Go to Www Irs GovForm8888 Internal Revenue Service 2020

Understanding IRS Form 8888

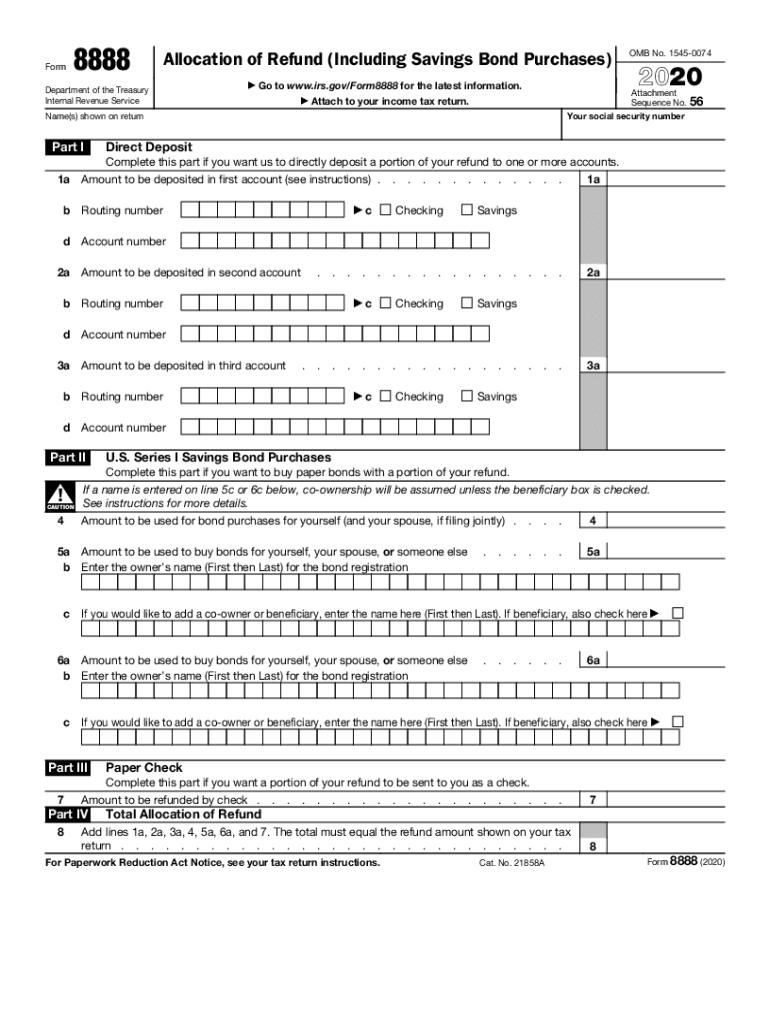

IRS Form 8888, also known as the Allocation of Refund, is a tax form used by individuals to direct the IRS on how to allocate their tax refunds. This form allows taxpayers to split their refund into multiple accounts, making it easier to manage funds. It is particularly useful for those who wish to save a portion of their refund, pay bills, or make contributions to retirement accounts. Understanding the purpose and function of this form is essential for effective tax planning.

Steps to Complete IRS Form 8888

Completing IRS Form 8888 involves several key steps:

- Gather necessary information, including your tax return details and bank account information.

- Indicate on the form how you would like your refund allocated. You can choose to deposit your refund into up to three different accounts.

- Provide the routing and account numbers for each of the accounts you wish to use.

- Review the completed form for accuracy to avoid delays in processing.

- Submit the form along with your tax return, either electronically or by mail.

Legal Use of IRS Form 8888

IRS Form 8888 is legally binding when completed and submitted according to IRS guidelines. To ensure its legal validity, the form must be filled out accurately, with all required information provided. Compliance with IRS regulations is crucial, as any errors or omissions may lead to processing delays or issues with your refund. Utilizing a reliable eSigning platform can help ensure that your submission meets all legal requirements.

Filing Deadlines for IRS Form 8888

Filing deadlines for IRS Form 8888 align with the general tax filing deadlines. Typically, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to be aware of these deadlines to avoid penalties and ensure timely receipt of your refund.

Required Documents for IRS Form 8888

To complete IRS Form 8888, you will need several documents:

- Your completed tax return (Form 1040 or 1040-SR).

- Bank account information, including routing and account numbers.

- Any relevant tax documents that support your refund claim.

Having these documents on hand will streamline the completion process and help ensure accuracy.

Examples of Using IRS Form 8888

IRS Form 8888 can be used in various scenarios, such as:

- A taxpayer who wants to split their refund between a savings account and checking account.

- A person who wishes to allocate part of their refund to an IRA for retirement savings.

- Individuals who want to pay off debts by directing a portion of their refund to a creditor.

These examples illustrate the flexibility of the form in managing tax refunds effectively.

Quick guide on how to complete go to wwwirsgovform8888 internal revenue service

Prepare Go To Www irs govForm8888 Internal Revenue Service effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Go To Www irs govForm8888 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Go To Www irs govForm8888 Internal Revenue Service with ease

- Locate Go To Www irs govForm8888 Internal Revenue Service and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of misplaced or lost documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Go To Www irs govForm8888 Internal Revenue Service and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct go to wwwirsgovform8888 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the go to wwwirsgovform8888 internal revenue service

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the purpose of IRS Form 8888?

IRS Form 8888 is used to allocate your tax refund to multiple accounts, helping you manage your finances effectively. By utilizing the IRS for 8888, you can split your refund into checking and savings accounts, which can be particularly beneficial for budgeting.

-

How can airSlate SignNow help with IRS Form 8888?

airSlate SignNow simplifies the process of managing IRS Form 8888 by allowing you to eSign and send documents securely. This streamlining helps reduce errors and speeds up your refund allocation process with the IRS for 8888.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8888?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans provide access to a user-friendly platform that can handle documents like IRS Form 8888 efficiently without breaking the bank.

-

What features does airSlate SignNow offer for IRS documents?

airSlate SignNow provides features such as customizable templates, secure eSignatures, and real-time document tracking. These features ensure you can manage your IRS for 8888 efficiently while maintaining the integrity and confidentiality of your information.

-

Can airSlate SignNow integrate with other financial software for IRS Form 8888?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting software. This integration can streamline your workflow, making it easier to prepare and file your IRS for 8888 alongside your other financial documents.

-

What are the benefits of eSigning IRS Form 8888?

eSigning IRS Form 8888 with airSlate SignNow saves time and reduces paper waste. Additionally, the security features ensure that your information remains safe throughout the submission process, streamlining interactions with the IRS for 8888.

-

How can I ensure my IRS Form 8888 is submitted correctly?

Using airSlate SignNow’s document validation features can help ensure that your IRS Form 8888 is submitted correctly. By pre-filling details and tracking progress, you can minimize the risk of errors when dealing with the IRS for 8888.

Get more for Go To Www irs govForm8888 Internal Revenue Service

- Ease card north tyneside form

- Dairy nz milk smart workbook form

- Acc250 reimbursement of client travel expenses ancillary services client payments form

- Wine bottle forms

- 330 per dozen form

- Countertop order form

- Monthly bookkeeping engagement letter form

- Land titles form f cancellation of builders lien

Find out other Go To Www irs govForm8888 Internal Revenue Service

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement