Azdor Govtax Creditscertification SchoolCertification for School Tuition OrganizationsArizona 2021

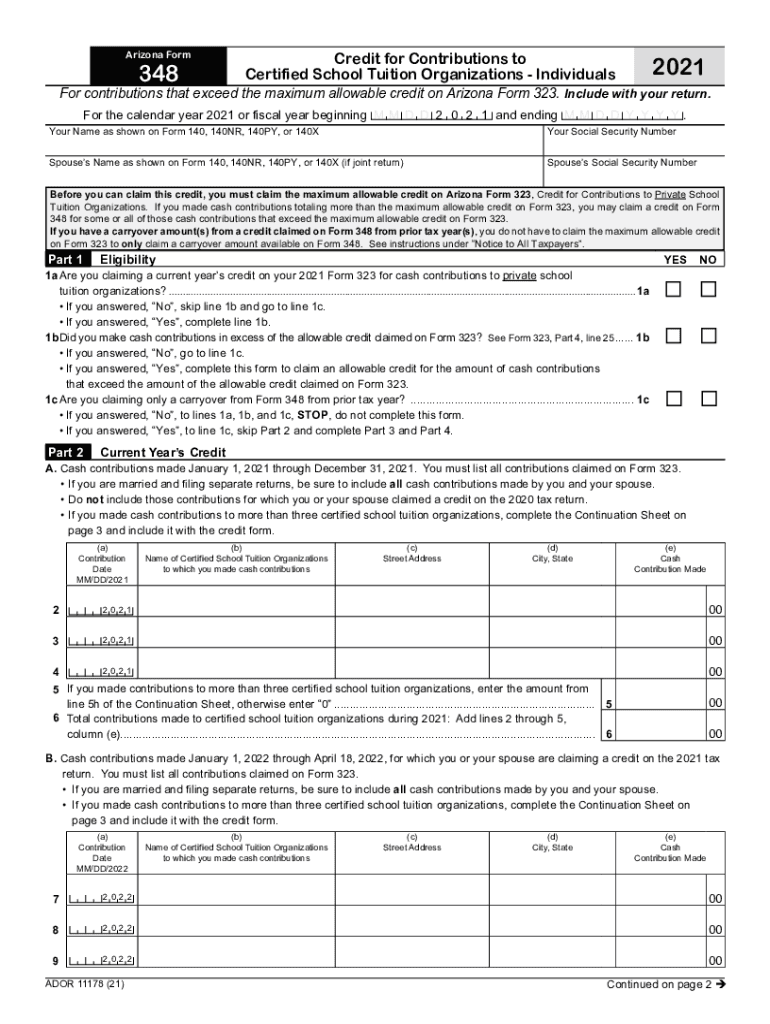

What is the Arizona Form 348?

The Arizona Form 348, also known as the Arizona Department of Revenue Tax Credits Certification for School Tuition Organizations, is a crucial document for taxpayers who wish to claim tax credits for contributions made to school tuition organizations. This form certifies that the contributions are eligible for tax credits under Arizona law. It is essential for individuals and businesses that support educational initiatives and want to benefit from the associated tax advantages.

Steps to Complete the Arizona Form 348

Completing the Arizona Form 348 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary information, including your personal details, the amount contributed, and the name of the school tuition organization. Next, accurately fill out the form, ensuring that all sections are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form to the Arizona Department of Revenue either online or via mail, depending on your preference.

Eligibility Criteria for Arizona Form 348

To qualify for the tax credits associated with the Arizona Form 348, taxpayers must meet specific eligibility criteria. Individuals must be Arizona residents and have made contributions to a qualified school tuition organization. Additionally, the contributions must not exceed the limits set by Arizona law. Understanding these criteria is vital for ensuring that your contributions are eligible for the tax credits you intend to claim.

Form Submission Methods for Arizona Form 348

The Arizona Form 348 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to submit the form online through the Arizona Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be printed and mailed to the appropriate address provided by the department. In-person submissions may also be possible at designated locations, allowing for direct interaction with department staff.

Key Elements of the Arizona Form 348

Understanding the key elements of the Arizona Form 348 is essential for effective completion and submission. The form includes sections for taxpayer information, contribution details, and the certification of the school tuition organization. Each section must be filled out accurately to avoid delays or rejections. Additionally, taxpayers must provide their signature, affirming the accuracy of the information provided and their eligibility for the tax credits.

Legal Use of the Arizona Form 348

The legal use of the Arizona Form 348 is governed by state tax laws that outline the requirements for claiming tax credits. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Arizona Department of Revenue. This includes submitting the form within specified deadlines and ensuring that contributions are made to qualified organizations. Understanding these legal parameters helps taxpayers navigate the process effectively and avoid potential penalties.

Quick guide on how to complete azdorgovtax creditscertification schoolcertification for school tuition organizationsarizona

Complete Azdor govtax creditscertification schoolCertification For School Tuition OrganizationsArizona effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and electronically sign your documents quickly and efficiently. Handle Azdor govtax creditscertification schoolCertification For School Tuition OrganizationsArizona on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Azdor govtax creditscertification schoolCertification For School Tuition OrganizationsArizona with ease

- Obtain Azdor govtax creditscertification schoolCertification For School Tuition OrganizationsArizona and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Azdor govtax creditscertification schoolCertification For School Tuition OrganizationsArizona and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azdorgovtax creditscertification schoolcertification for school tuition organizationsarizona

Create this form in 5 minutes!

How to create an eSignature for the azdorgovtax creditscertification schoolcertification for school tuition organizationsarizona

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an e-signature for a PDF on Android devices

People also ask

-

What is Form 348 Arizona and who needs it?

Form 348 Arizona is a crucial document required for various administrative tasks in Arizona. Businesses, employers, and individuals might need to fill out this form for specific applications or governmental processes.

-

How does airSlate SignNow simplify the process of filling out Form 348 Arizona?

airSlate SignNow offers an intuitive platform that allows users to easily fill out Form 348 Arizona online. With features like drag-and-drop editing and templates, it streamlines the completion process and minimizes errors.

-

Is there a cost associated with using airSlate SignNow for Form 348 Arizona?

Yes, airSlate SignNow offers various pricing plans tailored to businesses of different sizes. These plans include cost-effective solutions to manage and eSign documents, including Form 348 Arizona.

-

Can I integrate airSlate SignNow with other applications to manage Form 348 Arizona?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications. This makes it easy to manage Form 348 Arizona alongside your existing workflows and systems.

-

What are the benefits of using airSlate SignNow for electronic signatures on Form 348 Arizona?

Using airSlate SignNow for electronic signatures on Form 348 Arizona ensures faster processing times and reduces paper waste. Additionally, it provides a legally binding signature solution, enhancing document security.

-

How secure is airSlate SignNow when handling Form 348 Arizona?

airSlate SignNow employs robust security measures to protect your documents, including Form 348 Arizona. It features encryption, secure storage, and compliance with industry standards to ensure that your information is safe.

-

Can I track the status of my Form 348 Arizona submissions using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form 348 Arizona submissions in real time. This feature helps you stay informed about where your documents are in the signing process.

Get more for Azdor govtax creditscertification schoolCertification For School Tuition OrganizationsArizona

- Florida legal adult form

- Legal last will and testament form for single person with adult children florida

- Legal last will and testament for married person with minor children from prior marriage florida form

- Legal last will and testament form for married person with adult children from prior marriage florida

- Legal last will and testament form for divorced person not remarried with adult children florida

- Legal last will and testament form for divorced person not remarried with no children florida

- Legal last will and testament form for divorced person not remarried with minor children florida

- Legal last will and testament form for divorced person not remarried with adult and minor children florida

Find out other Azdor govtax creditscertification schoolCertification For School Tuition OrganizationsArizona

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF