Minnesota Revenue M1W Auradesignerwear 2021

What is the Minnesota Revenue M1W?

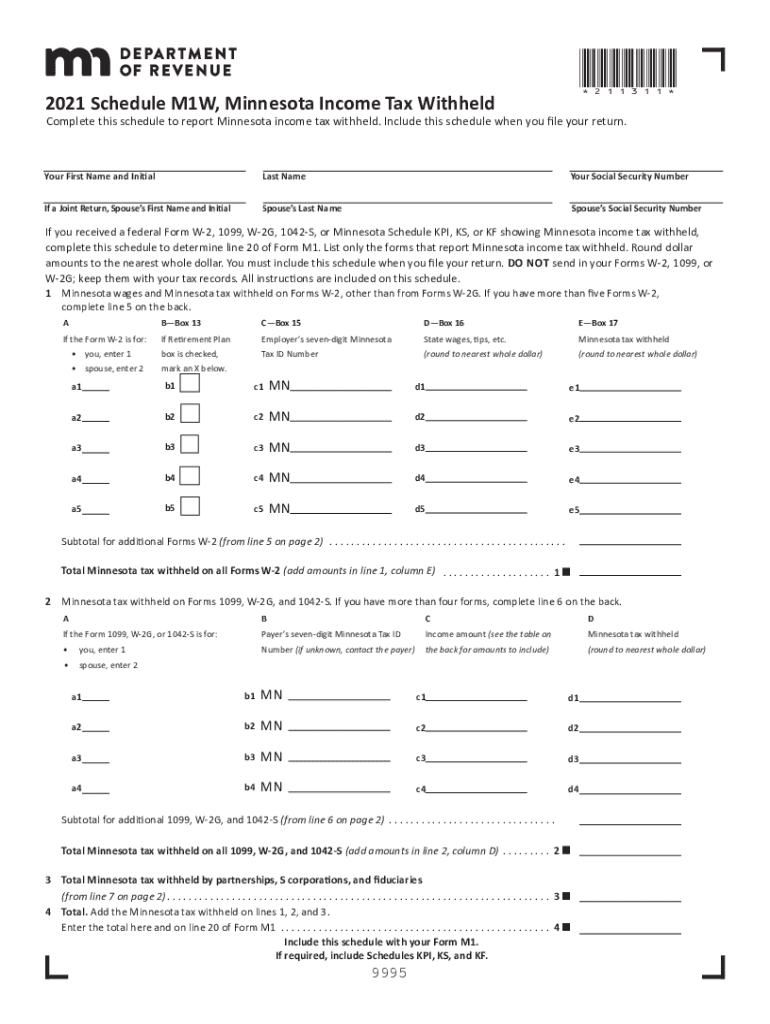

The Minnesota Revenue M1W is a form used by taxpayers in Minnesota to report state income tax withheld. This form is essential for individuals who have had Minnesota income tax withheld from their wages or other income sources. It serves as a record of the tax withheld and is used when filing state income tax returns. The M1W form helps ensure that taxpayers receive proper credit for taxes already paid, which can affect their overall tax liability.

Steps to complete the Minnesota Revenue M1W

Completing the Minnesota Revenue M1W involves several key steps:

- Gather necessary information, including your Social Security number, employer details, and total income.

- Indicate the amount of Minnesota tax withheld from your income on the form.

- Ensure all sections of the M1W are filled out accurately, including your personal information and any applicable deductions.

- Review the completed form for any errors before submission to avoid delays or issues with your tax return.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Minnesota Revenue M1W. Typically, the form must be submitted by the same deadline as your state income tax return. For most taxpayers, this date falls on April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Staying informed about these dates helps ensure timely filing and compliance with state tax regulations.

Form Submission Methods

The Minnesota Revenue M1W can be submitted through various methods to accommodate different taxpayer preferences:

- Online: Many taxpayers choose to file electronically through approved tax software, which often simplifies the process.

- Mail: You can print the completed form and mail it to the Minnesota Department of Revenue at the designated address.

