Go to Www Irs GovForm990 for the Latest Information Inspection 2020

Understanding the 990 airSlate SignNow assets form

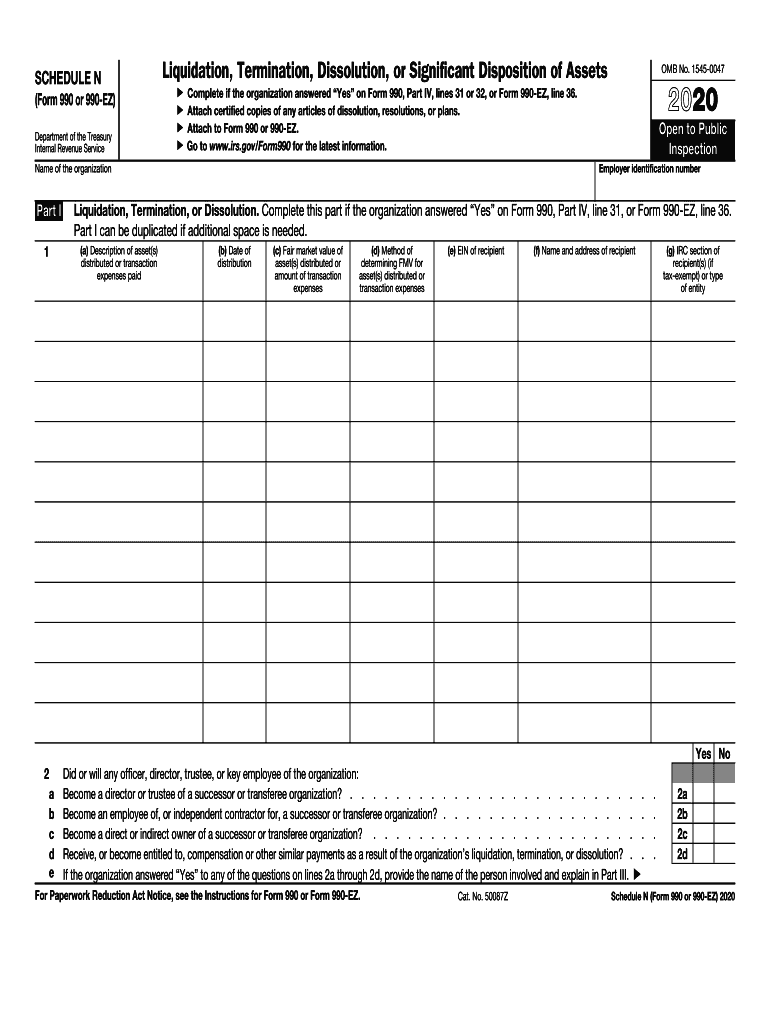

The 990 airSlate SignNow assets form is an essential document for organizations, particularly non-profits, to report their financial activities and ensure transparency. This form is used to disclose information about the organization's assets, liabilities, and revenue. It is crucial for maintaining compliance with IRS regulations and for providing stakeholders with a clear picture of the organization's financial health.

Key elements of the 990 airSlate SignNow assets form

This form includes several important sections that organizations must complete accurately. Key elements include:

- Asset Disclosure: A detailed account of all assets owned by the organization, including cash, investments, and property.

- Liabilities: Information regarding any debts or obligations, which is vital for assessing the organization's financial stability.

- Revenue Reporting: A comprehensive overview of all income sources, including donations, grants, and service fees.

- Governance Information: Details about the organization's leadership and governance structure.

Steps to complete the 990 airSlate SignNow assets form online

Filling out the 990 airSlate SignNow assets form online can streamline the process and enhance accuracy. Here are the steps to follow:

- Access the form through the airSlate SignNow platform.

- Begin by entering the organization's basic information, including name, address, and EIN.

- Proceed to fill out the asset and liability sections, ensuring all figures are accurate and up-to-date.

- Review the revenue reporting section, detailing all income sources.

- Ensure all required signatures are included, utilizing airSlate SignNow's eSignature capabilities for authenticity.

- Submit the completed form electronically through the platform.

Legal use of the 990 airSlate SignNow assets form

The 990 airSlate SignNow assets form is legally binding when filled out correctly and submitted in compliance with IRS regulations. It is essential that organizations adhere to all guidelines to avoid penalties and ensure that their financial reporting is transparent and accurate.

Filing deadlines for the 990 airSlate SignNow assets form

Organizations must be aware of the filing deadlines for the 990 airSlate SignNow assets form to maintain compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form would be due by May 15 of the following year.

Penalties for non-compliance with the 990 airSlate SignNow assets form

Failure to file the 990 airSlate SignNow assets form on time can result in significant penalties. Organizations may face fines for late submissions, and repeated failures to comply can lead to the loss of tax-exempt status. It is vital for organizations to prioritize timely and accurate filing to avoid these consequences.

Quick guide on how to complete go to wwwirsgovform990 for the latest information inspection

Prepare Go To Www irs govForm990 For The Latest Information Inspection effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the features you require to create, edit, and eSign your documents quickly and without interruptions. Manage Go To Www irs govForm990 For The Latest Information Inspection on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Go To Www irs govForm990 For The Latest Information Inspection without hassle

- Obtain Go To Www irs govForm990 For The Latest Information Inspection and then click Get Form to commence.

- Make use of the tools provided to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with functions that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to confirm your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your selection. Modify and eSign Go To Www irs govForm990 For The Latest Information Inspection and guarantee smooth communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct go to wwwirsgovform990 for the latest information inspection

Create this form in 5 minutes!

How to create an eSignature for the go to wwwirsgovform990 for the latest information inspection

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 990 airSlate SignNow assets form online?

The 990 airSlate SignNow assets form online is a digital document that allows users to efficiently manage their asset declarations. This online form streamlines the process, making it faster and more accessible for businesses looking to comply with regulatory requirements.

-

How can I access the 990 airSlate SignNow assets form online?

To access the 990 airSlate SignNow assets form online, simply visit the airSlate SignNow website and navigate to the forms section. From there, you can easily locate and fill out the form using our user-friendly interface.

-

What features does the 990 airSlate SignNow assets form online offer?

The 990 airSlate SignNow assets form online comes equipped with features such as e-signature capabilities, customizable templates, and secure document storage. These functionalities enhance the user experience and ensure the integrity of your documents.

-

Is the 990 airSlate SignNow assets form online secure?

Yes, the 990 airSlate SignNow assets form online is highly secure. airSlate SignNow employs top-tier encryption standards and compliance with industry regulations to ensure your sensitive information is protected throughout the signing process.

-

What are the benefits of using the 990 airSlate SignNow assets form online for my business?

Using the 990 airSlate SignNow assets form online can greatly improve efficiency by reducing paperwork and streamlining signing processes. This not only saves time but also enhances collaboration and accuracy in managing asset-related documents.

-

Can I integrate the 990 airSlate SignNow assets form online with other software?

Absolutely! The 990 airSlate SignNow assets form online can be integrated with various software and applications. This flexibility allows users to streamline their workflow and enhances overall productivity.

-

What is the pricing structure for using the 990 airSlate SignNow assets form online?

The pricing for using the 990 airSlate SignNow assets form online varies based on the chosen plan. We offer competitive rates with various subscription options to accommodate different business needs, ensuring you get the best solution for your budget.

Get more for Go To Www irs govForm990 For The Latest Information Inspection

- West virginia marriage application form

- Name change notification form west virginia

- Wv commercial lease form

- West virginia employers form

- West virginia petition form

- Wv evidence form

- Psychiatric or psychological report certification of confidentiality west virginia form

- Request for award of claimants attorney fees and expenses west virginia form

Find out other Go To Www irs govForm990 For The Latest Information Inspection

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will