Printable Arizona Form 348 Credit for Contributions to Certified School Tuition Organization Individuals 2019

What is the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals

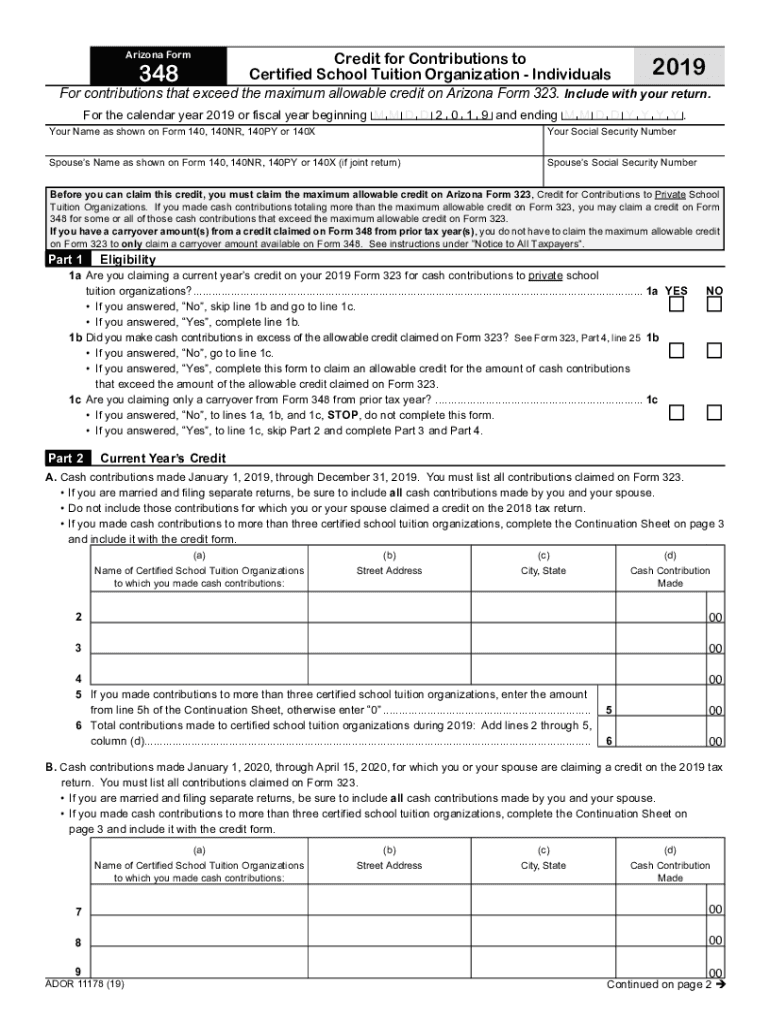

The Printable Arizona Form 348 is a tax document that allows individuals to claim a credit for contributions made to certified school tuition organizations. This form is specifically designed for Arizona taxpayers who wish to support private education through donations. By completing this form, individuals can receive a dollar-for-dollar tax credit, which can significantly reduce their state tax liability. The contributions made must go to organizations that provide scholarships for students attending private schools in Arizona.

How to use the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals

Using the Printable Arizona Form 348 involves several straightforward steps. First, individuals must ensure they are contributing to a certified school tuition organization recognized by the state. After making the contribution, the taxpayer should obtain a receipt from the organization, which is necessary for completing the form. Next, the individual fills out the form with personal details, the amount contributed, and the name of the organization. Finally, the completed form should be submitted with the Arizona state tax return to claim the credit.

Steps to complete the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals

Completing the Printable Arizona Form 348 requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your personal identification details and the contribution amount.

- Obtain a receipt from the certified school tuition organization that confirms your donation.

- Fill out the form, ensuring all fields are accurately completed.

- Double-check the information for accuracy to avoid any issues during tax filing.

- Submit the form along with your Arizona state tax return.

Legal use of the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals

The Printable Arizona Form 348 is legally binding when filled out correctly and submitted in accordance with Arizona tax laws. It is important for taxpayers to ensure that their contributions are made to certified organizations, as only these donations qualify for the tax credit. Additionally, maintaining proper documentation, such as receipts and completed forms, is crucial for compliance and to avoid penalties during tax audits.

Eligibility Criteria

To be eligible for the tax credit using the Printable Arizona Form 348, individuals must meet specific criteria. Taxpayers must be residents of Arizona and must contribute to a certified school tuition organization. The contributions must be made within the tax year for which the credit is being claimed. There are limits on the amount that can be claimed, which varies depending on the taxpayer's filing status. It is advisable to check the latest guidelines from the Arizona Department of Revenue for any changes in eligibility requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Arizona Form 348 align with the general tax filing deadlines in Arizona. Typically, taxpayers must submit their state tax returns, including Form 348, by April 15 of the following year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential for taxpayers to be aware of these dates to ensure they can claim their credits without incurring penalties.

Quick guide on how to complete printable 2020 arizona form 348 credit for contributions to certified school tuition organization individuals

Easily prepare Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Handle Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals on any device using the airSlate SignNow applications for Android or iOS and streamline any document-based procedure today.

How to edit and electronically sign Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals effortlessly

- Locate Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals while ensuring excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 arizona form 348 credit for contributions to certified school tuition organization individuals

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 arizona form 348 credit for contributions to certified school tuition organization individuals

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals?

The Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals allows individuals to claim a tax credit for contributions made to certified school tuition organizations. This form is essential for tax filers in Arizona who wish to reduce their state tax liability while supporting education.

-

How can I obtain the Printable Arizona Form 348?

You can easily download the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals from our website. Our platform provides a user-friendly interface, allowing you to access and print the form directly from your device, ensuring a seamless experience.

-

Are there any costs associated with using the Printable Arizona Form 348?

There is no cost to download the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals. airSlate SignNow offers free access to this essential form, allowing you to focus on maximizing your tax credits without any additional fees.

-

What are the benefits of using airSlate SignNow for the Printable Arizona Form 348?

Using airSlate SignNow for the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals streamlines the signing and submission process. Our platform ensures your documents are securely stored and easily accessible, while also providing eSignature capabilities for added convenience.

-

Can I eSign the Printable Arizona Form 348 online?

Yes, you can eSign the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals directly on our platform. airSlate SignNow makes it easy to add your signature electronically, saving you time and simplifying the submission process.

-

How do I ensure my Printable Arizona Form 348 is submitted correctly?

To ensure your Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals is submitted correctly, double-check all information entered on the form. Additionally, use our platform to track the submission process and receive confirmation once it has been filed.

-

What integrations does airSlate SignNow offer for the Printable Arizona Form 348?

airSlate SignNow seamlessly integrates with various applications and platforms to enhance your experience with the Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals. These integrations allow for efficient workflows, making it easier to manage and process your forms alongside other business operations.

Get more for Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals

Find out other Printable Arizona Form 348 Credit For Contributions To Certified School Tuition Organization Individuals

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple