Form W 3 Transmittal of Wage and Tax Statements 2020

What makes the 2021 form w 3 transmittal of wage and tax statements legally binding?

As the society takes a step away from in-office working conditions, the execution of documents more and more takes place online. The 2021 form w 3 transmittal of wage and tax statements isn’t an exception. Working with it using electronic tools differs from doing this in the physical world.

An eDocument can be viewed as legally binding provided that certain requirements are satisfied. They are especially vital when it comes to stipulations and signatures associated with them. Typing in your initials or full name alone will not guarantee that the organization requesting the sample or a court would consider it accomplished. You need a trustworthy solution, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your 2021 form w 3 transmittal of wage and tax statements when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make document execution legal and secure. In addition, it gives a lot of opportunities for smooth completion security wise. Let's quickly run through them so that you can be certain that your 2021 form w 3 transmittal of wage and tax statements remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Dual-factor authentication: adds an extra layer of protection and validates other parties' identities via additional means, like an SMS or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data safely to the servers.

Filling out the 2021 form w 3 transmittal of wage and tax statements with airSlate SignNow will give greater confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete 2021 form w 3 transmittal of wage and tax statements

Complete Form W 3 Transmittal Of Wage And Tax Statements seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form W 3 Transmittal Of Wage And Tax Statements on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign Form W 3 Transmittal Of Wage And Tax Statements effortlessly

- Obtain Form W 3 Transmittal Of Wage And Tax Statements and select Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you would like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 3 Transmittal Of Wage And Tax Statements and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form w 3 transmittal of wage and tax statements

Create this form in 5 minutes!

How to create an eSignature for the 2021 form w 3 transmittal of wage and tax statements

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an e-signature for a PDF file on Android devices

People also ask

-

How do I get a copy of my w3?

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS' Online Ordering for Information Returns and Employer Returns page, or visit .irs.gov/orderforms and click on Employer and Information returns.

-

How can I get a copy of my W3 form?

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS' Online Ordering for Information Returns and Employer Returns page, or visit .irs.gov/orderforms and click on Employer and Information returns.

-

What is a w1?

Form W-1 is a tax form used by employers who are required to withhold Occupational License Fees/Taxes from gross salaries, wages, commissions, and other forms of compensation earned by employees for work performed within Louisville/Jefferson County, Kentucky.

-

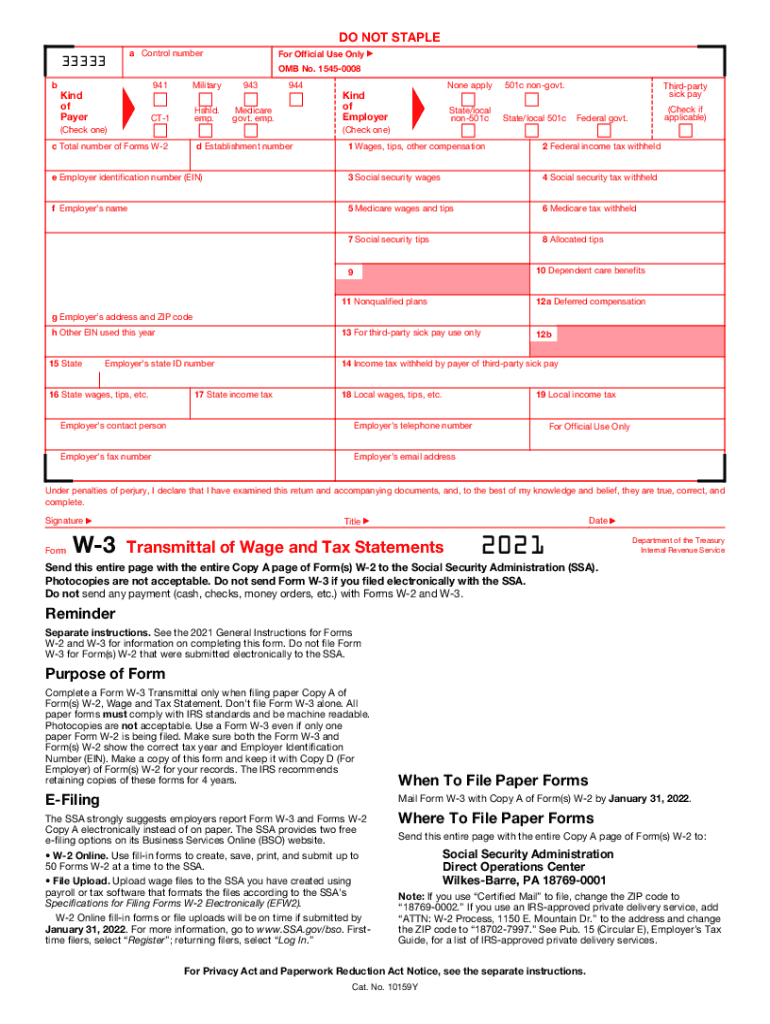

What is IRS form w3 used for?

Use Form W-3 to transmit Copy A of Forms W-2.

-

Why can't I print my tax forms?

If you're unable to print out a form, it's because the form isn't ready to be filed yet. The form isn't ready for one of the following reasons: The IRS (for federal returns) or your state (for state returns) is still working on finalizing the form.

-

Who provides W3?

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

-

What is a 1096 for?

Use Form 1096 to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service. Do not use this form to transmit electronically. For electronic submissions, see Publication 1220, Specifications for Filing Forms 1097, 1098, 1099, 3921, 3922, 5498, 8935, and W-2G ElectronicallyPDF.

-

What are w3 wages?

A W-3 form, also called the Transmittal of Wage and Tax Statements form, is a summary of all of a business' employee wages and contributions for the previous tax year. This form is sent to the Social Security Administration(SSA) for proper filing.

-

Can you print out tax forms?

We accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. This policy includes forms printed from IRS.gov and output on high-quality devices such as laser or ink-jet printers, unless otherwise specified on the form itself.

-

Where is my W3 in QuickBooks desktop?

To print W3 in QuickBooks Desktop Payroll Enhanced and Standard you have to follow the steps that are mentioned below: First, You have to go to the Employees option. Then you have to choose Payroll Tax Forms and W-2s option. After that, You have to click on the Process Payroll Forms option.

-

What is W3 online?

A W-3 form, also called the Transmittal of Wage and Tax Statements form, is a summary of all of a business' employee wages and contributions for the previous tax year. This form is sent to the Social Security Administration(SSA) for proper filing.

-

What is the difference between a W-2 and a w3?

The difference between Form W-2 and Form W-3 is the person(s) who complete the forms. Employees are required to complete Form W-2 while employers are responsible for completing Form W-3. Employers must file both W-2 and W-3 forms with the Social Security Administration by January 31 of every year.

-

What is a W3 Wage statement?

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

-

What is w3 used for?

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

-

Can you print out 2021 tax forms?

We accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. This policy includes forms printed from IRS.gov and output on high-quality devices such as laser or ink-jet printers, unless otherwise specified on the form itself.

-

Can I print my t4 from CRA account?

Getting your T4E Your T4E is available as early as February 1 through My Service Canada Account (MSCA). You can view, print and submit a copy of it with your Canada Revenue Agency (CRA) tax return. To access your T4E online, you need to log in or register for MSCA. You can also get your T4E by mail.

-

What is Transmittal of Wage and tax Statements?

Forms W-2 are sent to Social Security along with a Form W-3 (Transmittal of Income and Tax Statements). Employers are required to file a Form W-2 for wages paid to each employee from whom: Income, Social Security, or Medicare taxes were withheld, or.

-

How to print Canada government forms?

All of the forms on our website are PDF (portable document format), unless otherwise indicated. To view and print these forms, your computer must be equipped with signNow® Acrobat® Reader™ (Version 4.05 or higher). You can download this product free of charge from the signNow website.

-

How do I pull my W3 from QBO?

Select Taxes, then Payroll Tax. Select Filings. Select Resources. Select Archived forms and filings. Select the date range you need, or search the forms you need. Select View on the W-2 or W-3 form you want to print. Select the print icon on the Reader toolbar. Then select Print again.

-

Where can I get tax forms Canada 2021?

view, download and print the package at canada.ca/taxes-general-package. order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

Get more for Form W 3 Transmittal Of Wage And Tax Statements

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property hawaii form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497304441 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property hawaii form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential hawaii form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property hawaii form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property hawaii form

- Hi landlord 497304447 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497304449 form

Find out other Form W 3 Transmittal Of Wage And Tax Statements

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free