Form 561 NR Oklahoma Capital Gain Deduction for Part Year 2021

What is the Form 561 NR Oklahoma Capital Gain Deduction For Part Year

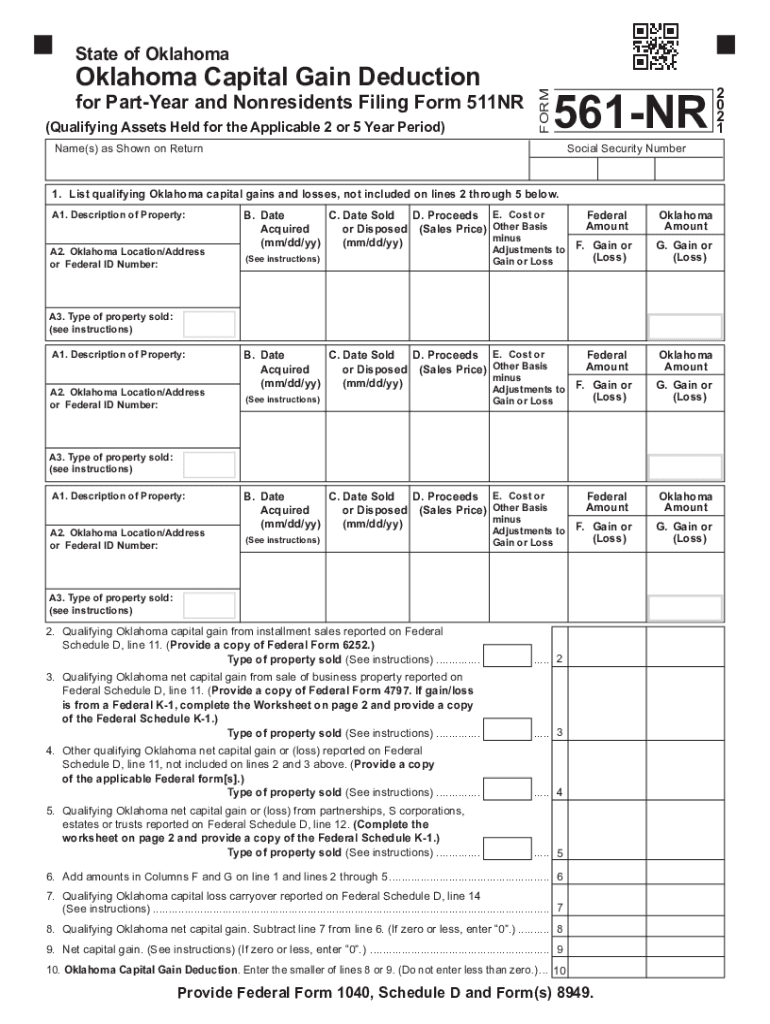

The Oklahoma Form 561 NR is specifically designed for non-residents who are eligible to claim a capital gain deduction for part of the year. This form allows individuals to report capital gains earned while they were residents of Oklahoma, ensuring they receive the appropriate deductions on their state tax returns. Understanding this form is essential for non-residents who want to accurately reflect their tax obligations and maximize their deductions.

How to use the Form 561 NR Oklahoma Capital Gain Deduction For Part Year

Using the Oklahoma Form 561 NR involves several steps that ensure compliance with state tax regulations. First, gather all necessary financial documents related to the capital gains you wish to report. Next, complete the form by providing your personal information, details of the capital gains, and any deductions you are claiming. It is important to follow the instructions carefully to avoid errors that could delay processing. Once completed, submit the form along with your state tax return.

Steps to complete the Form 561 NR Oklahoma Capital Gain Deduction For Part Year

Completing the Form 561 NR requires careful attention to detail. Here are the steps to follow:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Report the total amount of capital gains you earned during the year.

- Indicate the portion of those gains that are eligible for the deduction.

- Calculate the deduction amount based on the instructions provided with the form.

- Review the form for accuracy before signing and dating it.

Eligibility Criteria

To be eligible for the deductions on the Oklahoma Form 561 NR, you must meet specific criteria. You should be a non-resident of Oklahoma for part of the year and have incurred capital gains during the time you were a resident. Additionally, the gains must be from the sale of assets that are recognized under Oklahoma tax law. It is crucial to ensure that you meet these eligibility requirements to avoid complications during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Form 561 NR align with the state tax return deadlines. Typically, the deadline for filing your state tax return is April fifteenth of the following year. If you need additional time, you may apply for an extension, but it is important to check specific dates each year as they can vary. Keeping track of these deadlines ensures that you remain compliant and avoid penalties.

Required Documents

When completing the Oklahoma Form 561 NR, you will need several documents to support your claims. These include:

- Proof of residency status during the year.

- Documentation of capital gains, such as sale agreements or brokerage statements.

- Any previous tax returns that may be relevant to your current filing.

Having these documents ready will streamline the process and help ensure that your form is completed accurately.

Quick guide on how to complete 2020 form 561 nr oklahoma capital gain deduction for part year

Complete Form 561 NR Oklahoma Capital Gain Deduction For Part Year effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Form 561 NR Oklahoma Capital Gain Deduction For Part Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 561 NR Oklahoma Capital Gain Deduction For Part Year with ease

- Locate Form 561 NR Oklahoma Capital Gain Deduction For Part Year and then click Get Form to initiate.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to share your form: through email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 561 NR Oklahoma Capital Gain Deduction For Part Year and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 561 nr oklahoma capital gain deduction for part year

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 561 nr oklahoma capital gain deduction for part year

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What are the Oklahoma Form 561 instructions 2020?

The Oklahoma Form 561 instructions 2020 provide clear guidelines on how to complete and submit the form for various state purposes. It is essential to carefully follow these instructions to ensure accurate processing and compliance with state regulations.

-

How can airSlate SignNow assist with Oklahoma Form 561 instructions 2020?

AirSlate SignNow streamlines the process of filling out Oklahoma Form 561 instructions 2020 by allowing users to easily upload, edit, and electronically sign the document. Our platform ensures that you can complete all required fields accurately and efficiently.

-

What features does airSlate SignNow offer for managing documents like Oklahoma Form 561 instructions 2020?

AirSlate SignNow includes features such as document templates, eSignature capabilities, and cloud storage, which enhance your workflow when handling Oklahoma Form 561 instructions 2020. These tools allow for seamless collaboration and faster turnaround times.

-

Is airSlate SignNow affordable for small businesses needing Oklahoma Form 561 instructions 2020?

Yes, airSlate SignNow is a cost-effective solution for small businesses requiring assistance with Oklahoma Form 561 instructions 2020. Our flexible pricing plans accommodate various budget levels, ensuring you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with other tools while using Oklahoma Form 561 instructions 2020?

Absolutely! AirSlate SignNow offers integrations with numerous productivity tools, making it easy to manage Oklahoma Form 561 instructions 2020 alongside your existing workflows. This interoperability helps streamline processes and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for Oklahoma Form 561 instructions 2020?

Using airSlate SignNow for Oklahoma Form 561 instructions 2020 offers several benefits, including reduced paperwork, faster completion times, and secure storage. Additionally, the eSignature feature simplifies approvals, ensuring a hassle-free experience.

-

How do I get started with airSlate SignNow for Oklahoma Form 561 instructions 2020?

Getting started with airSlate SignNow for Oklahoma Form 561 instructions 2020 is easy! Simply sign up for an account, explore our user-friendly interface, and upload your documents to begin. Our support team is also available to assist you with any questions you may have.

Get more for Form 561 NR Oklahoma Capital Gain Deduction For Part Year

Find out other Form 561 NR Oklahoma Capital Gain Deduction For Part Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors