Minnesota Income Tax Withheld Minnesota Department of 2016

What is the Minnesota Income Tax Withheld Minnesota Department Of

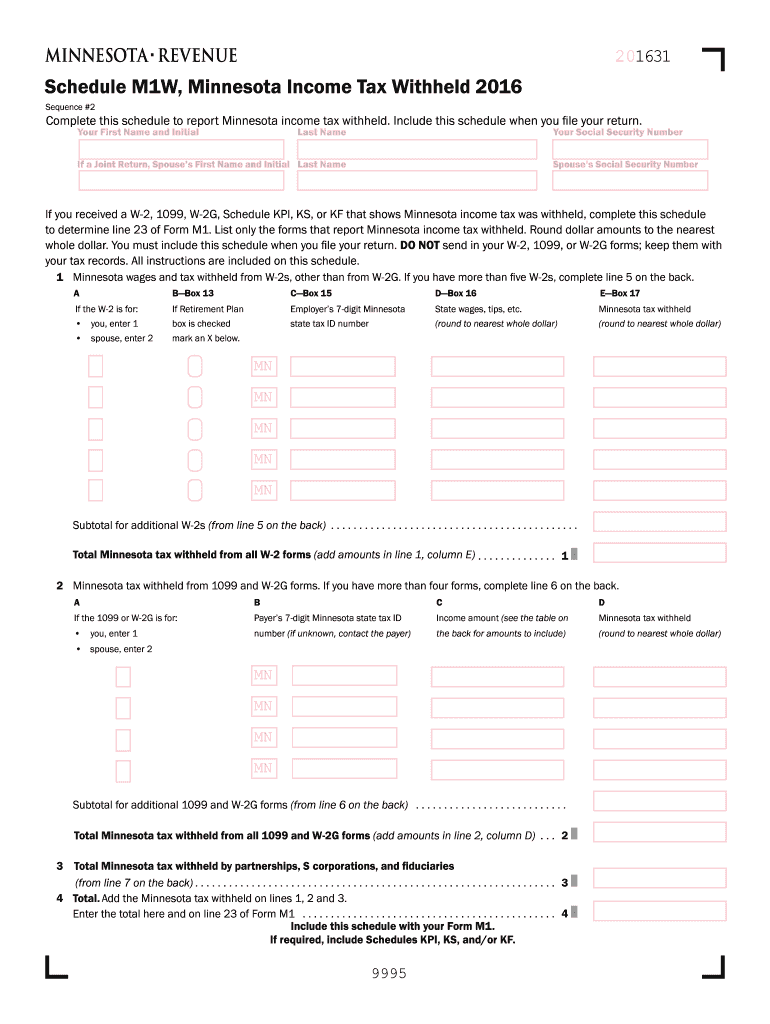

The Minnesota Income Tax Withheld form is a crucial document used by employers to report the amount of state income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax regulations and helps employees track their tax obligations. The Minnesota Department of Revenue oversees this form, which is part of the state's efforts to manage tax collection efficiently. Proper completion of this form ensures that the correct amounts are reported to the state, helping employees avoid potential penalties or issues during tax filing.

Steps to complete the Minnesota Income Tax Withheld Minnesota Department Of

Completing the Minnesota Income Tax Withheld form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect employee details, including names, Social Security numbers, and total wages paid.

- Calculate withholding amounts: Use the Minnesota withholding tables to determine the correct amount of state income tax to withhold based on employee earnings.

- Fill out the form: Enter the required information accurately, ensuring all fields are completed to avoid delays.

- Review for accuracy: Double-check all entries for errors before submission to prevent complications.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person, as specified by the Minnesota Department of Revenue.

How to obtain the Minnesota Income Tax Withheld Minnesota Department Of

Employers can obtain the Minnesota Income Tax Withheld form directly from the Minnesota Department of Revenue's official website. The form is typically available in a downloadable format, allowing for easy access and completion. Additionally, employers may also receive copies of this form through their payroll software, which often includes built-in features for generating necessary tax forms. It is important to ensure that the most current version of the form is used to comply with any recent updates in tax regulations.

Legal use of the Minnesota Income Tax Withheld Minnesota Department Of

The Minnesota Income Tax Withheld form must be used in accordance with state tax laws. Employers are legally required to withhold state income tax from employees' wages and report this information accurately. Failure to comply with these regulations can result in penalties for both the employer and employee. It is essential for employers to stay informed about any changes in tax laws or withholding rates to ensure ongoing compliance. Using the form correctly helps maintain transparency and accountability in tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Income Tax Withheld form are critical for compliance. Employers must submit this form according to the schedule set by the Minnesota Department of Revenue, which typically aligns with payroll periods. Important dates to remember include:

- Quarterly filing deadlines for businesses that report withholding on a quarterly basis.

- Annual filing deadlines for employers who report annually.

- Specific dates for submitting forms electronically or via mail, as outlined by the Minnesota Department of Revenue.

Staying aware of these deadlines helps avoid late fees and ensures that employees' tax withholdings are reported accurately and on time.

Required Documents

To complete the Minnesota Income Tax Withheld form, employers need to prepare several documents and pieces of information:

- Employee payroll records, including names, Social Security numbers, and total wages.

- Details of any exemptions claimed by employees, which may affect withholding amounts.

- Previous tax filings, if applicable, to ensure consistency in reporting.

Having these documents ready will streamline the process of completing the form and ensure compliance with state regulations.

Quick guide on how to complete 2016 minnesota income tax withheld minnesota department of

Your assistance manual on how to create your Minnesota Income Tax Withheld Minnesota Department Of

If you’re wondering how to generate and present your Minnesota Income Tax Withheld Minnesota Department Of, here are some concise guidelines on how to simplify tax submission.

First, you just need to set up your airSlate SignNow account to modify the way you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to alter, generate, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, as well as revert to revise information as necessary. Enhance your tax management with advanced PDF modification, electronic signing, and easy sharing.

Follow the instructions below to finish your Minnesota Income Tax Withheld Minnesota Department Of in a matter of minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Select Obtain form to access your Minnesota Income Tax Withheld Minnesota Department Of in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to incorporate your legally-recognized electronic signature (if required).

- Review your record and correct any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to return errors and delay refunds. Before e-filing your taxes, be sure to check the IRS website for submission regulations in your area.

Create this form in 5 minutes or less

Find and fill out the correct 2016 minnesota income tax withheld minnesota department of

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

Create this form in 5 minutes!

How to create an eSignature for the 2016 minnesota income tax withheld minnesota department of

How to generate an electronic signature for your 2016 Minnesota Income Tax Withheld Minnesota Department Of in the online mode

How to create an eSignature for the 2016 Minnesota Income Tax Withheld Minnesota Department Of in Google Chrome

How to create an electronic signature for putting it on the 2016 Minnesota Income Tax Withheld Minnesota Department Of in Gmail

How to make an electronic signature for the 2016 Minnesota Income Tax Withheld Minnesota Department Of from your smart phone

How to generate an eSignature for the 2016 Minnesota Income Tax Withheld Minnesota Department Of on iOS devices

How to generate an eSignature for the 2016 Minnesota Income Tax Withheld Minnesota Department Of on Android

People also ask

-

What is the process for managing Minnesota Income Tax Withheld with the Minnesota Department Of?

To manage Minnesota Income Tax Withheld, you must regularly report the withheld amounts to the Minnesota Department Of Revenue. Ensure that you are up to date with current tax rates and regulations, and maintain proper records of all withholding. airSlate SignNow can streamline this process by offering document templates and electronic signatures for easy compliance.

-

How can airSlate SignNow help with Minnesota Income Tax Withheld reporting?

airSlate SignNow simplifies the reporting of Minnesota Income Tax Withheld by allowing users to gather necessary signatures and documentation electronically. This saves time and reduces the risk of errors when submitting to the Minnesota Department Of Revenue. Additionally, you can efficiently track the status of your documents through our platform.

-

Are there any costs associated with using airSlate SignNow for Minnesota Income Tax Withheld documentation?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for managing Minnesota Income Tax Withheld documents. The plans are designed to provide a cost-effective solution, ensuring that you have the necessary tools to stay compliant with the Minnesota Department Of while managing your budget.

-

What features does airSlate SignNow offer to assist with Minnesota Income Tax Withheld?

Key features include customizable document templates, secure electronic signatures, and automated workflow processes that streamline the management of Minnesota Income Tax Withheld. Our platform also supports real-time tracking and notifications, ensuring that you are always aware of the status of your documents submitted to the Minnesota Department Of.

-

Is airSlate SignNow compliant with Minnesota Department Of regulations?

Absolutely, airSlate SignNow is designed with compliance in mind, ensuring that all features adhere to regulations set forth by the Minnesota Department Of. This helps businesses confidently manage their Minnesota Income Tax Withheld services without worrying about legal complications. Our continuous updates keep you aligned with any changes in the law.

-

Can I integrate airSlate SignNow with my existing payroll systems for Minnesota Income Tax Withheld?

Yes, airSlate SignNow offers various integration options with popular payroll systems to facilitate the management of Minnesota Income Tax Withheld. This seamless integration allows you to synchronize data and streamline your payroll processes with compliance for the Minnesota Department Of. Start automating your workflows today to save time and increase accuracy.

-

What are the benefits of using airSlate SignNow for Minnesota Income Tax Withheld documentation?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and better compliance with Minnesota Department Of requirements. Our platform improves record-keeping and provides quick access to essential documents. Additionally, the electronic signature feature enhances the speed of approvals needed for Minnesota Income Tax Withheld.

Get more for Minnesota Income Tax Withheld Minnesota Department Of

- Food and safety license form

- Purchase agreement and invoice amway australia form

- International roaming application form airtel

- Wfnj 1j 37547421 form

- Proxy form for intermediary or 3rd party capago capago

- Formulaire p4 pl cerfa n 1193202 d claration de cessation d araplbpl

- Cross examination debate ballot uiltexas form

- Www co monterey ca usplanning services 11318planning servicesmonterey county ca form

Find out other Minnesota Income Tax Withheld Minnesota Department Of

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later