Form 990 or 990 EZ Schedule N Liquidation, Termination, Dissolution, or Significant Disposition of Assests Irs 2016

What is the Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assets IRS

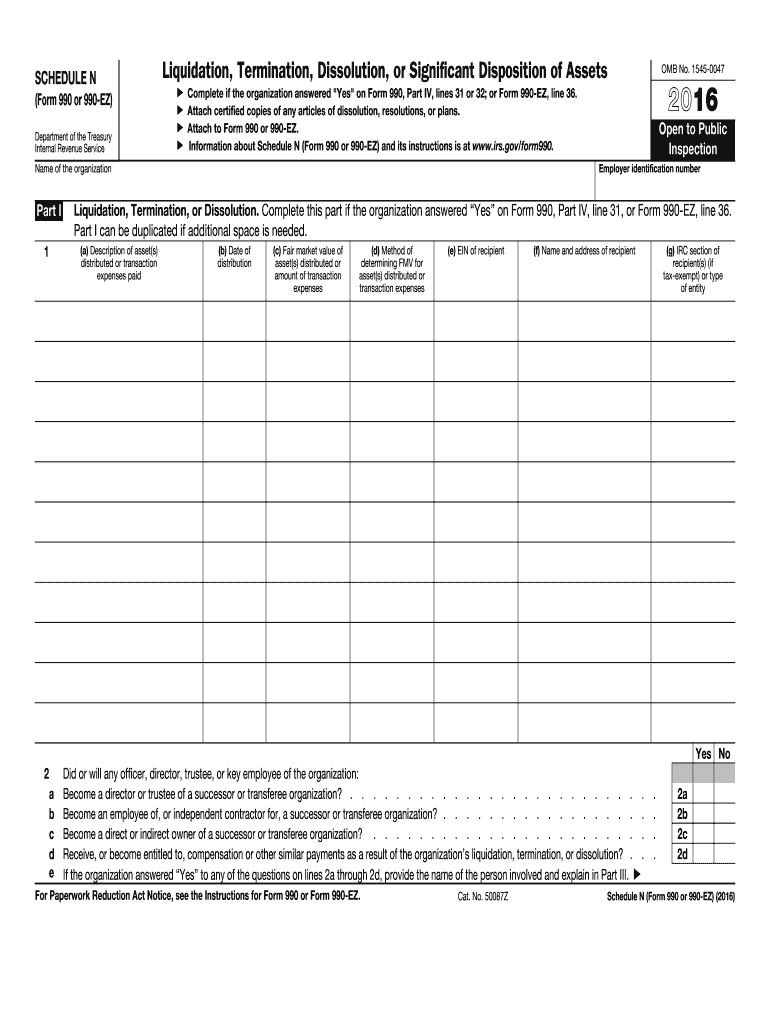

The Form 990 or 990 EZ Schedule N is a crucial document for tax-exempt organizations in the United States. It is specifically used to report the liquidation, termination, dissolution, or significant disposition of assets. This form provides the IRS with detailed information about the organization’s financial activities during the process of ceasing operations or significantly altering its asset structure. The completion of this form ensures compliance with federal tax regulations and helps maintain transparency regarding the organization’s financial status.

Steps to Complete the Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assets IRS

Completing the Form 990 or 990 EZ Schedule N involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including asset valuations and liabilities. Next, accurately fill out the form by providing details about the organization’s assets being disposed of, the method of disposition, and any related financial transactions. It is essential to review the form for completeness and accuracy before submission. Finally, ensure that all required signatures are obtained to validate the document.

Legal Use of the Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assets IRS

The legal use of the Form 990 or 990 EZ Schedule N is vital for organizations undergoing liquidation or termination. This form serves as an official record of the organization’s financial activity during its dissolution process. By submitting this form, organizations comply with IRS regulations, which can help avoid penalties or legal issues related to improper reporting. Furthermore, accurate reporting can aid in the proper distribution of remaining assets and ensure that all tax obligations are met.

IRS Guidelines for the Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assets IRS

The IRS provides specific guidelines for completing the Form 990 or 990 EZ Schedule N. Organizations must adhere to these guidelines to ensure compliance. Key aspects include accurately reporting the date of liquidation or termination, providing a detailed description of asset dispositions, and ensuring that all financial information is up to date. Organizations should also be aware of any changes in IRS regulations that may affect the completion of this form.

Filing Deadlines for the Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assets IRS

Filing deadlines for the Form 990 or 990 EZ Schedule N are critical to ensure timely compliance with IRS requirements. Generally, the form must be filed on the fifteenth day of the fifth month after the end of the organization’s fiscal year. However, organizations should verify specific deadlines based on their fiscal year and any extensions that may apply. Failing to meet these deadlines can result in penalties and complications regarding the organization’s tax-exempt status.

Required Documents for the Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assets IRS

When preparing to file the Form 990 or 990 EZ Schedule N, organizations must gather several required documents. These typically include financial statements, asset valuations, and records of any transactions related to the disposition of assets. Additionally, any documentation that supports the organization’s decision to liquidate or dissolve should be included. Having these documents ready will facilitate a smoother filing process and ensure that all necessary information is accurately reported.

Quick guide on how to complete 2016 form 990 or 990 ez schedule n liquidation termination dissolution or significant disposition of assests irs

Effortlessly Complete Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests Irs on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, alter, and eSign your documents promptly without any hold-ups. Manage Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests Irs on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Simplest Method to Modify and eSign Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests Irs with Ease

- Locate Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests Irs and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select crucial sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional hand-signed signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether via email, SMS, or an invite link, or download it onto your computer.

Eliminate concerns about lost or misplaced files, laborious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests Irs to ensure smooth communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 990 or 990 ez schedule n liquidation termination dissolution or significant disposition of assests irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 990 or 990 ez schedule n liquidation termination dissolution or significant disposition of assests irs

How to make an electronic signature for your 2016 Form 990 Or 990 Ez Schedule N Liquidation Termination Dissolution Or Significant Disposition Of Assests Irs online

How to generate an electronic signature for the 2016 Form 990 Or 990 Ez Schedule N Liquidation Termination Dissolution Or Significant Disposition Of Assests Irs in Chrome

How to create an electronic signature for signing the 2016 Form 990 Or 990 Ez Schedule N Liquidation Termination Dissolution Or Significant Disposition Of Assests Irs in Gmail

How to generate an eSignature for the 2016 Form 990 Or 990 Ez Schedule N Liquidation Termination Dissolution Or Significant Disposition Of Assests Irs right from your smartphone

How to generate an electronic signature for the 2016 Form 990 Or 990 Ez Schedule N Liquidation Termination Dissolution Or Significant Disposition Of Assests Irs on iOS devices

How to create an electronic signature for the 2016 Form 990 Or 990 Ez Schedule N Liquidation Termination Dissolution Or Significant Disposition Of Assests Irs on Android OS

People also ask

-

What is Form 990 Or 990 EZ Schedule N?

Form 990 Or 990 EZ Schedule N is a crucial IRS form used by organizations to report the liquidation, termination, or dissolution of their entity, or any signNow disposition of assets. This form helps ensure compliance with IRS regulations while providing transparency about the entity's financial health and activities.

-

How can airSlate SignNow help with Form 990 Or 990 EZ Schedule N?

AirSlate SignNow simplifies the process of preparing and submitting your Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or signNow Disposition Of Assests Irs. With our platform, you can easily eSign required documents, ensuring faster processing and compliance with IRS requirements.

-

What features does airSlate SignNow offer for handling IRS forms?

AirSlate SignNow offers a range of features tailored for IRS forms, including customizable templates and secure e-signature options. Our platform ensures that your Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or signNow Disposition Of Assests Irs is completed accurately and submitted on time.

-

Is airSlate SignNow affordable for non-profits needing to file Form 990?

Yes, airSlate SignNow is a cost-effective solution designed for businesses and non-profits alike. We provide competitive pricing plans that accommodate organizations looking to manage their Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or signNow Disposition Of Assests Irs without breaking the budget.

-

What are the benefits of using airSlate SignNow for IRS form submissions?

Using airSlate SignNow for your IRS form submissions streamlines the entire process, enhances accuracy, and saves time. You can track the status of your Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or signNow Disposition Of Assests Irs submissions and securely store documents for future reference.

-

Can airSlate SignNow integrate with other accounting software for IRS filings?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to enhance workflow efficiency. This integration allows for easy access to your Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or signNow Disposition Of Assests Irs data, simplifying the filing process.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption measures to protect your sensitive information while you prepare and submit Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or signNow Disposition Of Assests Irs.

Get more for Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests Irs

- Dish network landlord permission form

- Property protection plan form

- Pima agreement form

- Rems food and drug administration fda form

- Department of health and mental hygiene code of maryland regulations 100705 form

- Business ampamp excise tax forms

- Prior authorization request form required for met

- Cml form

Find out other Form 990 Or 990 EZ Schedule N Liquidation, Termination, Dissolution, Or Significant Disposition Of Assests Irs

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free