Irs Form 8888 2016

What is the Irs Form 8888

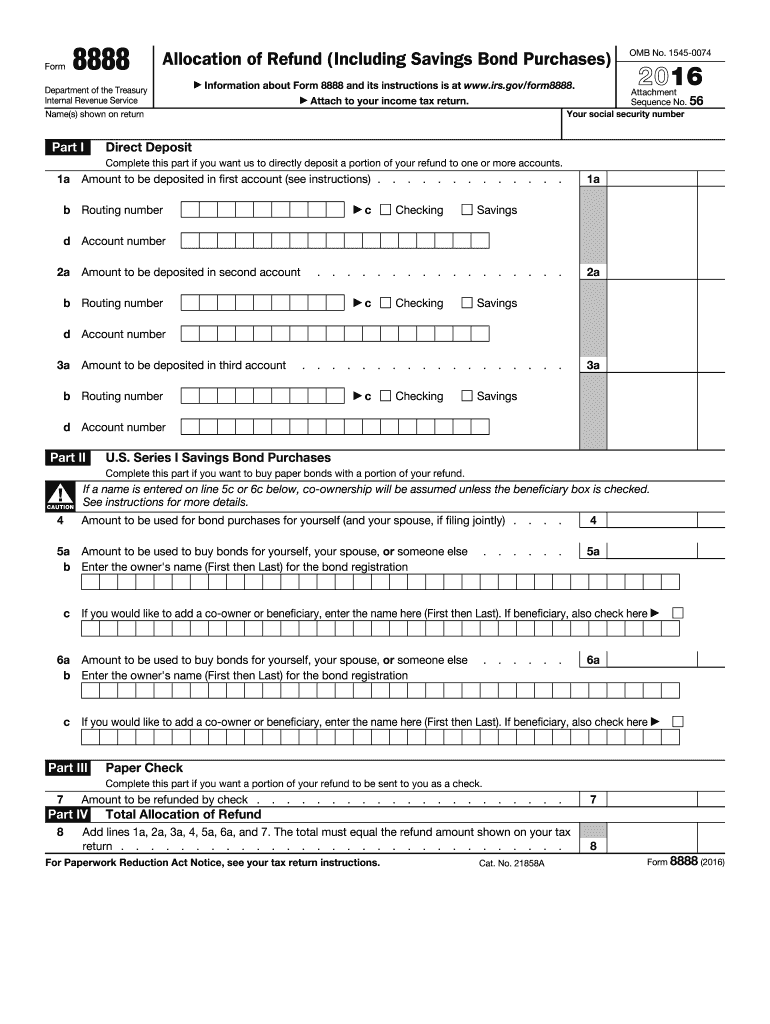

The IRS Form 8888 is a tax form used by individuals to allocate their tax refunds to multiple accounts. This form allows taxpayers to direct their refunds to different bank accounts, making it easier to manage finances. It is particularly useful for those who wish to split their refunds between personal savings, checking accounts, or even to purchase U.S. savings bonds. By using this form, taxpayers can ensure that their refunds are distributed according to their financial needs and goals.

How to use the Irs Form 8888

To use the IRS Form 8888, taxpayers must first complete their tax return. Once the return is prepared, they can fill out Form 8888 to specify how they want their refund allocated. The form requires the taxpayer's name, Social Security number, and the details of the accounts where the refund will be deposited. It is essential to double-check the account numbers to avoid any delays in receiving the refund. After completing the form, it should be attached to the tax return when submitting it to the IRS.

Steps to complete the Irs Form 8888

Completing the IRS Form 8888 involves several straightforward steps:

- Begin by entering your personal information, including your name and Social Security number.

- Indicate the total refund amount you expect to receive from your tax return.

- Decide how you want to split your refund. You can allocate funds to up to three different accounts or purchase U.S. savings bonds.

- For each allocation, provide the account type (checking or savings) and the account number.

- Review the completed form for accuracy and ensure all information is correct.

Legal use of the Irs Form 8888

The IRS Form 8888 is legally recognized as a valid method for directing tax refunds. When completed correctly, it adheres to IRS regulations and ensures that taxpayers can manage their refunds according to their preferences. It is important to use the form as intended and ensure that all information provided is accurate to avoid complications with the IRS. The form also complies with electronic filing standards, allowing for efficient processing of refunds.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when using the IRS Form 8888. The primary deadline for filing tax returns is typically April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, if a taxpayer is requesting an extension, they should file Form 4868 by the original deadline. It is crucial to submit Form 8888 along with the tax return by these deadlines to ensure timely processing of refunds.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8888 can be submitted through various methods, depending on how the taxpayer files their tax return. For those filing electronically, the form can be included as part of the e-filing process. Taxpayers who choose to file by mail should attach Form 8888 to their paper tax return. In-person submissions are typically not an option for this form, as it is primarily designed for inclusion with electronic or mailed tax returns.

Quick guide on how to complete irs form 8888 2016

Complete Irs Form 8888 seamlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the instruments needed to create, edit, and eSign your documents rapidly without delays. Manage Irs Form 8888 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Irs Form 8888 with ease

- Obtain Irs Form 8888 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and eSign Irs Form 8888 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8888 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form 8888 2016

How to generate an eSignature for your Irs Form 8888 2016 online

How to generate an eSignature for your Irs Form 8888 2016 in Google Chrome

How to generate an eSignature for putting it on the Irs Form 8888 2016 in Gmail

How to generate an eSignature for the Irs Form 8888 2016 from your smartphone

How to make an electronic signature for the Irs Form 8888 2016 on iOS

How to make an electronic signature for the Irs Form 8888 2016 on Android OS

People also ask

-

What is IRS Form 8888 and how can I use it with airSlate SignNow?

IRS Form 8888 allows taxpayers to split their tax refunds into multiple accounts or use it for purchasing U.S. Savings Bonds. With airSlate SignNow, you can easily eSign and submit IRS Form 8888 electronically, streamlining your tax filing process and ensuring your refund is allocated exactly as you intend.

-

How can airSlate SignNow help with completing IRS Form 8888?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out IRS Form 8888. You can easily access the form, fill it out, and eSign it, all in one place, ensuring that you meet all IRS requirements without hassle.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8888?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses and individuals. You can choose a plan that fits your needs, allowing you to eSign IRS Form 8888 and manage other documents efficiently without breaking the bank.

-

What features does airSlate SignNow offer for IRS Form 8888 preparation?

airSlate SignNow provides features such as templates, reusable fields, and secure cloud storage that enhance the preparation of IRS Form 8888. These features ensure that your form is filled out correctly and securely stored, making it easy to access when you need it.

-

Can I integrate airSlate SignNow with my tax preparation software for IRS Form 8888?

Absolutely! airSlate SignNow seamlessly integrates with various tax preparation software, allowing you to easily handle IRS Form 8888. This integration helps streamline your workflow, so you can eSign and submit your forms without switching between platforms.

-

What are the benefits of using airSlate SignNow for IRS Form 8888?

Using airSlate SignNow for IRS Form 8888 offers numerous benefits, including faster processing times, enhanced security, and improved accuracy. The platform's user-friendly interface ensures that you can complete your form quickly and confidently, reducing the chances of errors.

-

Is airSlate SignNow secure for submitting IRS Form 8888?

Yes, airSlate SignNow prioritizes security and complies with industry standards to protect your sensitive information. When you submit IRS Form 8888 through our platform, you can be assured that your data is encrypted and securely handled.

Get more for Irs Form 8888

- Small business dvbe certification application std 812 rev 042011 form

- Transcript request form registraramp39s office sweet briar college registrar sbc

- Professional paralegal recertification form nals nals

- Re certification form missouri office of equal opportunity oeo mo

- F 00027 form

- Medical report blank page form

- Mail merge pdf form

- Salary sacrifice external private form

Find out other Irs Form 8888

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template