buyer claiming the exemption.

- Seller Information: Name and address of the seller from whom the goods or services are purchased.

- Exemption Reason: A clear statement of the reason for the tax exemption.

- Signature: The buyer's signature, affirming the accuracy of the information provided.

Each element must be completed accurately to ensure the validity of the exemption claim.

Eligibility Criteria

Eligibility for using the Form 149 Sales And Use Tax Exemption Certificate varies by state and is typically based on the nature of the buyer's organization or the specific type of purchase. Common eligible entities include non-profit organizations, government agencies, and certain educational institutions. To qualify, the buyer must ensure that their purchases align with the criteria set forth by state tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct form 149 sales and use tax exemption certificate pdf

Create this form in 5 minutes!

How to create an eSignature for the form 149 sales and use tax exemption certificate pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 149 Sales And Use Tax Exemption Certificate pdf?

The Form 149 Sales And Use Tax Exemption Certificate pdf is a document used by businesses to claim exemption from sales and use tax on eligible purchases. This certificate is essential for ensuring compliance with tax regulations while saving costs on taxable items. By using this form, businesses can streamline their purchasing processes and maintain accurate records.

-

How can airSlate SignNow help with the Form 149 Sales And Use Tax Exemption Certificate pdf?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the Form 149 Sales And Use Tax Exemption Certificate pdf. Our user-friendly interface simplifies the process, allowing users to complete and manage their exemption certificates quickly. This ensures that your documents are always compliant and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the Form 149 Sales And Use Tax Exemption Certificate pdf?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan includes features that facilitate the creation and management of documents like the Form 149 Sales And Use Tax Exemption Certificate pdf. We recommend reviewing our pricing page to find the best option for your organization.

-

What features does airSlate SignNow offer for managing the Form 149 Sales And Use Tax Exemption Certificate pdf?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the Form 149 Sales And Use Tax Exemption Certificate pdf. These tools enhance efficiency and ensure that your documents are processed quickly and securely. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the Form 149 Sales And Use Tax Exemption Certificate pdf?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Form 149 Sales And Use Tax Exemption Certificate pdf alongside your existing tools. This seamless integration helps streamline workflows and enhances productivity across your organization.

-

What are the benefits of using airSlate SignNow for the Form 149 Sales And Use Tax Exemption Certificate pdf?

Using airSlate SignNow for the Form 149 Sales And Use Tax Exemption Certificate pdf provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are signed and stored securely, reducing the risk of errors and compliance issues. This allows businesses to focus on their core operations while managing tax exemption processes efficiently.

-

How secure is airSlate SignNow when handling the Form 149 Sales And Use Tax Exemption Certificate pdf?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Form 149 Sales And Use Tax Exemption Certificate pdf and other sensitive documents. Our platform complies with industry standards to ensure that your data remains confidential and secure. You can trust us to safeguard your information throughout the signing process.

Get more for Form 149 Sales And Use Tax Exemption Certificate pdf

- Sellers andor buyers shall correct andor replace any closing document at the request of form

- The property at the address described above flood zone status is form

- Pledge of certificate of deposit state of louisiana parish form

- La rev stat121421 rs 121421dissolution by form

- You cannot immigrate through adult adoptiona peoples form

- Before me personally appeared form

- On this day of form

- Request for subpoenas form

Find out other Form 149 Sales And Use Tax Exemption Certificate pdf

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word