Withholding and Your Income Tax ReturnMinnesota Department of Revenue 2022-2026

Understanding the m1w form 2024

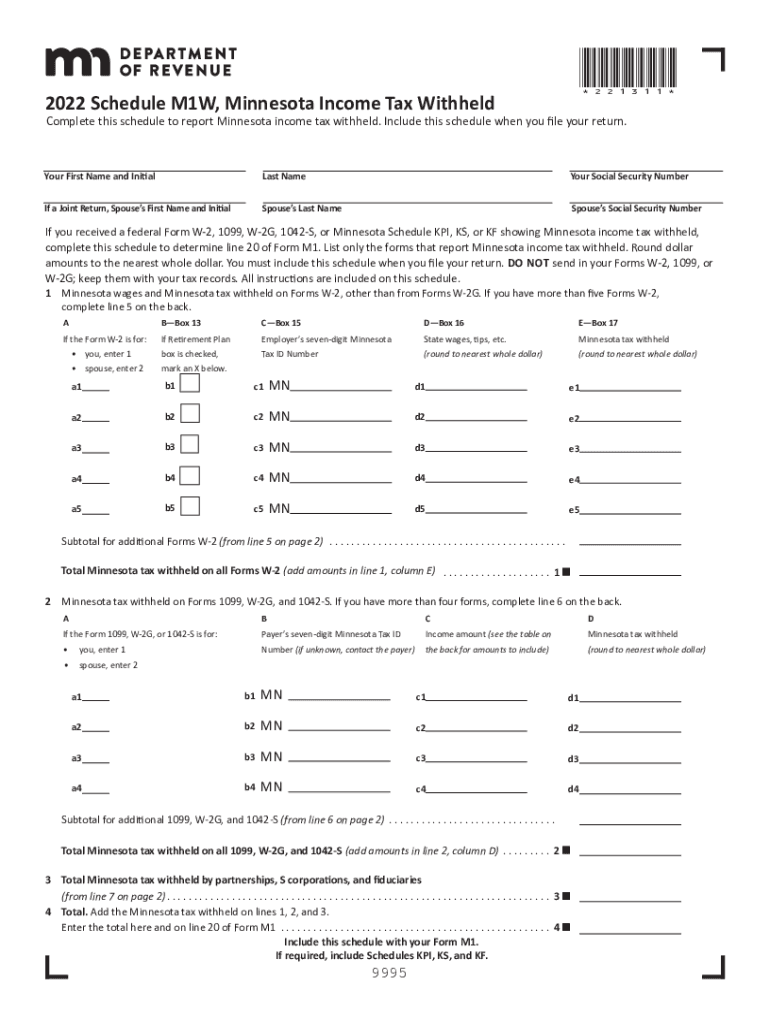

The m1w form 2024 is a critical document used for reporting withholding and income tax in Minnesota. This form is essential for taxpayers who need to reconcile their withholding amounts with their actual tax liability. It is specifically designed for individuals who have had Minnesota income tax withheld from their paychecks or other income sources. Understanding the m1w form is vital for ensuring compliance with state tax laws and for accurately filing your income tax return.

Steps to complete the m1w form 2024

Completing the m1w form 2024 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your Social Security number, total income, and the amount of tax withheld. Next, fill out the form by providing your personal details and the relevant financial information. It is important to double-check all entries for accuracy, as mistakes can lead to penalties or delays in processing. Once completed, you can submit the form electronically or by mail, depending on your preference and the requirements set by the Minnesota Department of Revenue.

Legal use of the m1w form 2024

The m1w form 2024 is legally recognized for tax purposes in Minnesota. To ensure its validity, the form must be filled out completely and accurately, adhering to the guidelines provided by the Minnesota Department of Revenue. Using a reliable digital platform for eSigning the form can enhance its legal standing, as it ensures compliance with electronic signature laws. It is essential to retain a copy of the submitted form for your records, as it may be required for future reference or audits.

Filing deadlines for the m1w form 2024

Timely filing of the m1w form 2024 is crucial to avoid penalties. The Minnesota Department of Revenue typically sets specific deadlines for submitting this form, often aligned with the overall income tax filing deadline. It is advisable to stay informed about these dates to ensure that you file on time. Late submissions may incur fines or interest on any unpaid taxes, so being proactive in your filing process is essential.

Required documents for the m1w form 2024

To complete the m1w form 2024 accurately, certain documents are required. These include your W-2 forms from employers, any 1099 forms for additional income, and documentation of any tax credits or deductions you plan to claim. Having these documents readily available will streamline the process and help ensure that your form is completed correctly. It is also beneficial to have previous year’s tax returns for reference, especially if there have been changes in your financial situation.

Penalties for non-compliance with the m1w form 2024

Failure to file the m1w form 2024 or inaccuracies in the form can lead to penalties imposed by the Minnesota Department of Revenue. These penalties can include fines, interest on unpaid taxes, and potential legal action for serious violations. To avoid these consequences, it is important to ensure that the form is completed accurately and submitted on time. Regularly reviewing your tax obligations and maintaining accurate records can help mitigate the risk of non-compliance.

Quick guide on how to complete withholding and your income tax returnminnesota department of revenue

Prepare Withholding And Your Income Tax ReturnMinnesota Department Of Revenue effortlessly on any device

Digital document administration has become popular among businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Withholding And Your Income Tax ReturnMinnesota Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign Withholding And Your Income Tax ReturnMinnesota Department Of Revenue without hassle

- Find Withholding And Your Income Tax ReturnMinnesota Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Edit and eSign Withholding And Your Income Tax ReturnMinnesota Department Of Revenue and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding and your income tax returnminnesota department of revenue

Create this form in 5 minutes!

People also ask

-

What is the m1w form 2024 used for?

The m1w form 2024 is primarily used for reporting income and expenses related to specific business activities. It is essential for individuals and companies to accurately complete this form to comply with tax regulations. By using airSlate SignNow, you can easily eSign and manage your m1w form 2024 digitally.

-

How can airSlate SignNow help with completing the m1w form 2024?

AirSlate SignNow provides an intuitive platform that allows you to fill out and eSign the m1w form 2024 with ease. You'll benefit from our user-friendly interfaces, templates, and document management features. This streamlines the process and ensures your forms are completed accurately and timely.

-

Is there a cost associated with using airSlate SignNow for the m1w form 2024?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Users can select the plan that best suits their requirements for managing documents like the m1w form 2024. With our cost-effective solutions, you can enhance your document workflow without breaking the bank.

-

Can I integrate airSlate SignNow with other software for the m1w form 2024?

Absolutely! airSlate SignNow supports numerous integrations with popular software platforms, making it easy to streamline your workflow. You can connect it with accounting software and other applications to simplify the preparation and submission of your m1w form 2024.

-

What features does airSlate SignNow offer for managing the m1w form 2024?

AirSlate SignNow provides essential features like document templates, automated workflows, and secure eSigning specifically designed for forms like the m1w form 2024. These features help save time, reduce errors, and enhance collaboration among stakeholders involved in the form completion process.

-

How secure is airSlate SignNow when handling the m1w form 2024?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and ensure that your data, including the m1w form 2024, is protected and confidential. Our platform complies with industry standards for data security, giving you peace of mind when eSigning and managing documents.

-

What are the benefits of using airSlate SignNow for the m1w form 2024?

Using airSlate SignNow for the m1w form 2024 offers numerous benefits, including streamlined document workflow, reduced turnaround time, and enhanced accuracy. Our platform allows you to access, fill, and eSign your forms anytime, anywhere, improving productivity and efficiency for your business.

Get more for Withholding And Your Income Tax ReturnMinnesota Department Of Revenue

- Nebraska notice commencement 497318114 form

- Nebraska notice 497318115 form

- Nebraska 3 day notice form

- 30 day notice of material noncompliance with lease or rental agreement for residential from landlord to tenant nebraska form

- 30 day notice of material noncompliance with lease or rental agreement for residential from tenant to landlord nebraska form

- Nebraska 14 day form

- Nebraska notice form

- 5 day notice to termination for failure to deliver possession of leased premises for residential from tenant to landlord form

Find out other Withholding And Your Income Tax ReturnMinnesota Department Of Revenue

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word