Form 149 2018

What is the Form 149?

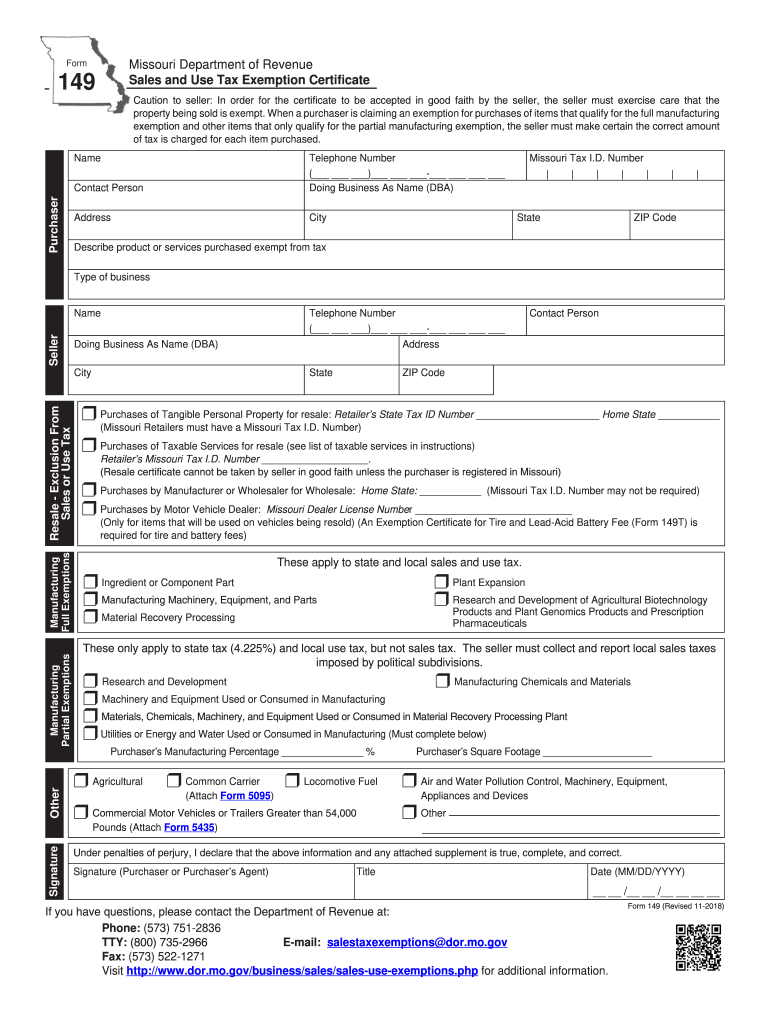

The Form 149, also known as the Missouri sales tax exemption certificate, is a crucial document for businesses and individuals seeking to make tax-exempt purchases in the state of Missouri. This form allows eligible buyers to claim exemption from sales tax when purchasing goods or services that are intended for resale or for specific exempt purposes. Understanding the purpose and use of this form is essential for compliance with state tax regulations.

How to use the Form 149

To utilize the Form 149 effectively, buyers must complete the form accurately and present it to the seller at the time of purchase. The seller retains the form for their records, which helps validate the tax-exempt status of the transaction. It is important to ensure that the items being purchased qualify for tax exemption under Missouri law, as misuse of the form can lead to penalties.

Steps to complete the Form 149

Completing the Form 149 involves several straightforward steps:

- Download the form from the Missouri Department of Revenue website or obtain a physical copy.

- Fill in your name, address, and the type of business or organization you represent.

- Provide your Missouri sales tax identification number, if applicable.

- Indicate the specific items or services being purchased and their intended use.

- Sign and date the form to certify the accuracy of the information provided.

Once completed, present the form to the seller to finalize the tax-exempt purchase.

Legal use of the Form 149

The Form 149 is legally binding when used correctly. It is designed to protect both the buyer and seller by ensuring that sales tax is only applied to taxable transactions. Misuse of the form, such as using it for non-qualifying purchases, can result in legal consequences, including fines and back taxes owed. Therefore, it is crucial to understand the legal implications of using this form.

Eligibility Criteria

To qualify for using the Form 149, the buyer must meet specific eligibility criteria established by the Missouri Department of Revenue. Generally, the form is available to businesses that are registered for sales tax and intend to resell the purchased items. Non-profit organizations may also qualify if the purchases are for exempt purposes. It is essential to verify eligibility before completing the form to ensure compliance with state regulations.

Form Submission Methods

The Form 149 can be submitted in various ways, depending on the seller's requirements. Typically, the completed form is presented in person at the time of purchase. Some sellers may allow electronic submission via email or fax, but this varies by business. It is advisable to confirm the preferred submission method with the seller to ensure proper processing of the tax-exempt transaction.

Quick guide on how to complete mo tax exemption 2018 2019 form

Your assistance manual on how to prepare your Form 149

If you are wondering how to fulfill and submit your Form 149, here are some quick pointers to facilitate tax processing.

To begin, simply register your airSlate SignNow account to revolutionize how you manage documentation online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to edit, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify responses as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Form 149 in just a few minutes:

- Create your account and start working on PDFs in minutes.

- Utilize our catalog to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Form 149 in our editor.

- Enter the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to include your legally-binding eSignature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Follow this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper submissions can lead to return errors and delay refunds. Additionally, make sure to check the IRS website for filing regulations in your state prior to e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct mo tax exemption 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I file tax exempted interest from PPF in the ITR 1 form for AY 2018-2019?

In form no 1 exempted income up to Rs.5,000/, can be filed. If the ecempted income is above Rs. 5,000/- then form no. 2 should be used. In case your exempted PPF interest is Rs. 5,000/- or below then there is a col in form no.1 where exempted income can be filled. This col is very small there for, please see very minutaly.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

Create this form in 5 minutes!

How to create an eSignature for the mo tax exemption 2018 2019 form

How to make an eSignature for the Mo Tax Exemption 2018 2019 Form online

How to make an eSignature for the Mo Tax Exemption 2018 2019 Form in Chrome

How to make an electronic signature for signing the Mo Tax Exemption 2018 2019 Form in Gmail

How to create an eSignature for the Mo Tax Exemption 2018 2019 Form right from your mobile device

How to create an eSignature for the Mo Tax Exemption 2018 2019 Form on iOS

How to generate an electronic signature for the Mo Tax Exemption 2018 2019 Form on Android devices

People also ask

-

What is the form 149 sales tax exemption?

The form 149 sales tax exemption is a document used to signNow that a purchaser is exempt from paying sales tax on specific purchases. This form is essential for businesses that want to avoid unnecessary tax expenses while purchasing goods or services. Understanding how to properly use the form 149 sales tax exemption can save your business signNow costs.

-

How can airSlate SignNow help with the form 149 sales tax exemption?

airSlate SignNow can streamline the process of obtaining and managing the form 149 sales tax exemption. With our eSignature capabilities, users can easily send the form to vendors for their signatures, ensuring a smooth and efficient transaction. Our platform is designed to simplify these processes, making tax exemption a hassle-free experience.

-

Are there any costs associated with using airSlate SignNow for the form 149 sales tax exemption?

airSlate SignNow offers competitive pricing plans that cater to various business needs when managing documents, including the form 149 sales tax exemption. Our pricing is designed to be cost-effective, especially when considering the time and money saved through our streamlined eSignature process. Contact us for a detailed pricing plan specific to your business requirements.

-

What are the key features of airSlate SignNow related to the form 149 sales tax exemption?

Key features of airSlate SignNow include easy document creation, secure eSignature capabilities, and real-time tracking of the form 149 sales tax exemption. Users can also leverage templates to easily reuse documents, saving time in future transactions. Additionally, our platform offers integration with various applications, enhancing efficiency in your business operations.

-

How does airSlate SignNow enhance document security for the form 149 sales tax exemption?

Security is a top priority at airSlate SignNow, especially for sensitive documents such as the form 149 sales tax exemption. We utilize robust encryption technology and stringent compliance measures to ensure that all documents are safely transmitted and stored. With airSlate SignNow, you can confidently manage your sales tax exemption forms without compromising on security.

-

Can I integrate airSlate SignNow with other software for my form 149 sales tax exemption needs?

Yes, airSlate SignNow offers integrations with numerous software applications to enhance your workflow regarding the form 149 sales tax exemption. Whether you use accounting software or CRM systems, our platform can connect seamlessly, making it easier to manage your documents and tax exemption processes. Explore our integration options to find the best fits for your business.

-

What benefits does using airSlate SignNow provide for managing the form 149 sales tax exemption?

Using airSlate SignNow for your form 149 sales tax exemption offers several benefits, including improved efficiency, reduced paperwork, and enhanced collaboration among team members. Our platform simplifies the signature process, which can expedite the approval of your exemption form. Streamlining these processes can lead to time savings and better organization in managing tax-related documents.

Get more for Form 149

- Chemistry counting atoms worksheet form

- Truewind community association design guidelines form

- Report of absolute divorce or annulment the collaborative law group form

- Binb canton onlain form

- Defendants original answer williamson county texas wilco form

- Har transfer listings bformb robyn jones homes

- Fax order form freebirds world burrito

- Qdoba fundraiser application form

Find out other Form 149

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document