About Form 8888, Allocation of Refund Including IRS Tax Forms 2022-2026

What is Form 8888?

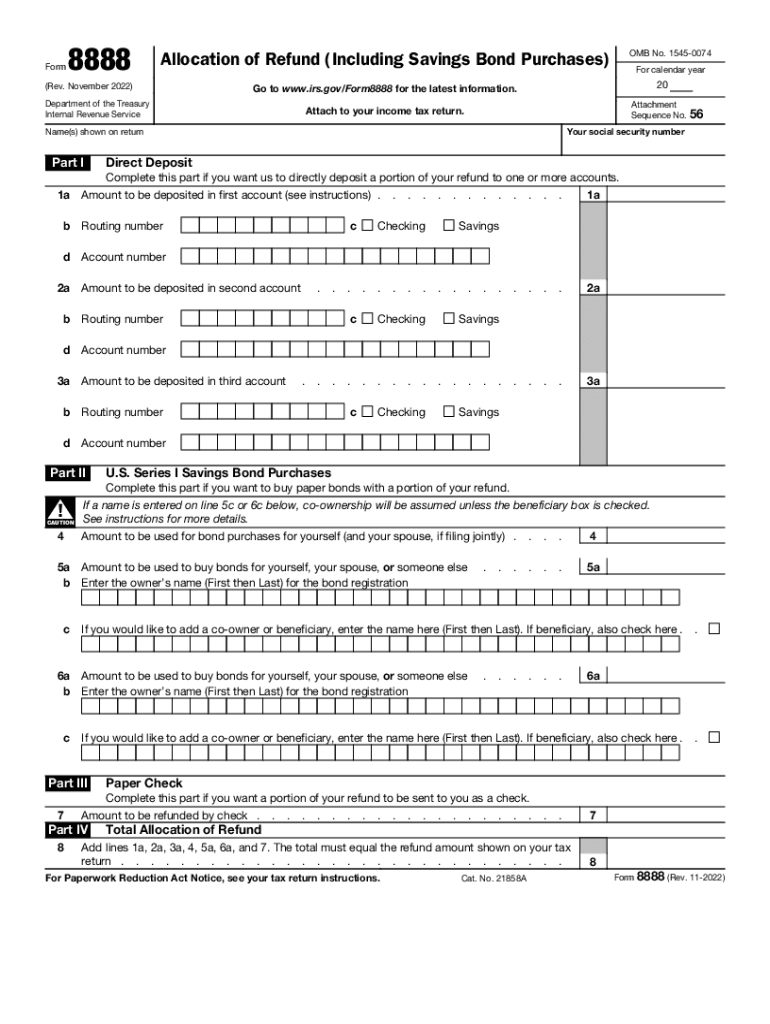

Form 8888, known as the Allocation of Refund, is an IRS tax form that allows taxpayers to specify how they want their tax refund distributed. This form is particularly useful for individuals who wish to allocate their refund into multiple accounts, such as checking and savings accounts, or to purchase U.S. savings bonds. By using Form 8888, taxpayers can manage their finances more effectively and ensure that their funds are directed according to their preferences.

How to Use Form 8888

Using Form 8888 involves filling out the form accurately to ensure the proper allocation of your tax refund. Taxpayers must provide their personal information, including name, address, and Social Security number. Additionally, they need to specify the amount to be deposited into each account or the amount to be used for purchasing savings bonds. It is essential to double-check all entries to avoid delays in processing. Once completed, the form should be attached to your tax return when filing.

Steps to Complete Form 8888

Completing Form 8888 involves several key steps:

- Gather your personal information, including your Social Security number and bank account details.

- Indicate the total refund amount and how you want it allocated among different accounts or bonds.

- Fill in the bank routing numbers and account numbers for direct deposits.

- Review the form for accuracy to prevent any processing issues.

- Attach the completed form to your tax return before submission.

Legal Use of Form 8888

Form 8888 is legally recognized as a valid means for taxpayers to allocate their refunds. To ensure compliance with IRS regulations, it is crucial to complete the form accurately and submit it alongside your tax return. The IRS accepts e-filed returns with Form 8888, which enhances the convenience of filing taxes digitally. Adhering to IRS guidelines ensures that your refund allocation is processed without complications.

Required Documents for Form 8888

To complete Form 8888, you will need several documents:

- Your completed tax return (Form 1040 or 1040-SR).

- Bank account information, including routing and account numbers.

- Any relevant documentation for purchasing savings bonds, if applicable.

Having these documents ready will streamline the process and help ensure that your refund is allocated correctly.

Filing Deadlines for Form 8888

Form 8888 must be submitted along with your tax return by the IRS filing deadline, typically April 15 for most taxpayers. If you are filing for an extension, ensure that you submit your return, including Form 8888, by the extended deadline. Timely submission is essential to receive your refund without unnecessary delays.

Quick guide on how to complete about form 8888 allocation of refund including irs tax forms

Complete About Form 8888, Allocation Of Refund Including IRS Tax Forms seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage About Form 8888, Allocation Of Refund Including IRS Tax Forms on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric task today.

How to modify and eSign About Form 8888, Allocation Of Refund Including IRS Tax Forms effortlessly

- Locate About Form 8888, Allocation Of Refund Including IRS Tax Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign About Form 8888, Allocation Of Refund Including IRS Tax Forms and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8888 allocation of refund including irs tax forms

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 8888?

airSlate SignNow is a robust eSigning solution that empowers businesses to send and eSign documents effortlessly. Its streamlined interface makes it easy for users to manage documents, making it a cost-effective choice for companies looking to enhance their workflow, especially those considering the 8888 plan for enhanced features.

-

What pricing options does airSlate SignNow offer under the 8888 plan?

Under the 8888 plan, airSlate SignNow provides competitive pricing that suits businesses of all sizes. This plan includes comprehensive features that support high-volume document signing, making it an attractive option for organizations looking for both quality and affordability.

-

What features are included in the 8888 plan of airSlate SignNow?

The 8888 plan of airSlate SignNow includes advanced features like team management, customized templates, and in-depth reporting analytics. These features are designed to enhance user experience and streamline document workflows for businesses aiming for efficiency and productivity.

-

How can businesses benefit from using airSlate SignNow's 8888 plan?

Businesses using the 8888 plan of airSlate SignNow can signNowly reduce the time spent on document processing. The solution allows for rapid eSigning and simplifies the document management process, leading to faster turnaround times and improved customer satisfaction.

-

Is airSlate SignNow compatible with other software applications under the 8888 plan?

Yes, airSlate SignNow offers seamless integrations with various software applications under its 8888 plan. This ensures that businesses can incorporate eSigning into their existing workflows, enhancing efficiency without disrupting their operations.

-

What customer support options are available for users of the 8888 plan?

Users of the 8888 plan will have access to comprehensive customer support options, including live chat, email, and extensive online resources. This ensures that any questions or issues can be quickly addressed, allowing businesses to maximize the benefits of airSlate SignNow.

-

Can I upgrade to the 8888 plan easily if I start with a basic plan?

Absolutely! Upgrading to the 8888 plan from a basic plan in airSlate SignNow is a straightforward process. Users can enjoy increased capabilities as their business grows without facing signNow disruptions in their current workflows.

Get more for About Form 8888, Allocation Of Refund Including IRS Tax Forms

- Nj lien 497319180 form

- Written request by owner to provide list mechanic liens individual new jersey form

- Quitclaim deed from individual to llc new jersey form

- Warranty deed from individual to llc new jersey form

- New jersey corporation 497319185 form

- Written request by contractor to provide list mechanic liens individual new jersey form

- New jersey mechanic form

- File lien form

Find out other About Form 8888, Allocation Of Refund Including IRS Tax Forms

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure