Irs Form 8888 2012

What is the IRS Form 8888

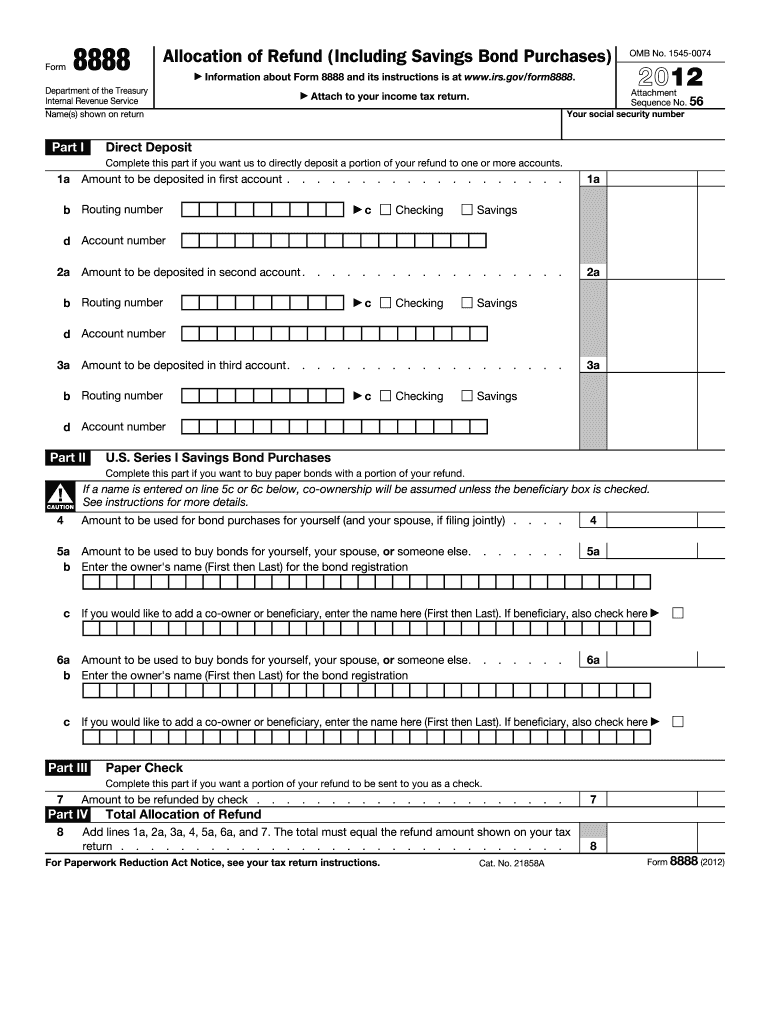

The IRS Form 8888, also known as the Allocation of Refund (Including Savings Bond Purchases), is a tax form used by individuals to direct how their federal tax refund should be allocated. Taxpayers can choose to split their refund into multiple accounts, purchase U.S. savings bonds, or deposit the funds into one account. This form is particularly useful for those who want to manage their finances more effectively by distributing their refunds across various savings or checking accounts.

How to use the IRS Form 8888

To use the IRS Form 8888, taxpayers must complete the form after filling out their federal tax return. The form requires information about the taxpayer's refund amount and the account details where the refund should be deposited. Taxpayers can specify up to three different accounts for direct deposit. Additionally, the form allows for the purchase of U.S. savings bonds, providing a secure investment option for a portion of the refund.

Steps to complete the IRS Form 8888

Completing the IRS Form 8888 involves several straightforward steps:

- Obtain the form from the IRS website or through tax preparation software.

- Fill in your name, Social Security number, and the amount of your refund.

- Indicate how you would like your refund allocated by providing bank account details or selecting savings bonds.

- Review the completed form for accuracy.

- Attach Form 8888 to your federal tax return before submitting it to the IRS.

Legal use of the IRS Form 8888

The IRS Form 8888 is legally recognized as a valid method for directing tax refunds. When filled out correctly, it ensures that the taxpayer's refund is allocated according to their preferences. Compliance with IRS regulations is essential, and taxpayers must ensure that the information provided is accurate to avoid delays or issues with their refunds.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the IRS Form 8888. Typically, the deadline for submitting federal tax returns, along with Form 8888, is April fifteen of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file on time to avoid penalties and ensure timely receipt of refunds.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 8888 can be submitted in several ways, depending on how the taxpayer files their federal tax return. For those using tax preparation software, the form can be submitted electronically along with the tax return. Alternatively, taxpayers can print the completed form and mail it to the IRS along with their paper tax return. In-person submission is typically not an option, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete 2012 irs form 8888

Complete Irs Form 8888 effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers a wonderful eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary formats and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your files quickly without delays. Manage Irs Form 8888 on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to modify and electronically sign Irs Form 8888 with ease

- Find Irs Form 8888 and click Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize important sections of your files or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Formulate your signature using the Sign feature, which takes only moments and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form: via email, text (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow manages all your document management needs within a few clicks from any device you prefer. Modify and electronically sign Irs Form 8888 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs form 8888

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs form 8888

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is IRS Form 8888?

IRS Form 8888 is a tax form used to direct the IRS to deposit your refund into multiple accounts. It provides taxpayers with a convenient way to manage their refunds from their tax returns effectively.

-

How can airSlate SignNow help with IRS Form 8888?

airSlate SignNow allows users to easily eSign and send IRS Form 8888 securely, ensuring that your tax documents are authenticated and processed faster. The platform streamlines document management, making it easier to handle your tax-related paperwork.

-

Are there any costs associated with using airSlate SignNow for IRS Form 8888?

Yes, airSlate SignNow offers various pricing plans to fit different needs. Depending on your requirements, you can choose a plan that suits your budget while enabling you to eSign IRS Form 8888 and other important documents.

-

What features does airSlate SignNow offer for managing IRS Form 8888?

airSlate SignNow offers features such as secure eSigning, document templates, and cloud storage. These tools make managing IRS Form 8888 easy and efficient, ensuring that you can quickly access and send your forms whenever needed.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 8888?

Absolutely! airSlate SignNow is designed to comply with IRS regulations, providing a secure platform for eSigning IRS Form 8888. Our commitment to compliance ensures that your tax documents are handled according to federal standards.

-

Can I integrate airSlate SignNow with other tax software for IRS Form 8888?

Yes, airSlate SignNow can integrate seamlessly with various accounting and tax software. This integration allows you to efficiently manage IRS Form 8888 alongside your other financial documents, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for IRS Form 8888?

Using airSlate SignNow for IRS Form 8888 allows for faster processing and a more streamlined experience in managing your taxes. The platform enhances collaboration and document tracking, ultimately saving you time and reducing errors.

Get more for Irs Form 8888

- Autonomic dysreflexia in spinal cord injury overview form

- Section 6378 exemption certificate form

- Request for non residential gas service e mail to form

- Douglas roy iii we care trust fund form

- Scva membership form southern california volleyball association scvavolleyball

- Tinyurl com shsphysicals form

- 170501 experience standards english in revision form

- Application for permit facilities amp parks form

Find out other Irs Form 8888

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document