Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version 2021

Understanding the Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

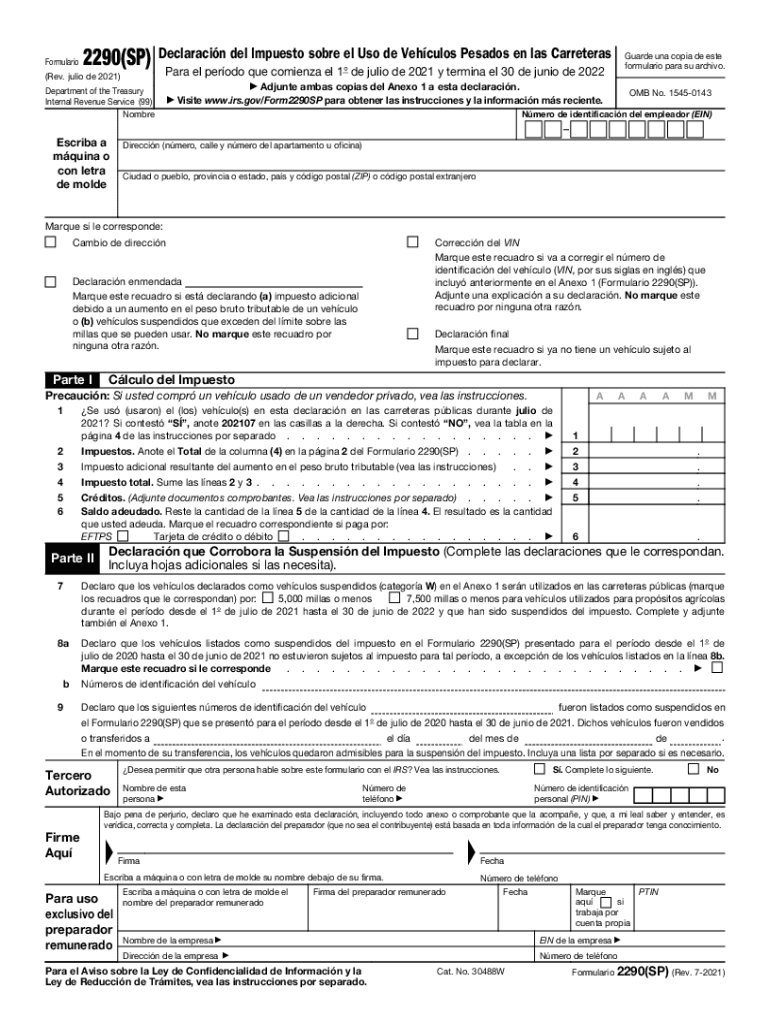

The Form 2290SP Rev July is specifically designed for Spanish-speaking individuals and businesses to report and pay the Heavy Vehicle Use Tax (HVUT) to the IRS. This form is essential for those who operate heavy vehicles with a gross weight of 55,000 pounds or more on public highways. The tax is calculated based on the weight of the vehicle and is due annually. Understanding the purpose and requirements of this form is crucial for compliance with federal tax laws.

Steps to Complete the Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

Completing the Form 2290SP involves several key steps:

- Gather necessary information, including the Vehicle Identification Number (VIN), gross weight, and business details.

- Fill out the form accurately, ensuring all sections are completed in Spanish.

- Calculate the tax owed based on the vehicle's weight and the applicable tax rate.

- Sign and date the form to certify the information provided is true and correct.

- Submit the form to the IRS by the deadline, along with any payment due.

How to Obtain the Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

The Form 2290SP can be obtained directly from the IRS website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. The form is available in PDF format, which can be printed and filled out manually, or completed electronically using compatible software.

Legal Use of the Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

The legal use of the Form 2290SP is governed by IRS regulations regarding the Heavy Vehicle Use Tax. This form must be filed annually by individuals and businesses that operate heavy vehicles. Failure to file or pay the tax can result in penalties and interest charges. It is essential to maintain accurate records and comply with all filing requirements to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2290SP are typically set for the end of August each year. However, if a vehicle is purchased or put into service after the initial deadline, the form must be filed within a specific timeframe. Keeping track of these important dates is crucial for timely compliance and avoiding penalties.

Penalties for Non-Compliance

Failure to file the Form 2290SP on time or pay the associated tax can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of time the tax remains unpaid. Additionally, interest will accrue on any unpaid amounts, increasing the overall financial burden. Understanding these penalties can help motivate timely compliance.

Quick guide on how to complete form 2290sp rev july 2021 heavy vehicle use tax return spanish version

Effortlessly prepare Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version on any device

Managing documents online has gained traction among companies and individuals. It offers a superb eco-conscious substitute for traditional printed and signed paperwork, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version easily

- Find Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant parts of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to share your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2290sp rev july 2021 heavy vehicle use tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 2290sp rev july 2021 heavy vehicle use tax return spanish version

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the formulario 2290 and why do I need it?

The formulario 2290 is a tax form used by heavy vehicle owners to report and pay federal excise taxes. You need it to comply with IRS requirements and avoid penalties for late filing. Using airSlate SignNow, you can easily eSign and submit your formulario 2290 online.

-

How does airSlate SignNow simplify the formulario 2290 process?

airSlate SignNow simplifies the formulario 2290 process by providing an intuitive interface for completing and eSigning the document. Our platform allows you to upload, edit, and manage your forms seamlessly, ensuring that the entire workflow is efficient and user-friendly.

-

What are the pricing options for airSlate SignNow when filing the formulario 2290?

airSlate SignNow offers flexible pricing plans that accommodate various business sizes and needs. Whether you're a small business or a large enterprise, we have a package that allows you to file your formulario 2290 without exceeding your budget, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other tools for managing formulario 2290?

Yes, airSlate SignNow integrates seamlessly with a variety of popular business tools and platforms. This allows you to streamline your processes and access essential features while working on your formulario 2290, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for formulario 2290 eSignature?

Using airSlate SignNow for your formulario 2290 eSignature brings numerous benefits, including enhanced security and compliance with federal regulations. Our platform ensures that your documents are securely signed and stored, making it easier to retrieve and manage your tax documents whenever necessary.

-

Is it easy to fill out and submit the formulario 2290 using airSlate SignNow?

Absolutely! airSlate SignNow makes filling out and submitting your formulario 2290 straightforward and hassle-free. The user-friendly interface guides you through each step, ensuring that you complete your form correctly and submit it on time.

-

What features does airSlate SignNow offer for formulario 2290 management?

airSlate SignNow offers several features to manage your formulario 2290 effectively, including document templates, customizable workflows, and secure storage solutions. These features help you streamline the process, ensuring you stay organized and compliant with tax regulations.

Get more for Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

- Chart for determining amount of wages subject to attachment garnishment 7 delaware form

- Delaware judgment 497302303 form

- Application forma pauperis

- Title abandoned property form

- Instructions for filing a petition for title to abandoned personal property delaware form

- Answer to petition delaware form

- Notice abandoned property template form

- Trespass letter of suspension delaware form

Find out other Form 2290SP Rev July Heavy Vehicle Use Tax Return Spanish Version

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online