Unknown Organization Form 990, Schedule N News Apps 2023

Understanding the liquidation form

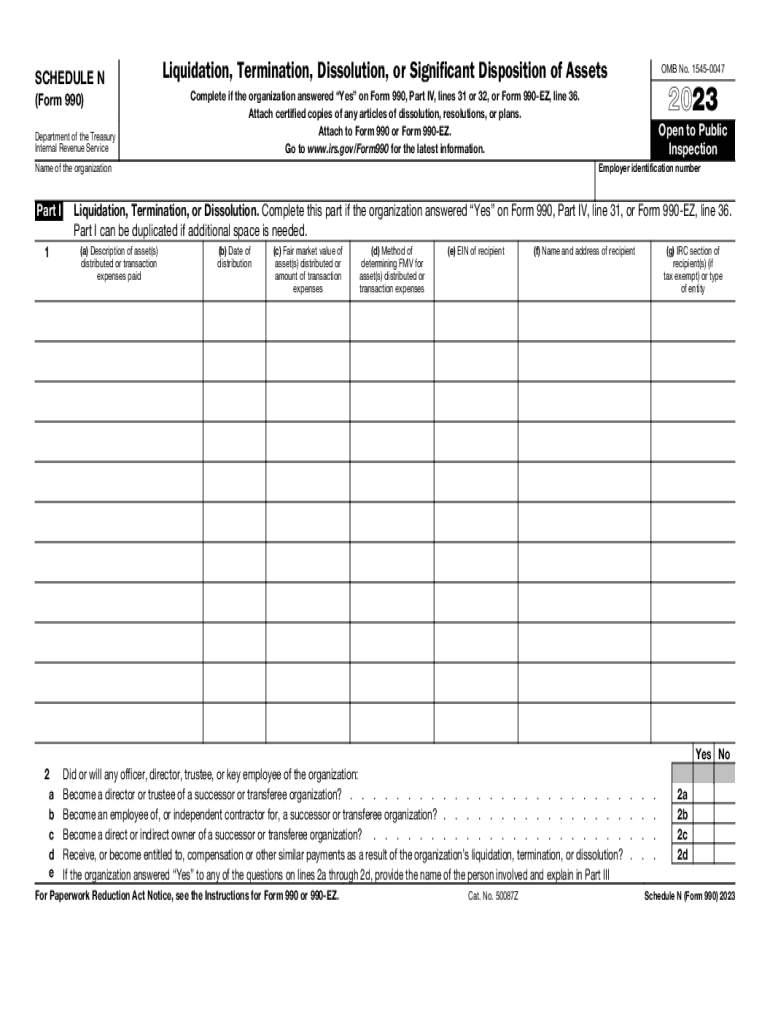

The liquidation form is a crucial document for organizations that are ceasing operations. It provides a structured way to report the dissolution of an entity and outlines how assets will be handled. This form is particularly relevant for nonprofit organizations, as it helps ensure compliance with IRS regulations during the termination process. By accurately completing the liquidation form, organizations can avoid potential penalties and ensure a smooth transition.

Steps to complete the liquidation form

Completing the liquidation form involves several key steps:

- Gather necessary information about the organization, including its legal name, address, and tax identification number.

- Detail the reasons for liquidation, ensuring that they align with IRS guidelines.

- List all assets and liabilities, providing a clear picture of the organization's financial status.

- Outline the proposed distribution of assets, including any payments to creditors and remaining funds to be allocated to other organizations or causes.

- Review the form for accuracy and completeness before submission.

Key elements of the liquidation form

The liquidation form includes several essential components that must be addressed:

- Entity Information: This section requires the organization's name, address, and identification number.

- Reason for Liquidation: A clear explanation of why the organization is ceasing operations.

- Asset and Liability Details: A comprehensive list of all assets, including cash, property, and investments, alongside any outstanding debts.

- Distribution Plan: A detailed plan for how remaining assets will be distributed among creditors and other parties.

IRS guidelines for the liquidation process

Following IRS guidelines is vital when completing the liquidation form. Organizations must ensure that they meet all requirements for dissolution, which may include notifying stakeholders, settling debts, and filing final tax returns. The IRS expects transparency in reporting, and failure to comply with these guidelines can result in penalties. Understanding these regulations helps organizations navigate the liquidation process effectively.

Filing deadlines and important dates

Timely submission of the liquidation form is essential to avoid penalties. Organizations should be aware of the following important dates:

- The deadline for filing the liquidation form is generally the same as the final tax return due date.

- Organizations must also consider any state-specific deadlines for dissolution.

- It is advisable to allow sufficient time for gathering necessary documents and completing the form accurately.

Required documents for the liquidation form

To successfully complete the liquidation form, organizations should prepare the following documents:

- Financial statements, including balance sheets and income statements.

- Records of all assets and liabilities.

- Meeting minutes or resolutions from the board of directors approving the liquidation.

- Any correspondence with creditors regarding debt settlement.

Quick guide on how to complete unknown organization form 990 schedule n news apps

Complete Unknown Organization Form 990, Schedule N News Apps effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Unknown Organization Form 990, Schedule N News Apps on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Unknown Organization Form 990, Schedule N News Apps with ease

- Obtain Unknown Organization Form 990, Schedule N News Apps and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight pertinent sections of the document or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the anxiety of lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Unknown Organization Form 990, Schedule N News Apps and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct unknown organization form 990 schedule n news apps

Create this form in 5 minutes!

How to create an eSignature for the unknown organization form 990 schedule n news apps

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a liquidation form, and how can airSlate SignNow help with it?

A liquidation form is a document used to report the dissolution of a business and the distribution of its assets. airSlate SignNow simplifies this process by allowing you to create, send, and eSign liquidation forms seamlessly, ensuring all parties can sign the document from anywhere.

-

Is airSlate SignNow cost-effective for filing liquidation forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage liquidation forms. With various pricing plans, you can choose one that fits your budget while benefiting from unlimited document signing and secure storage.

-

What features does airSlate SignNow offer for managing liquidation forms?

airSlate SignNow provides robust features for managing liquidation forms, including customizable templates, in-app signing, and automatic notifications. These tools help streamline the eSigning process, making it efficient and hassle-free.

-

Can I integrate airSlate SignNow with other applications for processing liquidation forms?

Absolutely! airSlate SignNow supports integrations with many popular applications like Google Drive, Salesforce, and more. This allows you to manage your liquidation forms alongside other business processes seamlessly.

-

How secure is the eSigning process for liquidation forms with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and secure storage methods to protect your liquidation forms and personal information, ensuring that your documents are safe throughout the eSigning process.

-

What benefits can I expect when using airSlate SignNow for liquidation forms?

By choosing airSlate SignNow for your liquidation forms, you can expect increased efficiency, reduced processing time, and enhanced document security. The user-friendly interface makes it easy for all stakeholders to sign documents quickly.

-

Is there a limit on the number of liquidation forms I can send with airSlate SignNow?

No, airSlate SignNow does not impose limits on the number of liquidation forms you can send, depending on your subscription plan. This flexibility ensures that you can manage all your necessary documentation without restrictions.

Get more for Unknown Organization Form 990, Schedule N News Apps

- Application for registration of a motor vehicle with restricted form

- Other special state provisionsgeorgia department of form

- Ohio bmv applicationfill out printable pdf forms online

- Dmv alaska motor vehicle crash form 12209one cho

- Forms manuals

- Safety inspection program form

- Dl 21sc penndot form

- Mc 390 ex parte motion and order to renew civil judgment form

Find out other Unknown Organization Form 990, Schedule N News Apps

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement