Credit for Contributions to Certified School Tuition 2023-2026

What is the Credit For Contributions To Certified School Tuition

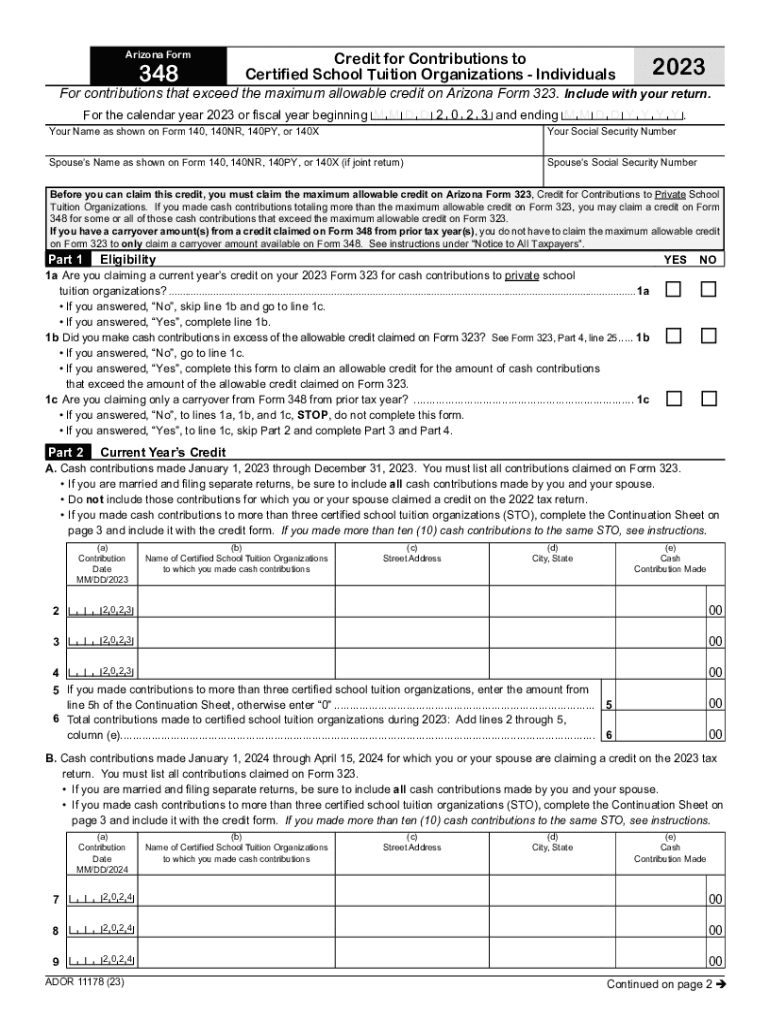

The Credit For Contributions To Certified School Tuition is a tax benefit available to taxpayers who contribute to qualified educational institutions in the United States. This credit encourages financial support for private and charter schools that meet specific certification criteria. By offering this credit, the government aims to promote educational options for families and enhance the quality of education. Eligible contributions typically include donations made to certified schools that directly support tuition costs for students.

How to use the Credit For Contributions To Certified School Tuition

To utilize the Credit For Contributions To Certified School Tuition, taxpayers must first ensure that their contributions are made to certified educational institutions. After making a qualifying contribution, individuals can claim the credit when filing their annual tax returns. It is essential to keep detailed records of all contributions, including receipts and any documentation provided by the school. Taxpayers should consult the IRS guidelines to determine the appropriate forms and calculations needed to claim the credit accurately.

Eligibility Criteria

Eligibility for the Credit For Contributions To Certified School Tuition generally requires that the taxpayer has made a contribution to a certified school. The school must be recognized by the state as a qualified educational institution. Additionally, there may be income limits or other specific requirements that taxpayers need to meet. It is advisable to review the latest IRS guidelines to ensure compliance with all eligibility conditions.

Required Documents

When claiming the Credit For Contributions To Certified School Tuition, taxpayers must gather several important documents. These typically include:

- Receipts or proof of contributions made to certified schools.

- Documentation from the school confirming the contribution and its purpose.

- Tax forms required for filing, such as Form 1040 and any applicable schedules.

Having these documents organized and accessible will facilitate a smoother filing process and help ensure that the credit is claimed correctly.

Steps to complete the Credit For Contributions To Certified School Tuition

Completing the process for the Credit For Contributions To Certified School Tuition involves several key steps:

- Identify and confirm that the school you are contributing to is certified.

- Make your contribution and obtain a receipt or documentation from the school.

- Gather all required documents, including proof of contribution and tax forms.

- Fill out the necessary tax forms, ensuring to include the credit on your tax return.

- Submit your tax return by the filing deadline, either electronically or via mail.

IRS Guidelines

The IRS provides specific guidelines regarding the Credit For Contributions To Certified School Tuition. Taxpayers should refer to IRS publications and instructions for detailed information on eligibility, contribution limits, and filing procedures. Staying informed about any changes to tax laws or regulations is crucial for ensuring compliance and maximizing potential benefits. Regularly checking the IRS website or consulting a tax professional can help clarify any uncertainties regarding the credit.

Quick guide on how to complete credit for contributions to certified school tuition

Complete Credit For Contributions To Certified School Tuition effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Credit For Contributions To Certified School Tuition on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centered task today.

How to modify and eSign Credit For Contributions To Certified School Tuition effortlessly

- Find Credit For Contributions To Certified School Tuition and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Modify and eSign Credit For Contributions To Certified School Tuition and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit for contributions to certified school tuition

Create this form in 5 minutes!

How to create an eSignature for the credit for contributions to certified school tuition

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit For Contributions To Certified School Tuition?

The Credit For Contributions To Certified School Tuition is a tax incentive that encourages individuals and businesses to contribute financially to certified schools. By taking advantage of this credit, contributors can reduce their tax liability while supporting educational institutions.

-

How can airSlate SignNow help with managing contributions for the Credit For Contributions To Certified School Tuition?

airSlate SignNow provides a streamlined platform to manage and eSign documents related to the Credit For Contributions To Certified School Tuition. By simplifying document workflows, our solution ensures that you can easily keep track of contributions and necessary tax documentation.

-

Are there any costs associated with using airSlate SignNow for Credit For Contributions To Certified School Tuition?

airSlate SignNow offers various pricing plans tailored to business needs, including options that can accommodate documentation for the Credit For Contributions To Certified School Tuition. You can choose a plan that fits your budget while enjoying robust features and cost-effective solutions.

-

What features does airSlate SignNow offer for managing educational contributions?

Our platform offers features such as easy document creation, templates for tax credits, unlimited eSigning, and secure storage. Specifically designed for educational contributions, these features help you efficiently handle all aspects of the Credit For Contributions To Certified School Tuition.

-

Is airSlate SignNow suitable for both individuals and businesses contributing to school tuition?

Yes, airSlate SignNow is designed for both individuals and businesses looking to contribute under the Credit For Contributions To Certified School Tuition program. Our user-friendly interface allows anyone to manage contributions seamlessly, enhancing the donation experience.

-

Can I integrate airSlate SignNow with other software for managing contributions?

Absolutely! airSlate SignNow offers integrations with various platforms such as CRM systems and accounting software. This makes it easier to manage records and documents related to the Credit For Contributions To Certified School Tuition within your existing systems.

-

How secure is my data when using airSlate SignNow for contributions?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that all documents related to the Credit For Contributions To Certified School Tuition are securely stored and transmitted, protecting your sensitive information.

Get more for Credit For Contributions To Certified School Tuition

Find out other Credit For Contributions To Certified School Tuition

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free