Form 14039 Rev 9 Identity Theft Affidavit 2021

What is the Form 14039 Identity Theft Affidavit

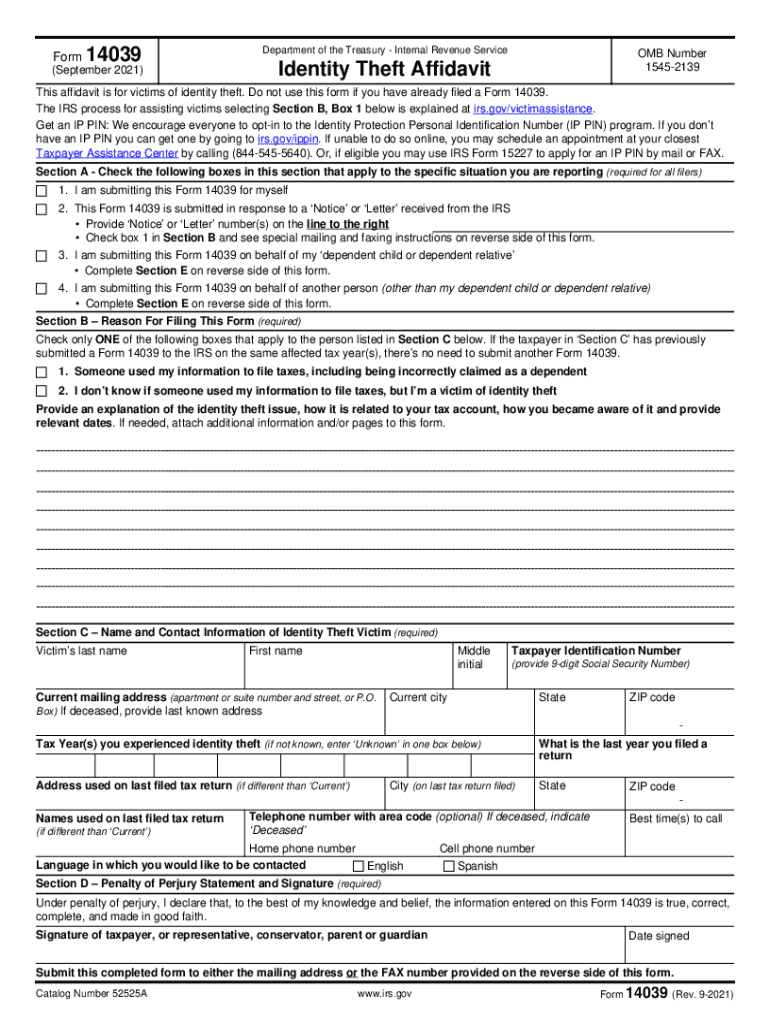

The Form 14039, also known as the Identity Theft Affidavit, is a crucial document issued by the IRS for individuals who suspect that their personal information has been misused for tax-related purposes. This form serves as a formal declaration that the taxpayer has been a victim of identity theft, which may have resulted in fraudulent tax returns being filed in their name. By submitting this affidavit, individuals can initiate the process of rectifying their tax records and protecting themselves from further identity theft issues.

Steps to Complete the Form 14039 Identity Theft Affidavit

Completing the Form 14039 requires careful attention to detail to ensure accuracy and compliance with IRS guidelines. Here are the key steps to follow:

- Begin by downloading the Form 14039 from the IRS website or accessing it through the idverify irs gov website.

- Provide your personal information, including your name, address, and Social Security number, in the designated fields.

- Indicate the nature of the identity theft by checking the appropriate boxes that describe your situation.

- Include any relevant documentation that supports your claim, such as a copy of the police report or any correspondence from the IRS regarding the identity theft.

- Sign and date the form to certify that the information provided is accurate and complete.

- Submit the completed form to the IRS as instructed, either by mail or electronically.

Legal Use of the Form 14039 Identity Theft Affidavit

The Form 14039 is legally recognized as a formal declaration of identity theft. When completed and submitted correctly, it allows the IRS to take necessary actions to protect the taxpayer's account and rectify any fraudulent activity. This affidavit is essential for individuals seeking to establish their identity and reclaim their tax records. It is important to ensure that all information provided is truthful and supported by appropriate documentation to avoid potential legal repercussions.

Required Documents for Form 14039 Submission

When submitting the Form 14039, certain documents may be required to substantiate your claim of identity theft. These may include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Any correspondence from the IRS indicating potential identity theft, such as a notice regarding a suspicious tax return.

- A police report documenting the identity theft incident, if applicable.

- Any other relevant documentation that supports your identity theft claim.

IRS Guidelines for Identity Theft Victims

The IRS provides specific guidelines for individuals who believe they are victims of identity theft. These guidelines include steps for reporting the theft, completing the Form 14039, and protecting your personal information moving forward. It is crucial to follow these guidelines closely to ensure that your claim is processed efficiently and that you receive the necessary assistance from the IRS. Familiarizing yourself with these guidelines can help streamline the resolution process and safeguard your identity.

Filing Deadlines for Form 14039

Understanding the filing deadlines associated with the Form 14039 is essential for timely resolution of identity theft issues. Generally, it is advisable to submit the form as soon as you suspect identity theft to prevent further complications with your tax records. The IRS may have specific deadlines for submitting the form based on your tax situation, so it is important to stay informed about any relevant timelines to ensure compliance and expedite the process.

Quick guide on how to complete form 14039 rev 9 2021 identity theft affidavit

Complete Form 14039 Rev 9 Identity Theft Affidavit effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 14039 Rev 9 Identity Theft Affidavit on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 14039 Rev 9 Identity Theft Affidavit with ease

- Obtain Form 14039 Rev 9 Identity Theft Affidavit and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically supplied by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Form 14039 Rev 9 Identity Theft Affidavit and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14039 rev 9 2021 identity theft affidavit

Create this form in 5 minutes!

How to create an eSignature for the form 14039 rev 9 2021 identity theft affidavit

The way to create an e-signature for a PDF file in the online mode

The way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is IRS identity verification?

IRS identity verification involves confirming your identity with the IRS for purposes such as tax filing or accessing tax-related services. It typically requires providing personal information to ensure security and prevent fraud. Understanding the IRS identity verification process is crucial for individuals and businesses in managing tax-related documentation.

-

How does airSlate SignNow support IRS identity verification?

AirSlate SignNow offers secure eSignature solutions that can simplify the IRS identity verification process. By allowing users to electronically sign and send necessary documents, it streamlines communication with the IRS. This efficiency saves time and reduces the likelihood of errors during identity verification.

-

Is there a cost associated with using airSlate SignNow for IRS identity verification?

AirSlate SignNow provides various pricing plans, making it cost-effective for businesses needing IRS identity verification services. Depending on your requirements, you can choose from different tiers to find the most suitable option. Each plan delivers robust features to assist with efficient document handling.

-

What features does airSlate SignNow offer to aid in IRS identity verification?

AirSlate SignNow includes features such as secure electronic signatures, document templates, and workflow automation, which enhance the IRS identity verification process. These tools help ensure that users can easily gather the needed signatures and approvals necessary for verification. Additionally, audit trails provide transparency and traceability.

-

Can airSlate SignNow integrate with other software for IRS identity verification?

Yes, airSlate SignNow integrates seamlessly with various software applications, which can enhance the IRS identity verification process. Whether you use CRM systems, cloud storage, or accounting platforms, integration allows for smooth data exchange and document management. This flexibility improves overall efficiency when handling sensitive documents.

-

What are the benefits of using airSlate SignNow for IRS identity verification?

Using airSlate SignNow for IRS identity verification offers multiple benefits, including improved document security and faster processing times. The platform ensures compliance with IRS regulations while allowing businesses to maintain a high level of customer service. Additionally, users can enjoy a user-friendly interface that simplifies document management.

-

How does airSlate SignNow ensure the security of IRS identity verification documents?

AirSlate SignNow prioritizes document security, particularly for sensitive IRS identity verification processes. The platform employs advanced encryption and secure data storage practices to protect information. Ensuring compliance with privacy laws, airSlate SignNow actively safeguards client data throughout the verification process.

Get more for Form 14039 Rev 9 Identity Theft Affidavit

- Mutual wills containing last will and testaments for unmarried persons living together with no children idaho form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children idaho form

- Mutual wills or last will and testaments for unmarried persons living together with minor children idaho form

- Non marital cohabitation living together agreement idaho form

- Paternity law and procedure handbook idaho form

- Bill of sale in connection with sale of business by individual or corporate seller idaho form

- Office lease agreement idaho form

- Commercial sublease idaho form

Find out other Form 14039 Rev 9 Identity Theft Affidavit

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe