Dissolution of Assets and Form 990 Instructions 2018

Understanding the Dissolution of Assets and Form 990 Instructions

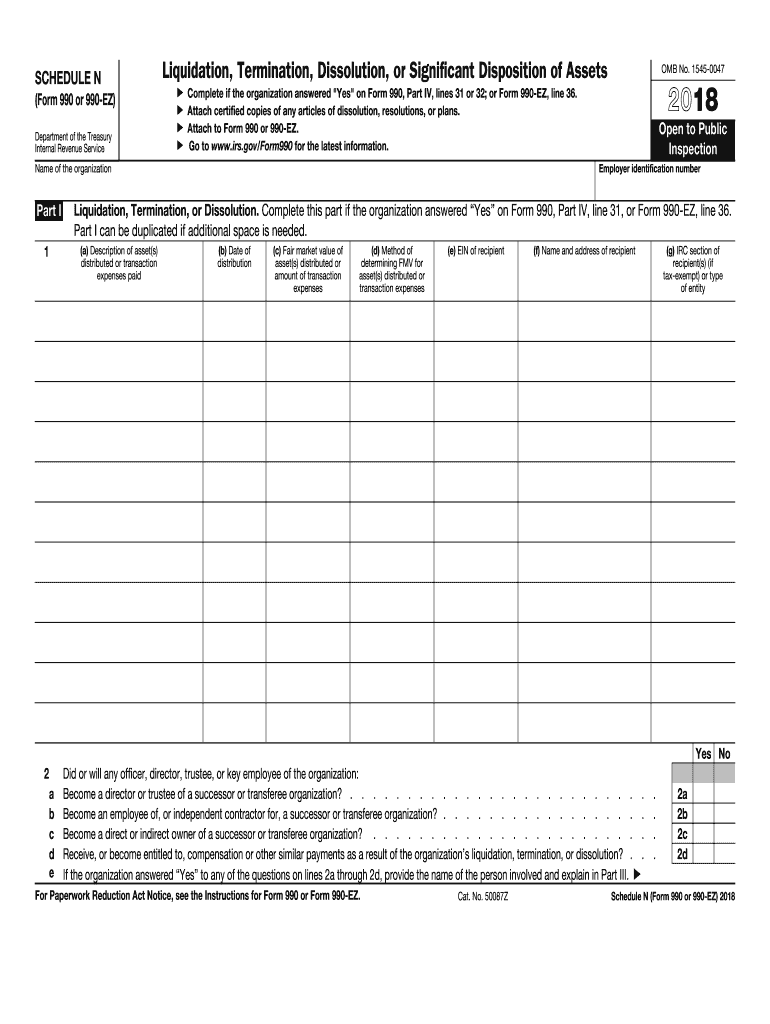

The dissolution of assets and the associated IRS Form 990 are crucial for non-profit organizations that are ceasing operations. This process involves reporting the organization's financial status and how its remaining assets will be managed. The IRS Form 990 is primarily used to provide transparency regarding the financial activities of tax-exempt organizations. When an organization dissolves, it must ensure that any remaining assets are distributed in accordance with its mission and applicable laws.

Key components of the dissolution process include identifying all assets, liabilities, and obligations. Organizations must also determine how to allocate remaining assets, which may involve transferring them to another non-profit or returning them to donors. Proper documentation and adherence to IRS guidelines are essential to avoid penalties and ensure compliance.

Steps to Complete the Dissolution of Assets and Form 990 Instructions

Completing the dissolution of assets and the IRS Form 990 requires careful planning and execution. Here are the essential steps:

- Review Organizational Bylaws: Check the bylaws for any specific procedures related to dissolution.

- Notify Stakeholders: Inform board members, employees, and relevant stakeholders about the decision to dissolve.

- Prepare Financial Statements: Compile a comprehensive financial statement that includes all assets and liabilities.

- Allocate Remaining Assets: Decide how remaining assets will be distributed, ensuring compliance with IRS regulations.

- Complete IRS Form 990: Fill out the form accurately, including all required schedules related to the dissolution.

- File the Form: Submit the completed Form 990 to the IRS by the specified deadline.

Following these steps helps ensure a smooth dissolution process while maintaining compliance with IRS requirements.

Legal Use of the Dissolution of Assets and Form 990 Instructions

Understanding the legal implications of dissolving a non-profit organization is vital. The dissolution process must comply with both state and federal laws. Non-profits must adhere to the specific guidelines outlined in IRS regulations regarding asset distribution and reporting. Failure to comply can result in penalties, including loss of tax-exempt status.

It is advisable for organizations to consult with legal counsel during the dissolution process to ensure that all legal requirements are met. This includes proper notification to the IRS and state authorities, as well as adherence to any specific state laws governing non-profit dissolution.

Filing Deadlines and Important Dates

Timely filing of IRS Form 990 is critical for non-profits undergoing dissolution. The IRS requires that Form 990 be filed by the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations that operate on a calendar year, this means the form is due by May 15. If an extension is needed, organizations can file Form 8868 to request an additional six months.

It is important to keep track of these deadlines to avoid late fees and potential penalties. Additionally, organizations should be aware of any state-specific filing requirements that may apply during the dissolution process.

Required Documents for Dissolution and Form 990

When preparing for the dissolution of a non-profit and filing Form 990, several documents are necessary:

- Financial statements detailing assets and liabilities

- Board meeting minutes approving the dissolution

- Documentation of asset distribution plans

- Completed IRS Form 990 and any required schedules

- State-specific dissolution forms, if applicable

Gathering these documents in advance can streamline the filing process and ensure compliance with both IRS and state requirements.

IRS Guidelines for Form 990 Dissolution

The IRS provides specific guidelines for completing Form 990 in the context of dissolution. Organizations must report all financial activities leading up to the dissolution, including revenue, expenses, and asset distributions. Additionally, any changes in the organization’s structure or purpose must be disclosed.

It is essential to accurately complete all sections of the form, especially those related to the organization’s final activities and asset distribution. This transparency helps maintain compliance and supports the organization’s commitment to ethical practices.

Quick guide on how to complete form 990 or 990 ez sch n

Uncover the simplest method to complete and endorse your Dissolution Of Assets And Form 990 Instructions

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to completing and endorsing your Dissolution Of Assets And Form 990 Instructions and associated forms for public services. Our intelligent electronic signature solution equips you with everything necessary to manage documents swiftly and in accordance with official standards - robust PDF editing, organizing, safeguarding, signing, and sharing tools all available within a user-friendly interface.

Only a few steps are needed to complete and endorse your Dissolution Of Assets And Form 990 Instructions:

- Upload the fillable template to the editor using the Get Form button.

- Verify the information required for your Dissolution Of Assets And Form 990 Instructions.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date alongside your signature and finalize your work with the Done button.

Store your finalized Dissolution Of Assets And Form 990 Instructions in the Documents folder within your profile, download it, or export it to your chosen cloud storage. Our solution also provides flexible file sharing options. There’s no need to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form 990 or 990 ez sch n

FAQs

-

If your nonprofit raised less than $5000 from any one contributor, can you skip filing Schedule B with your 990 or 990 EZ form to the IRS?

Yes, if no donor gave more than $5,000 (money and/or property) your organization can skip filing Schedule B of Form 990, as long as the organization isa public charity (checking either box 16a or 16b in Part II of Schedule A of 990) ora relatively new organization (checking box 13 in Part II of Schedule A of Form 990).Be sure you answer Question 2 in Part IV of Form 990 “No.”

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How do I find out whether I belong to the OBC creamy or non-creamy layer while filling out a form?

Please go to the caste census of 2011 to find out whether you are a backward caste . Then find out from the website of Backward Classes Commission whether you fall in OBC list .Having found that , the criteria is as under -You will be in non-creamy layer if your parents’ total annual income is not more than Rs.8 lakh . Your own income , if any , is not included . Any agricultural income of your parents is also not included .

-

How do I get a B Pharm admission at Jamia Hamdard University? Do I need to fill out a form or is it through NEET?

Both who have given NEET or not given NEET are eligible for applying for b pharm in Jamia Hamdard. You can apply for the course through the given link:Jamia Hamdard Admissions 2018://admissions.jamiahamdard.eduAdmission in b pharm in Jamia Hamdard is based upon the personal interview conducted by the officials. The call for the interview is based upon the of aggregate of marks in PCB.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

What is wrong with the hiring process and how could it be fixed? Endless forms have to be filled out, nothing is unified, and GitHub, StackOverflow (for developers) or Dribbble (for designers) are not taken into consideration.

Finding the right job candidates is one of the biggest recruiting challenges. Recruiters and other HR professionals that don’t use best recruiting strategies are often unable to find high-quality job applicants. With all the changes and advances in HR technologies, new recruiting and hiring solutions have emerged. Many recruiters are now implementing these new solutions to become more effective and productive in their jobs.According to Recruitment strategies report 2017 done by GetApp, the biggest recruiting challenge in 2017 was the shortage of skilled candidates.The process of finding job candidates has changed signNowly since few years ago. Back then, it was enough to post a job on job boards and wait for candidates to apply. Also called “post and pray” strategy.Today, it is more about building a strong Employer Branding strategy that attracts high quality applicants for hard-to-fill roles.Steps for finding the right job candidates1. Define your ideal candidate a.k.a candidate personaNot knowing who your ideal candidate is, will make finding one impossible. To be able to attract and hire them, you need to know their characteristics, motivations, skills and preferences.Defining a candidate persona requires planning and evaluation. The best way is to start from your current talent star employees. Learn more about their personalities, preferences, motivations and characteristics. Use these findings to find similar people for your current and future job openings.2. Engage your current employeesYou probably already know that your current employees are your best brand ambassadors. Same as current product users are best ambassadors for product brands. Their word of mouth means more than anyone else’s.Encourage their engagement and let them communicate their positive experiences to the outside. Remember, your employees are your best ambassadors, and people trust people more than brands, CEOs and other C-level executives.Involving your current employees can not only help you build a strong Employer Branding strategy, but it can also help your employees feel more engaged and satisfied with their jobs.3. Write a clear job descriptionsEven though many recruiters underestimate this step, it is extremely important to do it right! Writing a clear and detailed job description plays a huge role in finding and attracting candidates with a good fit. Don’t only list duties, responsibilities and requirements, but talk about your company’s culture and Employee Value Proposition.To save time, here are our free job description templates.4. Streamline your efforts with a Recruitment Marketing toolIf you have right tools, finding the right job candidates is much easier and faster than without them. Solutions offered by recruitment marketing software are various, and with them you can build innovative recruiting strategies such as Inbound Recruiting and Candidate Relationship Management to improve Candidate Experience and encourage Candidate Engagement.Sending useful, timely and relevant information to the candidates from your talent pool is a great way for strengthening your Employer Brand and communicating your Employee Value Proposition.5. Optimize your career site to invite visitors to applyWhen candidates want to learn about you, they go to your career site. Don-t loose this opportunity to impress them. Create content and look that reflects your company’s culture, mission and vision. Tell visitors about other employees success and career stories.You can start by adding employee testimonials, fun videos, introduce your team, and write about cool project that your company is working on.Don’t let visitors leave before hitting “Apply Now” button.6. Use a recruiting software with a powerful sourcing toolToday, there are powerful sourcing tools that find and extract candidates profiles. They also add them directly to your talent pool. Manual search takes a lot of time and effort, and is often very inefficient. With a powerful sourcing tool, you can make this process much faster, easier and more productive. These tools help you find candidates that match both the position and company culture.7. Use an Applicant Tracking SystemSolutions offered by applicant tracking systems are various, but their main purpose is to fasten and streamline the selections and hiring processes. By fastening the hiring and selection process, you can signNowly improve Candidate Experience. With this, you can increase your application and hire rate for hard-to-fill roles. Did you know that top talent stays available on the market for only 10 days?8. Implement and use employee referral programsReferrals are proven to be best employees! Referrals can improve your time, cost and quality of hire, and make your hiring strategy much more productive. Yet, many companies still don’t have developed strategies for employee referrals.This is another great way to use your current employee to help you find the best people. To start, use these referral email templates for recruiters, and start engaging your employees today!GetApp‘s survey has proven that employee referrals take shortest to hire, and bring the highest quality job applicants.If you don’t have ideas about how to reward good referrals, here’s our favorite list of ideas for employee referral rewards.

Create this form in 5 minutes!

How to create an eSignature for the form 990 or 990 ez sch n

How to make an eSignature for your Form 990 Or 990 Ez Sch N online

How to make an electronic signature for the Form 990 Or 990 Ez Sch N in Google Chrome

How to make an electronic signature for putting it on the Form 990 Or 990 Ez Sch N in Gmail

How to generate an eSignature for the Form 990 Or 990 Ez Sch N straight from your smartphone

How to make an electronic signature for the Form 990 Or 990 Ez Sch N on iOS

How to generate an eSignature for the Form 990 Or 990 Ez Sch N on Android

People also ask

-

What is the disposition IRS 990 form and why is it important?

The disposition IRS 990 form is a crucial document for non-profit organizations to report their financial activities. It helps the IRS understand how charities operate and ensures transparency. Filing this form accurately is vital for compliance and maintaining tax-exempt status.

-

How can airSlate SignNow assist with the disposition IRS 990 form?

airSlate SignNow simplifies the process of preparing and eSigning the disposition IRS 990 form. With its user-friendly interface, you can easily fill out necessary fields and ensure timely submissions. Streamlining your documentation saves time and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow when dealing with IRS forms?

airSlate SignNow offers various pricing plans suitable for organizations of all sizes, ensuring access to essential features for managing the disposition IRS 990 form. Plans are designed to be cost-effective, empowering non-profits to manage documents without overspending. Explore our pricing to find the best fit for your needs.

-

Are there any features specific to managing the disposition IRS 990 form?

Yes, airSlate SignNow provides features tailored for managing the disposition IRS 990 form, such as document templates and automated workflows. These features help ensure you remain compliant and save valuable administrative time. Additionally, secure eSigning enhances your document management process.

-

Can airSlate SignNow integrate with accounting software for IRS forms?

Absolutely! airSlate SignNow offers integrations with popular accounting software, facilitating the seamless handling of the disposition IRS 990 form. This integration simplifies financial reporting and ensures accuracy, allowing you to focus more on your organization's mission.

-

What benefits does airSlate SignNow provide for submitting IRS forms?

Using airSlate SignNow for submitting the disposition IRS 990 form enhances speed and security. The platform’s eSigning capabilities ensure that documents are signed quickly and stored securely. You can easily track the status of your forms, reducing stress during tax season.

-

Is airSlate SignNow user-friendly for first-time users dealing with IRS forms?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for first-time users to manage the disposition IRS 990 form. The intuitive interface and guided processes facilitate a smooth experience. Our support resources are available to help you every step of the way.

Get more for Dissolution Of Assets And Form 990 Instructions

- Gus takes the train journeys pdf form

- Mv 285r form

- Elevator test report form montana dli business standards bsd dli mt

- Out in front state and federal regulation of air school of law form

- Application for intrusion alarm certificate form

- Subscription agreement template form

- Subscription service agreement template form

- Subscription subscription agreement template form

Find out other Dissolution Of Assets And Form 990 Instructions

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application