Fillable Online Form 990 Schedule N Liquidation 2021

What is the fillable online Form 990 Schedule N liquidation?

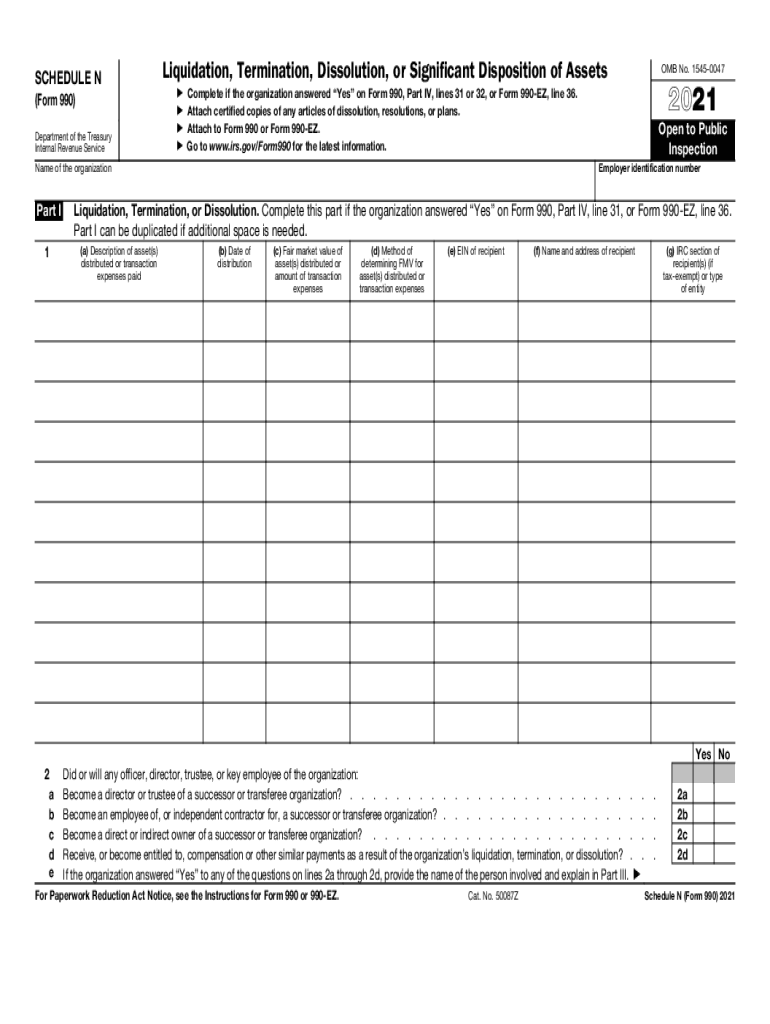

The fillable online Form 990 Schedule N liquidation is a specific tax document used by organizations to report the dissolution of their entity. This form is essential for entities that are terminating their operations and need to disclose the disposition of their assets. The Schedule N provides detailed information about how the organization’s assets were handled during the liquidation process, ensuring compliance with IRS regulations. This form is particularly relevant for non-profit organizations, as it allows them to formally document their closure and the distribution of any remaining assets.

Steps to complete the fillable online Form 990 Schedule N liquidation

Completing the fillable online Form 990 Schedule N liquidation involves several key steps:

- Gather necessary information: Collect all relevant details about the organization, including its legal name, Employer Identification Number (EIN), and the date of dissolution.

- Document asset disposition: Clearly outline how the organization's assets were distributed or disposed of during the liquidation process. This includes details about any transfers to other organizations or sales of assets.

- Complete the form: Fill out the online form accurately, ensuring that all sections are completed as required. Pay attention to any specific instructions provided for each section.

- Review for accuracy: Before submitting, review the form thoroughly to ensure all information is correct and complete. This helps prevent delays or issues with processing.

- Submit the form: Once finalized, submit the completed Schedule N electronically through the appropriate IRS channels.

Legal use of the fillable online Form 990 Schedule N liquidation

The legal use of the fillable online Form 990 Schedule N liquidation is crucial for compliance with IRS regulations. This form serves as an official record of the organization’s dissolution and the handling of its assets. Proper completion and submission of this form help protect the organization from potential legal issues related to asset distribution. It is important to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or complications during the dissolution process.

Filing deadlines / important dates for the fillable online Form 990 Schedule N liquidation

Filing deadlines for the fillable online Form 990 Schedule N liquidation are critical to ensure compliance with IRS requirements. Generally, the form must be submitted by the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this typically means a deadline of May 15. It is essential to be aware of these deadlines to avoid late filing penalties and to ensure that the dissolution process is completed in a timely manner.

Required documents for the fillable online Form 990 Schedule N liquidation

When completing the fillable online Form 990 Schedule N liquidation, several documents are typically required to support the information provided. These may include:

- Articles of dissolution or similar legal documents confirming the organization’s closure.

- Records of asset transfers or sales, including any agreements or contracts.

- Financial statements detailing the organization’s assets at the time of liquidation.

- Any correspondence with the IRS related to the dissolution process.

IRS guidelines for the fillable online Form 990 Schedule N liquidation

The IRS provides specific guidelines for completing the fillable online Form 990 Schedule N liquidation. These guidelines outline the necessary information to include, as well as the format for reporting asset dispositions. Organizations must adhere to these guidelines to ensure that their form is accepted and processed without issues. Familiarizing oneself with the IRS instructions can help streamline the completion process and ensure compliance with all legal requirements.

Quick guide on how to complete fillable online 2008 form 990 schedule n liquidation

Complete Fillable Online Form 990 Schedule N Liquidation effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle Fillable Online Form 990 Schedule N Liquidation on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Fillable Online Form 990 Schedule N Liquidation with ease

- Find Fillable Online Form 990 Schedule N Liquidation and click on Get Form to get started.

- Use the tools we offer to complete your form.

- Highlight signNow sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Fillable Online Form 990 Schedule N Liquidation to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online 2008 form 990 schedule n liquidation

Create this form in 5 minutes!

How to create an eSignature for the fillable online 2008 form 990 schedule n liquidation

How to generate an e-signature for a PDF in the online mode

How to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

The best way to make an e-signature for a PDF on Android OS

People also ask

-

What is a liquidation form?

A liquidation form is a document used by businesses to officially declare and facilitate the process of liquidating their assets. This form outlines the details regarding the liquidation process and ensures compliance with legal requirements. airSlate SignNow simplifies the completion and signing of this crucial document.

-

How can I create a liquidation form using airSlate SignNow?

Creating a liquidation form with airSlate SignNow is easy and efficient. Simply select a template or start from scratch, customize it as per your requirements, and add the necessary fields for signatures. Our intuitive platform allows you to send it out for signing in just a few clicks.

-

What are the benefits of using airSlate SignNow for liquidation forms?

Using airSlate SignNow for liquidation forms streamlines the entire process, allowing for faster and more secure document management. The benefits include electronic signatures, real-time tracking, and cloud storage, which collectively enhance efficiency and reduce the risk of paperwork errors.

-

Is there a cost associated with using airSlate SignNow for liquidation forms?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs. Whether you are an individual or a large corporation, you can choose a plan that best fits your budget and usage requirements. Our cost-effective solutions make it easy to access essential tools for managing liquidation forms.

-

Can I integrate airSlate SignNow with other software for managing liquidation forms?

Absolutely! airSlate SignNow supports integrations with popular software applications, enabling seamless management of your liquidation forms. Whether you use CRMs, document storage solutions, or other business tools, our platform offers flexibility and connectivity to ensure your workflow is uninterrupted.

-

How secure are the liquidation forms processed through airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and robust security protocols to ensure that your liquidation forms and sensitive data remain protected at all times. You can confidently manage and store your documents without worrying about unauthorized access.

-

How long does it take to finalize a liquidation form with airSlate SignNow?

Finalizing a liquidation form using airSlate SignNow is typically quick and efficient. Depending on the number of signatories and their availability, the entire process can take just minutes. This speed helps businesses manage their liquidation processes more effectively and without unnecessary delays.

Get more for Fillable Online Form 990 Schedule N Liquidation

Find out other Fillable Online Form 990 Schedule N Liquidation

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter