How to Get a Resale Certificate & Tax Exemption for Amazon 2022

Understanding the Missouri Tax Exempt Form

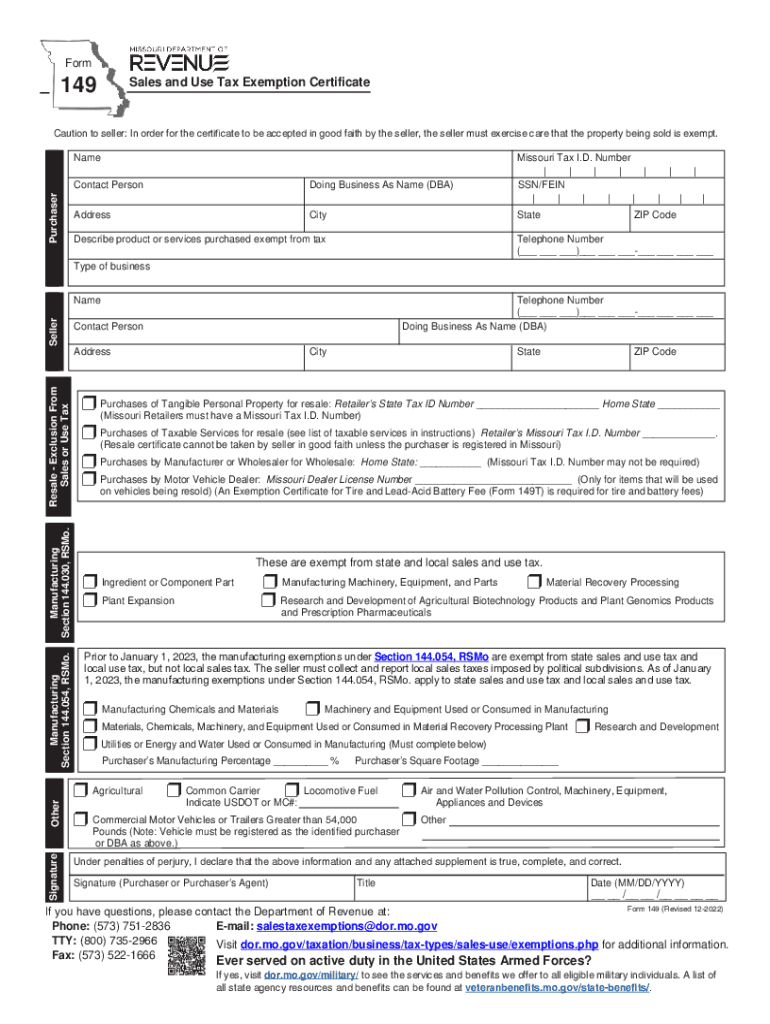

The Missouri tax exempt form, known as Form 149, is essential for businesses seeking to claim sales tax exemptions in the state. This form allows eligible organizations, such as non-profits and government entities, to purchase goods and services without incurring sales tax. Understanding the purpose and requirements of this form is crucial for compliance and financial efficiency.

Eligibility Criteria for the Missouri Form 149

To qualify for the Missouri tax exempt form, applicants must meet specific criteria. Generally, organizations must be recognized as tax-exempt under federal or state law. This includes non-profit organizations, educational institutions, and governmental bodies. Additionally, the purchases must be directly related to the organization’s exempt purpose. It is important to review the eligibility requirements thoroughly to ensure compliance.

Steps to Complete the Missouri Tax Exempt Form

Filling out the Missouri Form 149 involves several key steps:

- Gather necessary documentation, including proof of tax-exempt status.

- Complete all required fields on the form, ensuring accuracy.

- Provide a detailed description of the items or services being purchased.

- Sign and date the form to validate the information provided.

Once completed, the form can be submitted to the vendor to facilitate tax-exempt purchases.

Legal Use of the Missouri Tax Exempt Form

The Missouri tax exempt form must be used in accordance with state regulations. Misuse of the form can lead to penalties and loss of tax-exempt status. It is important for organizations to maintain accurate records of all transactions made under this exemption. Compliance with legal guidelines ensures that the organization can continue to benefit from tax exemptions without facing legal repercussions.

Form Submission Methods

The completed Missouri Form 149 can be submitted through various methods, including:

- Online submission via approved platforms.

- Mailing the form directly to the vendor.

- In-person delivery at the point of sale.

Choosing the appropriate submission method can streamline the process and ensure timely processing of tax-exempt purchases.

Key Elements of the Missouri Form 149

When filling out the Missouri tax exempt form, certain key elements must be included:

- Organization name and address.

- Tax identification number.

- Description of the exempt purpose.

- Signature of an authorized representative.

Each element is crucial for validating the exemption and ensuring compliance with state tax laws.

Common Mistakes to Avoid

When completing the Missouri Form 149, organizations should be aware of common pitfalls that may lead to complications:

- Failing to provide accurate information.

- Not including required documentation.

- Submitting the form without a signature.

By avoiding these mistakes, organizations can ensure a smoother process when claiming tax exemptions.

Quick guide on how to complete how to get a resale certificate ampamp tax exemption for amazon

Effortlessly Prepare How To Get A Resale Certificate & Tax Exemption For Amazon on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly solution to conventional printed and signed paperwork, allowing you to acquire the necessary forms and securely store them online. airSlate SignNow provides you with all the features required to create, adjust, and electronically sign your documents quickly and efficiently. Handle How To Get A Resale Certificate & Tax Exemption For Amazon on any device using airSlate SignNow apps for Android or iOS, and enhance any document-related task today.

How to Adjust and eSign How To Get A Resale Certificate & Tax Exemption For Amazon with Ease

- Locate How To Get A Resale Certificate & Tax Exemption For Amazon and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign How To Get A Resale Certificate & Tax Exemption For Amazon to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to get a resale certificate ampamp tax exemption for amazon

Create this form in 5 minutes!

How to create an eSignature for the how to get a resale certificate ampamp tax exemption for amazon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a MO tax exempt form and why is it important?

The MO tax exempt form is a document used by businesses in Missouri to claim exemption from sales tax. It is essential for companies that want to make tax-free purchases on eligible goods and services. By using the MO tax exempt form, you can ensure compliance with state tax regulations and potentially save signNow costs.

-

How can airSlate SignNow help me manage my MO tax exempt form?

airSlate SignNow provides a seamless platform for creating, sending, and electronically signing your MO tax exempt form. With our user-friendly interface, you can streamline the process, reduce paperwork, and ensure that your documents are securely stored and easy to access. This enhances efficiency in managing your tax-exempt transactions.

-

Is there a cost associated with using the MO tax exempt form feature in airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. While creating and managing a MO tax exempt form might come at no additional cost in certain plans, it's always best to check our pricing page for the most current details. Our services are competitively priced, providing excellent value for the features we offer.

-

Can I integrate airSlate SignNow with other software to manage my MO tax exempt forms?

Yes, airSlate SignNow offers integrations with a wide array of software applications that can help streamline the management of your MO tax exempt forms. Whether you're using accounting software or customer relationship management systems, our platform can enhance your workflow. Check our integrations list to see compatible software options.

-

What are the benefits of eSigning my MO tax exempt form with airSlate SignNow?

eSigning your MO tax exempt form with airSlate SignNow ensures a fast, efficient, and legally binding process. Not only does it eliminate the need for printing and scanning, but it also tracks the status of your documents in real-time. This enhances security and provides a clear audit trail for all signed documents.

-

How do I start using airSlate SignNow for my MO tax exempt form needs?

To start using airSlate SignNow for your MO tax exempt form needs, simply sign up for an account on our website. Once registered, you can quickly create and manage your tax exempt documents. Our intuitive interface and helpful resources will guide you through every step of the process.

-

What if I need help with my MO tax exempt form on airSlate SignNow?

If you need assistance with your MO tax exempt form on airSlate SignNow, our customer support team is readily available to help. You can signNow out through our support portal, where you'll find guides and FAQs to address common issues. Live chat and email options are also available for direct support.

Get more for How To Get A Resale Certificate & Tax Exemption For Amazon

- Drainage contract for contractor texas form

- Texas foundation form

- Plumbing contract for contractor texas form

- Brick mason contract for contractor texas form

- Fill in blank printable roofing contract template form

- Electrical contract for contractor texas form

- Sheetrock drywall contract for contractor texas form

- Flooring contract for contractor texas form

Find out other How To Get A Resale Certificate & Tax Exemption For Amazon

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast