Form 8888 Rev November Allocation of Refund Including Savings Bond Purchases 2021

What is the Form 8888 Allocation of Refund Including Savings Bond Purchases

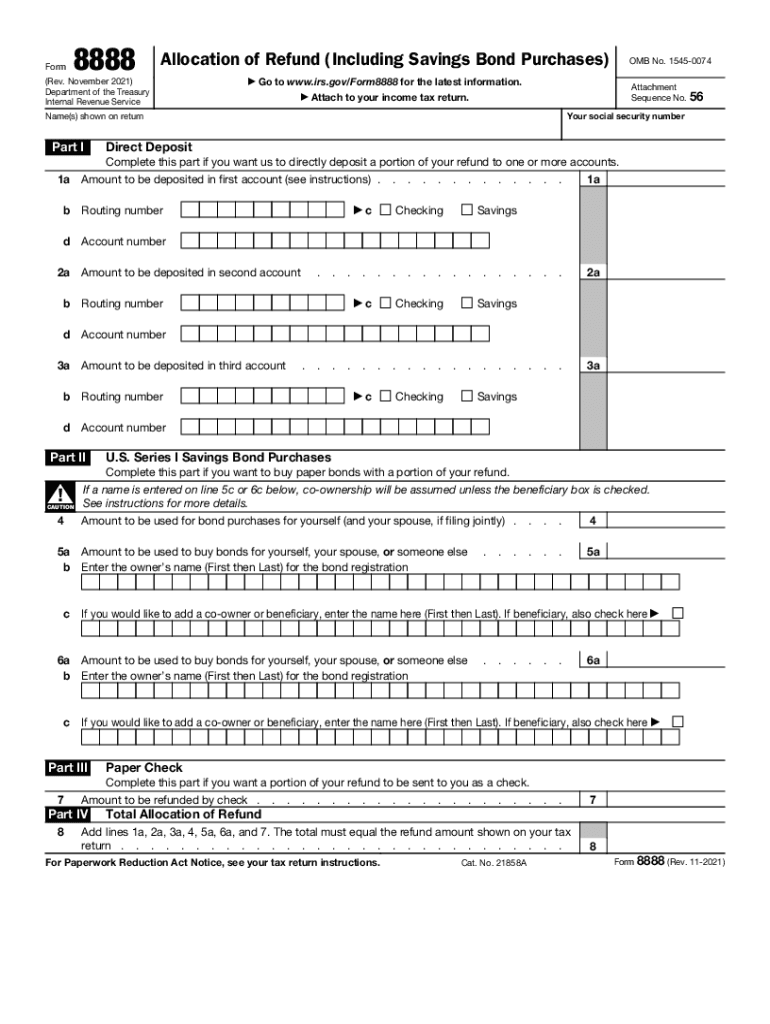

The Form 8888, officially known as the Allocation of Refund Including Savings Bond Purchases, is a document used by taxpayers to specify how they want their federal tax refund distributed. This form allows individuals to direct their refund into multiple accounts or to purchase U.S. savings bonds. It is particularly useful for taxpayers who wish to manage their finances by splitting their refund among different savings or checking accounts, or investing in savings bonds for future use.

How to Use the Form 8888 Allocation of Refund Including Savings Bond Purchases

To effectively use Form 8888, taxpayers should first ensure they have completed their federal tax return. Once the return is ready, they can fill out Form 8888 to indicate how they want their refund allocated. The form requires details such as the bank account numbers for direct deposits and the amount to be deposited into each account. If purchasing savings bonds, taxpayers must provide the necessary information regarding the bonds, including the amount and the recipient's details.

Steps to Complete the Form 8888 Allocation of Refund Including Savings Bond Purchases

Completing Form 8888 involves several straightforward steps:

- Start by entering your personal information, including your name, address, and Social Security number.

- Indicate your total refund amount as calculated on your tax return.

- Specify how you want to allocate your refund by filling in the appropriate sections for direct deposits and savings bond purchases.

- Double-check the account numbers and amounts to ensure accuracy.

- Sign and date the form before submitting it with your tax return.

IRS Guidelines for Form 8888

The IRS provides specific guidelines for using Form 8888. It is important to ensure that the form is filled out accurately to avoid delays in receiving your refund. The IRS recommends using direct deposit for faster processing. Additionally, taxpayers should keep a copy of the completed form for their records, along with their tax return. If there are any errors on the form, it could lead to complications in the refund process.

Eligibility Criteria for Using Form 8888

To use Form 8888, taxpayers must be eligible to receive a federal tax refund. This includes individuals who have filed their tax returns and are expecting a refund. There are no specific income limits or restrictions on who can use the form, making it accessible to a wide range of taxpayers. However, it is essential to ensure that the information provided on the form matches the details on the tax return to avoid any issues with processing.

Required Documents for Form 8888 Submission

When submitting Form 8888, taxpayers should have the following documents ready:

- Your completed federal tax return.

- Any relevant documentation related to your income and deductions.

- Bank account information for direct deposits, including account numbers and routing numbers.

- Details for any savings bonds you wish to purchase, including the recipient's information.

Quick guide on how to complete form 8888 rev november 2021 allocation of refund including savings bond purchases

Prepare Form 8888 Rev November Allocation Of Refund Including Savings Bond Purchases easily on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Form 8888 Rev November Allocation Of Refund Including Savings Bond Purchases on any platform through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Form 8888 Rev November Allocation Of Refund Including Savings Bond Purchases effortlessly

- Locate Form 8888 Rev November Allocation Of Refund Including Savings Bond Purchases and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that reason.

- Create your signature using the Sign tool, which takes seconds and holds the same legal standing as a traditional handwritten signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8888 Rev November Allocation Of Refund Including Savings Bond Purchases and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8888 rev november 2021 allocation of refund including savings bond purchases

Create this form in 5 minutes!

How to create an eSignature for the form 8888 rev november 2021 allocation of refund including savings bond purchases

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 8888?

airSlate SignNow is an innovative eSignature solution that empowers businesses to send and sign documents seamlessly. With the unique identifier '8888,' our platform ensures ease of use and cost-effectiveness for all users looking to streamline their document workflows.

-

What are the key features of airSlate SignNow that leverage 8888?

airSlate SignNow includes essential features like customizable templates, secure eSignature capabilities, and real-time tracking of document status. Utilizing our powerful tools with the reference '8888,' businesses can facilitate efficient communication and faster document turnaround times.

-

How much does airSlate SignNow cost with regard to 8888 subscriptions?

Pricing for airSlate SignNow varies based on your chosen plan, but it offers competitive rates designed for businesses of all sizes. When considering the number '8888' in our pricing models, users can find a solution that fits their budget without sacrificing quality.

-

What are the benefits of using airSlate SignNow with the keyword 8888 in mind?

By using airSlate SignNow, businesses can experience signNow efficiency gains—reducing time spent on paperwork. The connection to '8888' signifies the reliability and effectiveness of our service, promoting smoother workflows and enhanced collaboration.

-

Can airSlate SignNow integrate with other software while considering 8888?

Yes, airSlate SignNow offers integration capabilities with a variety of applications, including CRM and project management tools. The '8888' integration helps businesses streamline their processes, ensuring a cohesive environment for managing documents and signatures.

-

Is airSlate SignNow secure for handling sensitive documents marked with 8888?

Absolutely! airSlate SignNow prioritizes security, using advanced encryption techniques to protect sensitive information. The reference '8888' serves as a reminder of our commitment to maintaining data integrity and confidentiality for all users.

-

How does airSlate SignNow enhance team collaboration involving 8888?

airSlate SignNow facilitates enhanced team collaboration by allowing multiple users to interact with documents in real-time. With '8888' reflecting our collaborative features, teams can streamline approvals and feedback, making the document signing process more efficient.

Get more for Form 8888 Rev November Allocation Of Refund Including Savings Bond Purchases

- Sheetrock drywall contract for contractor hawaii form

- Flooring contract template form

- Hawaii deed form

- Notice of intent to enforce forfeiture provisions of contact for deed hawaii form

- Final notice of forfeiture and request to vacate property under contract for deed hawaii form

- Buyers request for accounting from seller under contract for deed hawaii form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed hawaii form

- General notice of default for contract for deed hawaii form

Find out other Form 8888 Rev November Allocation Of Refund Including Savings Bond Purchases

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement