Pesados 2020

What is the formulario 2290?

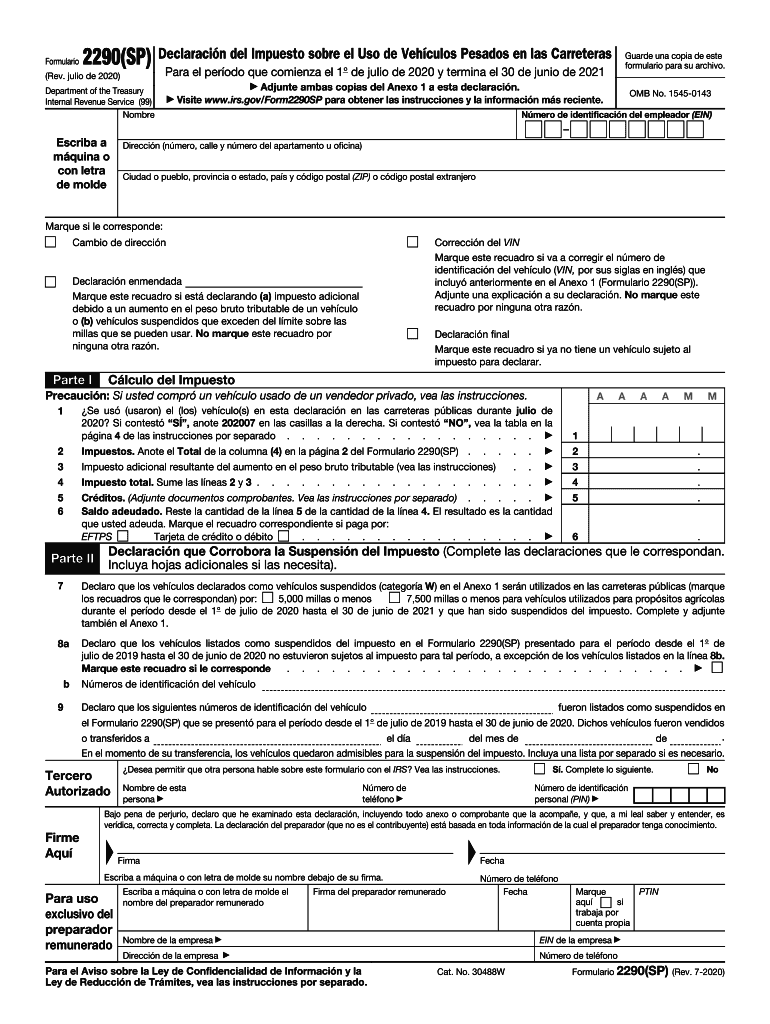

The formulario 2290, also known as the IRS Form 2290, is a tax form used by vehicle owners to report and pay the Heavy Highway Vehicle Use Tax. This tax applies to vehicles with a gross weight of 55,000 pounds or more that are used on public highways. The IRS requires this form to be filed annually, and it is essential for compliance with federal tax regulations. Understanding the purpose and requirements of the formulario 2290 is crucial for vehicle owners to avoid penalties and ensure proper tax reporting.

Steps to complete the formulario 2290

Completing the formulario 2290 involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN), vehicle details, and mileage information.

- Access the formulario 2290 online or obtain a printable version from the IRS website.

- Fill out the form accurately, ensuring all required fields are completed, including the vehicle identification number (VIN) and gross weight.

- Calculate the tax owed based on the number of vehicles and their weight classifications.

- Review the form for accuracy and completeness before submission.

- Submit the formulario 2290 electronically or by mail, along with payment for any taxes due.

Legal use of the formulario 2290

The legal use of the formulario 2290 is defined by IRS regulations. To be considered valid, the form must be completed accurately and submitted on time. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. It is important to maintain a copy of the submitted form for your records, as it serves as proof of compliance with federal tax requirements.

Filing Deadlines / Important Dates

Timely filing of the formulario 2290 is essential to avoid penalties. The IRS requires that the form be filed by the last day of the month following the month of first use of the vehicle. For example, if a vehicle is first used in July, the form must be filed by August 31. Additionally, if you are filing for the first time, it is important to be aware of the annual renewal deadline, which is typically the same date each year.

Required Documents

To complete the formulario 2290, you will need several documents and pieces of information:

- Employer Identification Number (EIN)

- Vehicle identification number (VIN) for each vehicle

- Gross weight of the vehicle

- Details of any suspended vehicles, if applicable

- Payment information for any taxes owed

Form Submission Methods

The formulario 2290 can be submitted through various methods:

- Online: The IRS allows electronic filing through approved providers, which can expedite processing and provide immediate confirmation.

- Mail: You can print the completed form and send it to the address specified in the form instructions. Ensure that you send it well before the deadline to allow for processing time.

- In-Person: While less common, some may choose to submit the form in person at designated IRS offices.

Quick guide on how to complete 2020 pesados

Effortlessly handle Pesados on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hindrance. Manage Pesados on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Pesados with ease

- Find Pesados and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searching for forms, and mistakes requiring new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Pesados while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 pesados

Create this form in 5 minutes!

How to create an eSignature for the 2020 pesados

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is formulario 2290 and why is it important?

Formulario 2290 is a crucial tax document for heavy vehicle users in the United States. It is used to report and pay the Heavy Highway Vehicle Use Tax, which is essential for compliance with federal tax laws. Failure to file this form can result in penalties, making it vital for truck owners and operators.

-

How does airSlate SignNow simplify the process of managing formulario 2290?

AirSlate SignNow streamlines the management of formulario 2290 by providing an easy-to-use platform for eSigning and sending documents. With our solution, users can quickly fill out, sign, and submit formulario 2290 electronically, saving time and reducing paperwork. Our intuitive interface ensures a hassle-free experience for all users.

-

What features does airSlate SignNow offer for formulario 2290 preparation?

AirSlate SignNow includes various features that enhance the preparation of formulario 2290, such as customizable templates and the ability to collaborate in real-time. Users can easily add fields for signatures and initials, ensuring that every required section of formulario 2290 is completed correctly. Additionally, the platform supports secure document storage and retrieval.

-

Is airSlate SignNow suitable for small businesses handling formulario 2290?

Yes, airSlate SignNow is designed to be cost-effective and beneficial for small businesses. Our pricing plans cater to different needs, allowing small business owners to efficiently manage formulario 2290 without breaking the budget. The platform's ease of use empowers small businesses to handle tax forms confidently.

-

Can I integrate airSlate SignNow with other software for formulario 2290?

Absolutely, airSlate SignNow offers seamless integrations with various software applications, enhancing the workflow for managing formulario 2290. Users can connect with accounting software, CRMs, and other tools to ensure a smooth document management process. This integration helps eliminate data entry errors and saves valuable time.

-

How secure is the electronic submission of formulario 2290 through airSlate SignNow?

Security is a top priority at airSlate SignNow when submitting formulario 2290. Our platform employs advanced encryption technology to protect sensitive information during electronic transactions. Users can be assured that their data is secure, and all signatures are legally binding, meeting compliance requirements.

-

What benefits do I gain from using airSlate SignNow for formulario 2290?

Using airSlate SignNow for formulario 2290 provides numerous benefits, including increased efficiency and reduced paperwork. The platform allows for quick document turnaround and the peace of mind knowing that you're compliant with IRS regulations. Additionally, the ability to access documents from anywhere offers tremendous convenience.

Get more for Pesados

Find out other Pesados

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer