Form Schedule M1W Minnesota Income Tax Withheld 2020

What is the Form Schedule M1W Minnesota Income Tax Withheld

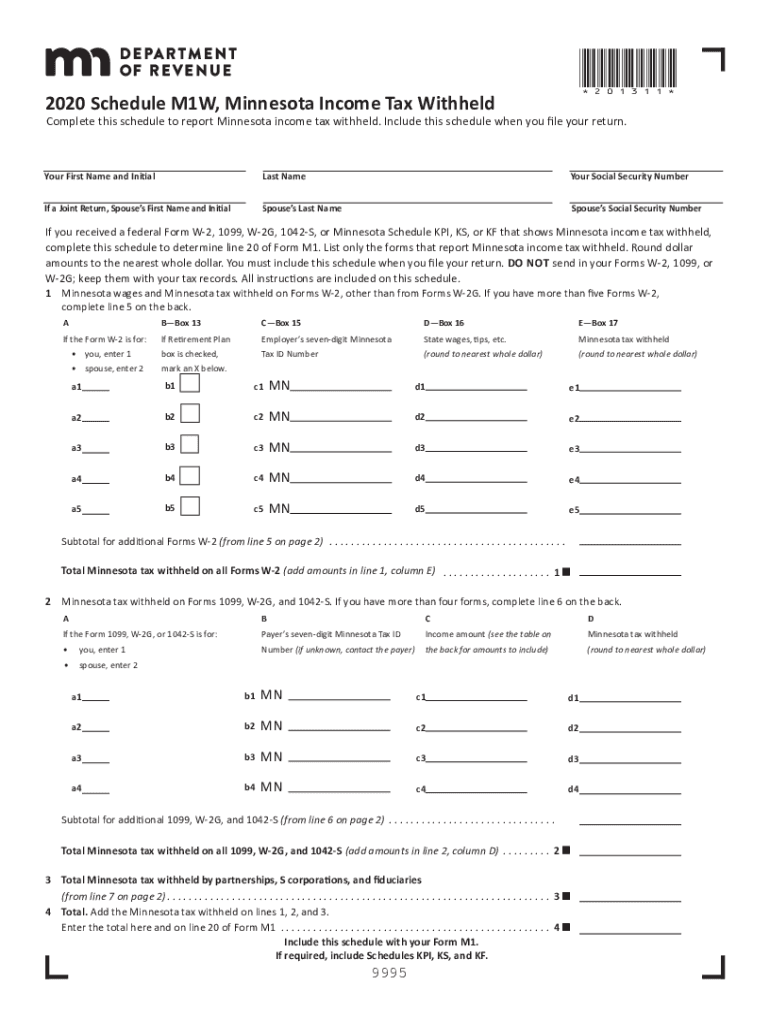

The Schedule M1W is a form used by residents of Minnesota to report income tax withheld from their earnings. This form is specifically designed for individuals who have had Minnesota income tax withheld by their employers or other payers. It serves as a means to reconcile the amount of tax withheld with the actual tax liability when filing a state income tax return. Understanding this form is crucial for ensuring accurate tax filings and compliance with Minnesota tax regulations.

How to use the Form Schedule M1W Minnesota Income Tax Withheld

To effectively use the Schedule M1W, individuals must first gather all relevant information regarding their income and the amount of tax withheld. This includes W-2 forms from employers and any other relevant income documentation. The form can be filled out electronically or printed for manual completion. After entering the required information, individuals should ensure that all calculations are accurate before submitting the form along with their Minnesota income tax return.

Steps to complete the Form Schedule M1W Minnesota Income Tax Withheld

Completing the Schedule M1W involves several key steps:

- Gather all necessary documentation, including W-2 forms and records of any other income.

- Fill out personal information, including name, address, and Social Security number.

- Report the total amount of Minnesota income tax withheld as indicated on your W-2 forms.

- Double-check all entries for accuracy, ensuring that totals match your records.

- Attach the completed Schedule M1W to your Minnesota tax return before submission.

Legal use of the Form Schedule M1W Minnesota Income Tax Withheld

The Schedule M1W is legally recognized as a valid document for reporting tax withheld in Minnesota. To ensure its legal standing, individuals must complete the form accurately and submit it within the designated filing period. Compliance with Minnesota tax laws is essential, as failure to use the form correctly can lead to penalties or issues with tax filings.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Schedule M1W. Typically, the form must be submitted by the same deadline as the Minnesota state income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Keeping track of these dates helps ensure timely compliance and avoids potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Schedule M1W can be submitted in several ways, providing flexibility for taxpayers. Individuals can file their forms electronically through approved tax preparation software, which often simplifies the process. Alternatively, the form can be printed and mailed to the Minnesota Department of Revenue. In some cases, taxpayers may also have the option to submit their forms in person at designated locations. Each method has its own advantages, depending on the taxpayer's preference and situation.

Quick guide on how to complete free form schedule m1w minnesota income tax withheld

Complete Form Schedule M1W Minnesota Income Tax Withheld effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form Schedule M1W Minnesota Income Tax Withheld on any device using airSlate SignNow mobile applications for Android or iOS and streamline your document-related tasks today.

The easiest method to modify and eSign Form Schedule M1W Minnesota Income Tax Withheld seamlessly

- Locate Form Schedule M1W Minnesota Income Tax Withheld and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize critical sections of your documents or conceal sensitive information with tools that airSlate SignNow specially offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or forgotten documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Schedule M1W Minnesota Income Tax Withheld and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct free form schedule m1w minnesota income tax withheld

Create this form in 5 minutes!

How to create an eSignature for the free form schedule m1w minnesota income tax withheld

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the schedule m1w 2018 form?

The schedule m1w 2018 form is a tax document used to report certain income and calculate liabilities for the fiscal year. It is essential for businesses to accurately complete the schedule m1w 2018 form to ensure compliance with tax regulations. Using airSlate SignNow can help streamline the process of preparing and submitting the schedule m1w 2018 form.

-

How can airSlate SignNow assist in completing the schedule m1w 2018 form?

airSlate SignNow simplifies the process of filling out the schedule m1w 2018 form by providing a user-friendly platform that allows you to easily input data and access templates. You can eSign the document directly within the platform, ensuring it is completed efficiently and securely. This integration saves time and reduces errors during preparation.

-

Is there a cost associated with using airSlate SignNow for the schedule m1w 2018 form?

Yes, there is a cost associated with using airSlate SignNow, but it offers various pricing plans tailored to meet different business needs. With its cost-effective solutions, you can access features that help manage documents, including the schedule m1w 2018 form. Investing in SignNow enhances your document management efficiency without breaking the bank.

-

What features does airSlate SignNow offer for managing the schedule m1w 2018 form?

airSlate SignNow provides a range of features including document templates, eSigning capabilities, and real-time collaboration. These tools make it easier to prepare and manage the schedule m1w 2018 form, reducing the likelihood of errors. Additionally, you can track the status of your documents to ensure timely submission.

-

Can I integrate airSlate SignNow with other software for the schedule m1w 2018 form?

Yes, airSlate SignNow offers seamless integrations with various software platforms, including CRM and accounting tools. This allows you to pull data directly into the schedule m1w 2018 form, streamlining the preparation process. Integration enhances productivity, ensuring all your document requirements are met efficiently.

-

What are the benefits of using airSlate SignNow for the schedule m1w 2018 form?

Using airSlate SignNow for the schedule m1w 2018 form provides several benefits including increased efficiency, enhanced security, and reduced paperwork. The platform simplifies the document management process, allowing for quicker turnaround times. Its electronic signing feature also ensures your documents are legally binding and securely stored.

-

Is my data safe when using airSlate SignNow for the schedule m1w 2018 form?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your information. When using the platform for the schedule m1w 2018 form, you can rest assured that your data remains confidential and secure. Compliance with industry regulations further enhances data protection.

Get more for Form Schedule M1W Minnesota Income Tax Withheld

- Request for notice with representative acknowledgment washington form

- Tenant landlord all form

- Request for notice with individual acknowledgment washington form

- Landlord failure 497429631 form

- Washington bill sale form

- Washington bill sale 497429633 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497429634 form

- Washington subordination agreement form

Find out other Form Schedule M1W Minnesota Income Tax Withheld

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now