8888 Form 2010

What is the 8888 Form

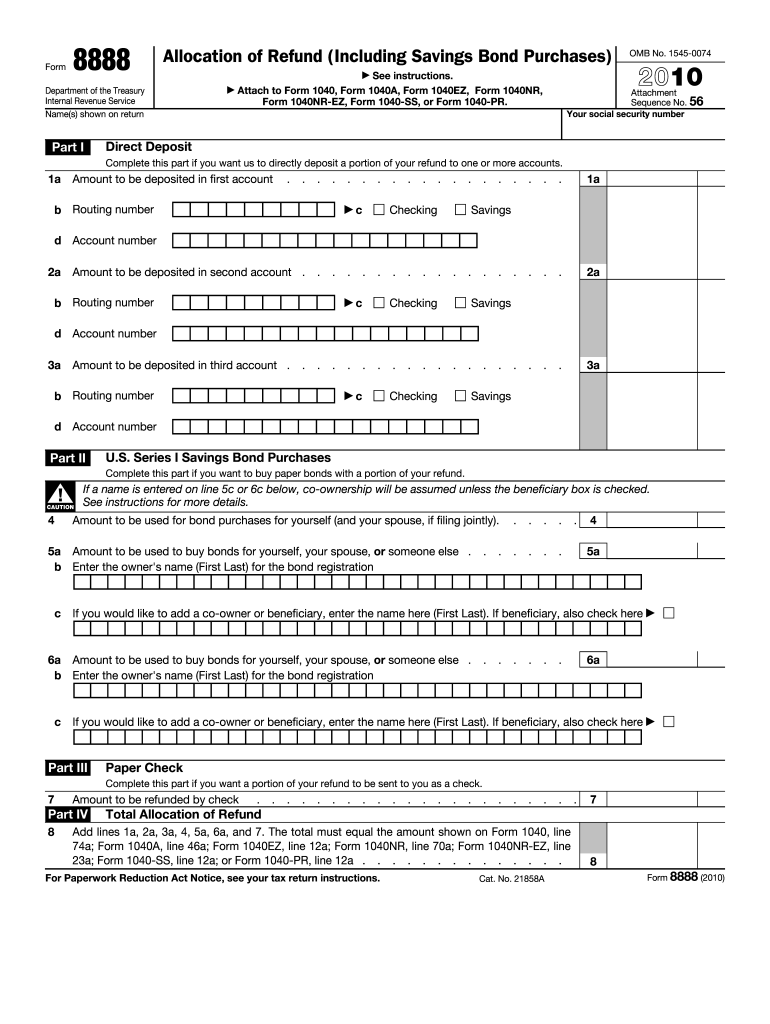

The 8888 Form, officially known as the "Allocation of Refund (Including Savings Bond Purchases)," is a document used by taxpayers in the United States to designate how their federal tax refunds should be allocated. This form allows individuals to specify multiple accounts or methods for receiving their refunds, including direct deposit into bank accounts or purchasing U.S. savings bonds. Understanding the purpose and functionality of the 8888 Form is crucial for ensuring that taxpayers can efficiently manage their refunds according to their financial needs.

How to use the 8888 Form

Using the 8888 Form involves a straightforward process that begins with obtaining the form from the IRS or a tax preparation service. Taxpayers should fill out the form by providing their personal information, including Social Security numbers and the amount of refund to be allocated. It is essential to indicate the specific amounts for each account or method chosen. After completing the form, it should be attached to the tax return when filing, ensuring that the IRS processes the refund allocations as specified.

Steps to complete the 8888 Form

Completing the 8888 Form involves several key steps:

- Obtain the 8888 Form from the IRS or an authorized tax service.

- Fill in personal details, including names, Social Security numbers, and filing status.

- Specify the total refund amount and how it should be divided among accounts or bonds.

- Double-check the information for accuracy to avoid processing delays.

- Attach the completed form to your tax return before submission.

Legal use of the 8888 Form

The 8888 Form is legally recognized as part of the tax filing process in the United States. It complies with IRS regulations, allowing taxpayers to allocate their refunds legally. To ensure legal use, it is important to complete the form accurately and submit it alongside the tax return by the deadline. Failure to comply with IRS guidelines may result in delays or issues with refund processing.

Filing Deadlines / Important Dates

Taxpayers must be aware of the important deadlines associated with the 8888 Form. The form should be submitted with the annual tax return, which is typically due on April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. Additionally, taxpayers should consider any state-specific deadlines that may apply to their filings.

Form Submission Methods (Online / Mail / In-Person)

The 8888 Form can be submitted through various methods, depending on how the taxpayer files their tax return. For those filing electronically, the form can be included in the e-filing process through compatible tax software. Alternatively, taxpayers can print the completed form and submit it by mail along with their paper tax return. In-person submissions may also be made at designated IRS offices, although this method is less common.

Required Documents

To complete the 8888 Form accurately, taxpayers should gather several key documents, including:

- Previous year’s tax return for reference.

- Bank account information for direct deposit, including routing and account numbers.

- Details of any U.S. savings bonds to be purchased.

Having these documents on hand will streamline the process and help ensure that all required information is accurately provided.

Quick guide on how to complete 2010 8888 form

Complete 8888 Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage 8888 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign 8888 Form with ease

- Locate 8888 Form and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign 8888 Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 8888 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 8888 form

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 8888 Form and how does it work?

The 8888 Form is a document that allows you to allocate your tax refund to multiple accounts or purchase U.S. savings bonds. With airSlate SignNow, you can easily fill out, sign, and send the 8888 Form electronically, ensuring a smooth and efficient submission process.

-

How much does it cost to use airSlate SignNow for the 8888 Form?

airSlate SignNow offers a variety of pricing plans that are designed to accommodate different business needs. Whether you need basic functionality for the 8888 Form or advanced features, you can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for completing the 8888 Form?

airSlate SignNow comes with features such as electronic signatures, document templates, and secure storage, all of which enhance the experience of filling out the 8888 Form. These tools simplify the process, allowing users to complete forms accurately and efficiently.

-

Can I use airSlate SignNow to integrate the 8888 Form with other applications?

Yes, airSlate SignNow allows integration with various applications, making it easy to manage your 8888 Form alongside other workflows. You can connect it with popular services like Google Drive, Dropbox, and more, ensuring seamless document management.

-

What are the benefits of using airSlate SignNow for the 8888 Form?

Using airSlate SignNow for the 8888 Form provides numerous benefits, including time-saving efficiencies and reduced errors. The platform's user-friendly interface helps you navigate the form quickly and allows for immediate digital signatures, optimizing your workflow.

-

Is airSlate SignNow secure for submitting the 8888 Form?

Absolutely, airSlate SignNow prioritizes security with bank-level encryption and secure data storage. When you submit the 8888 Form through the platform, you can trust that your personal information is protected against unauthorized access.

-

What support options are available for users of the 8888 Form in airSlate SignNow?

airSlate SignNow offers comprehensive support options for users needing assistance with the 8888 Form. You can signNow out through live chat, email support, or access extensive online resources and tutorials.

Get more for 8888 Form

- Construction contract cost plus or fixed fee idaho form

- Painting contract for contractor idaho form

- Trim carpenter contract for contractor idaho form

- Fencing contract for contractor idaho form

- Hvac contract for contractor idaho form

- Landscape contract for contractor idaho form

- Commercial contract for contractor idaho form

- Excavator contract for contractor idaho form

Find out other 8888 Form

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later