Arizona Form 348 Credit for Contributions to Certified School Tuition 2022

What is the Arizona Form 348 Credit For Contributions To Certified School Tuition

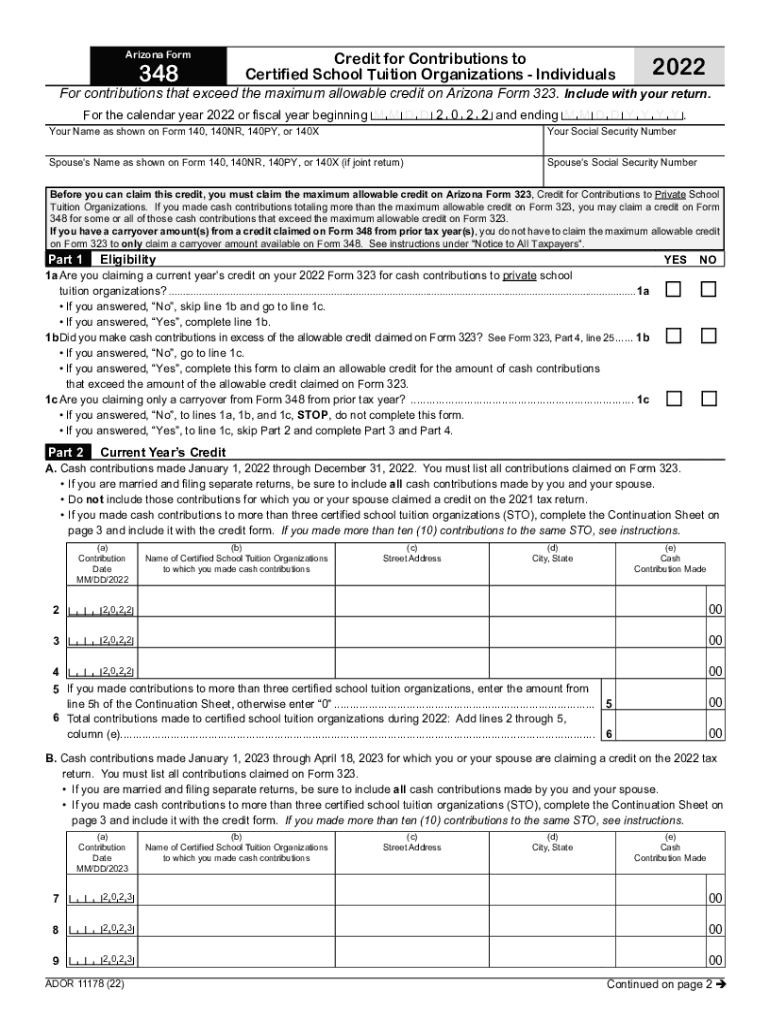

The Arizona Form 348 is a tax credit form that allows taxpayers to receive a credit for contributions made to certified school tuition organizations (STOs). This form is designed to support educational funding for students attending private schools in Arizona. By contributing to an STO, taxpayers can help provide scholarships to students while also benefiting from a dollar-for-dollar tax credit on their state income tax returns. This initiative aims to enhance educational opportunities and promote school choice within the state.

How to use the Arizona Form 348 Credit For Contributions To Certified School Tuition

To utilize the Arizona Form 348, taxpayers must first make a contribution to a certified school tuition organization. After making the contribution, they should complete the form by providing necessary details such as the amount contributed, the name of the STO, and personal identification information. Once completed, the form can be submitted with the taxpayer's Arizona state income tax return. It is important to retain a copy of the contribution receipt from the STO for record-keeping and verification purposes.

Steps to complete the Arizona Form 348 Credit For Contributions To Certified School Tuition

Completing the Arizona Form 348 involves several key steps:

- Make a contribution to a certified school tuition organization.

- Obtain a receipt from the STO confirming the contribution amount.

- Download or request the Arizona Form 348 from the Arizona Department of Revenue.

- Fill out the form with accurate information, including your personal details and contribution amount.

- Attach the form to your Arizona state income tax return.

- Keep a copy of the form and the contribution receipt for your records.

Eligibility Criteria

To qualify for the Arizona Form 348 tax credit, taxpayers must meet certain eligibility criteria. Individuals must be Arizona residents and must contribute to a certified school tuition organization. The contribution must be made within the tax year for which the credit is claimed. There are also limits on the amount that can be contributed and claimed as a tax credit, which may vary based on filing status, such as single or married filing jointly. It is essential to review the current guidelines to ensure compliance with eligibility requirements.

Legal use of the Arizona Form 348 Credit For Contributions To Certified School Tuition

The Arizona Form 348 is legally recognized as a valid method for claiming tax credits for contributions to certified school tuition organizations. To ensure its legal standing, taxpayers must adhere to the regulations set forth by the Arizona Department of Revenue. This includes using the form correctly, providing accurate information, and maintaining proper documentation of contributions. Compliance with these legal requirements helps safeguard the taxpayer's right to claim the credit and avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 348 can be submitted through various methods. Taxpayers have the option to file their state income tax return online, which often includes electronically submitting the form. Alternatively, the form can be printed and mailed to the Arizona Department of Revenue along with the tax return. In-person submissions may also be possible at designated tax offices. It is advisable to check the latest guidelines for any updates on submission methods and requirements.

Quick guide on how to complete arizona form 348 credit for contributions to certified school tuition

Complete Arizona Form 348 Credit For Contributions To Certified School Tuition effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Arizona Form 348 Credit For Contributions To Certified School Tuition on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to alter and electronically sign Arizona Form 348 Credit For Contributions To Certified School Tuition without hassle

- Locate Arizona Form 348 Credit For Contributions To Certified School Tuition and click Get Form to begin.

- Use the features provided to complete your form.

- Emphasize critical sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically supplies for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and electronically sign Arizona Form 348 Credit For Contributions To Certified School Tuition and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 348 credit for contributions to certified school tuition

Create this form in 5 minutes!

People also ask

-

What is form 348 Arizona?

Form 348 Arizona is a specific document used for certain state-related purposes, often related to tax filings or financial reporting. It is essential for ensuring compliance with Arizona's regulations and can be easily managed using eSignature solutions like airSlate SignNow.

-

How can airSlate SignNow help with form 348 Arizona?

With airSlate SignNow, businesses can effortlessly complete and eSign form 348 Arizona, streamlining the process. The platform ensures that all signatures are legally binding and stored securely, simplifying document management.

-

Is there a cost associated with using airSlate SignNow for form 348 Arizona?

Yes, airSlate SignNow offers various pricing plans that are affordable for all business sizes. The cost-effective solutions allow you to manage documents like form 348 Arizona efficiently without breaking the bank.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as template creation, organization of documents, and real-time tracking of eSignature statuses. These features enhance the handling of form 348 Arizona and other documents for improved efficiency.

-

Can I use airSlate SignNow to collaborate on form 348 Arizona with my team?

Absolutely! airSlate SignNow allows for easy collaboration, enabling you and your team to work together on form 348 Arizona. Team members can review, edit, and sign documents seamlessly, ensuring everyone is on the same page.

-

What are the benefits of using airSlate SignNow for form 348 Arizona?

Using airSlate SignNow for form 348 Arizona offers benefits such as increased efficiency, reduced paper consumption, and enhanced security. Digital signatures provide a quick turnaround, helping you to meet deadlines effortlessly.

-

Does airSlate SignNow integrate with other software for managing form 348 Arizona?

Yes, airSlate SignNow integrates with various applications, allowing for efficient data management alongside form 348 Arizona. This ensures that you can utilize existing software tools while maximizing productivity.

Get more for Arizona Form 348 Credit For Contributions To Certified School Tuition

- Montana trust indenture form

- Montana trust indenture form 497316657

- Partial release of property from deed of trust for corporation montana form

- Partial release of property from deed of trust for individual montana form

- Montana service complete form

- Issue form montana

- Montana court form

- Affidavit pauperis form

Find out other Arizona Form 348 Credit For Contributions To Certified School Tuition

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free