- In-Person: Some individuals may prefer to submit their forms in person at a local Department of Revenue office.

Legal use of the Minnesota Revenue M1W

The Minnesota Revenue M1W is legally recognized as a valid document for reporting state tax withholdings. To ensure its legal standing, taxpayers must complete the form accurately and submit it within the designated timeframes. Compliance with state tax laws is essential, as failure to file or inaccuracies can result in penalties or delays in processing tax returns. Understanding the legal implications of the M1W form helps taxpayers maintain compliance and avoid potential issues.

Key elements of the Minnesota Revenue M1W

Several key elements are essential when filling out the Minnesota Revenue M1W:

- Taxpayer Information: Accurate personal details, including name, address, and Social Security number.

- Employer Information: The name and address of the employer from whom the income was received.

- Withholding Amount: The total amount of Minnesota tax withheld during the tax year.

- Signature: The taxpayer must sign the form to validate the information provided.

Quick guide on how to complete minnesota revenue m1w auradesignerwear

Complete Minnesota Revenue M1W Auradesignerwear effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources necessary to create, amend, and eSign your documents swiftly without delays. Manage Minnesota Revenue M1W Auradesignerwear on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Minnesota Revenue M1W Auradesignerwear with ease

- Obtain Minnesota Revenue M1W Auradesignerwear and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Minnesota Revenue M1W Auradesignerwear while ensuring efficient communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota revenue m1w auradesignerwear

Create this form in 5 minutes!

How to create an eSignature for the minnesota revenue m1w auradesignerwear

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the importance of the 2020 Minnesota tax forms for businesses?

The 2020 Minnesota tax forms are crucial for businesses as they ensure compliance with state tax regulations. Properly filing these forms can help avoid penalties and secure potential deductions or credits. Understanding these forms allows businesses to manage their tax liabilities effectively.

-

How does airSlate SignNow help with signing 2020 Minnesota tax documents?

airSlate SignNow simplifies the process of signing 2020 Minnesota tax documents by providing a user-friendly eSignature platform. Users can electronically sign and send documents securely, saving time and reducing paperwork. This ensures that tax documents are processed quickly and efficiently.

-

What features does airSlate SignNow offer for managing 2020 Minnesota tax documents?

airSlate SignNow offers features such as customizable templates, secure storage, and real-time tracking for managing 2020 Minnesota tax documents. These tools enhance the document workflow, allowing users to keep track of changes and obtain signatures seamlessly. This makes handling tax forms more organized and efficient.

-

Is airSlate SignNow a cost-effective solution for handling 2020 Minnesota tax paperwork?

Yes, airSlate SignNow is a cost-effective solution for handling 2020 Minnesota tax paperwork. With various pricing plans, businesses can choose one that fits their budget while enjoying a range of powerful features. This reduces the overall cost of managing tax processes, making it affordable for all businesses.

-

Can I integrate airSlate SignNow with my accounting software for 2020 Minnesota tax submissions?

Absolutely! airSlate SignNow offers smooth integrations with various accounting software, making it easier to prepare and submit 2020 Minnesota tax documents. This functionality helps streamline your workflow and ensures that your tax forms are accurately filled out and submitted on time.

-

What benefits does using airSlate SignNow provide for 2020 Minnesota tax preparation?

Using airSlate SignNow for 2020 Minnesota tax preparation offers several benefits, including faster processing times and enhanced security. The platform's eSignature capabilities ensure that your documents are signed and sent without delays. Additionally, the user-friendly interface makes it easy to manage and organize all tax-related documents.

-

How do I ensure compliance with 2020 Minnesota tax laws using airSlate SignNow?

To ensure compliance with 2020 Minnesota tax laws using airSlate SignNow, keep updated with the state’s tax regulations and use pre-built templates designed for Minnesota tax forms. The platform's tracking features also help to maintain accurate records of all signed documents. Regularly checking for updates will ensure you're following the latest legal requirements.

Get more for Minnesota Revenue M1W Auradesignerwear

Find out other Minnesota Revenue M1W Auradesignerwear

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors