Irs Form 14039 2016

What is the Irs Form 14039

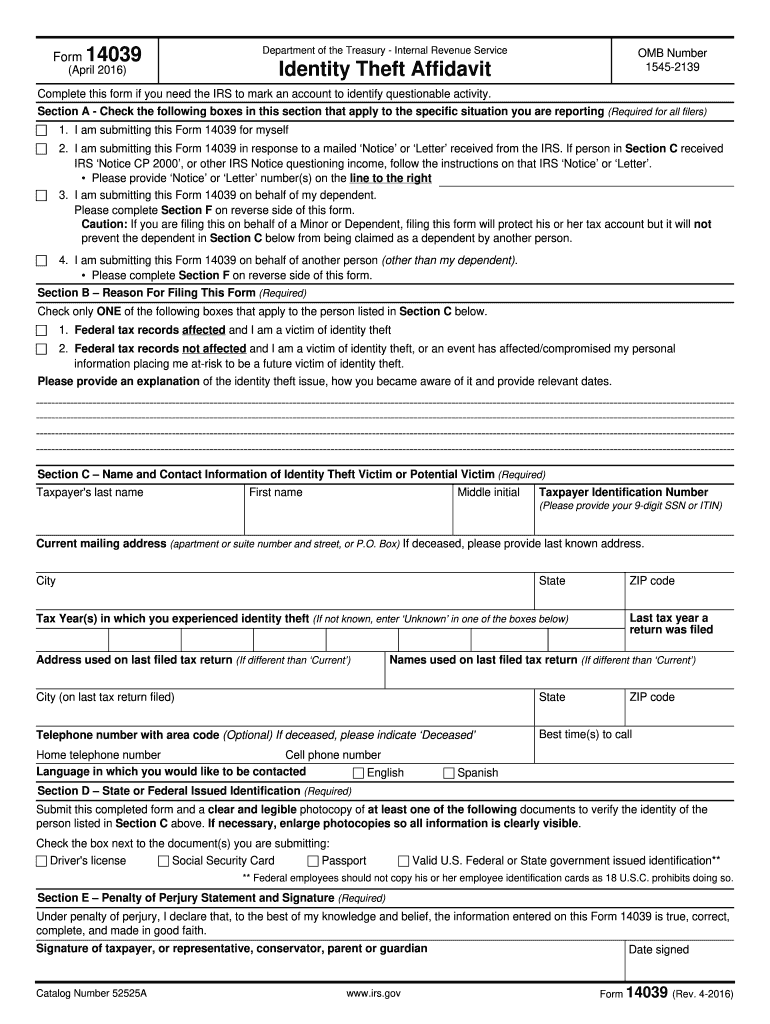

The IRS Form 14039, also known as the Identity Theft Affidavit, is a document used by individuals who believe they are victims of identity theft related to their tax records. This form allows taxpayers to report the misuse of their Social Security number and helps the IRS take action to protect their tax information. By filing this form, individuals can alert the IRS to potential fraudulent activity and request assistance in resolving any issues that may arise from identity theft.

How to use the Irs Form 14039

Using the IRS Form 14039 involves several steps to ensure that the information is accurately reported. First, individuals should gather any relevant documentation that supports their claim of identity theft. This includes any notices received from the IRS regarding suspicious activity. Next, fill out the form by providing personal information, including your name, address, and Social Security number, as well as details about the identity theft incident. Once completed, submit the form to the IRS as instructed, either by mail or electronically, depending on the situation.

Steps to complete the Irs Form 14039

Completing the IRS Form 14039 requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or obtain a physical copy.

- Provide your personal information, including your name, address, and Social Security number.

- Detail the circumstances of the identity theft, including how you discovered it and any relevant dates.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS, following the specific submission guidelines outlined in the form instructions.

Legal use of the Irs Form 14039

The IRS Form 14039 serves a vital legal purpose by allowing individuals to formally report identity theft to the IRS. This form is a critical step in protecting oneself from further financial harm and ensuring that the IRS can investigate fraudulent claims made in the victim's name. Legal use of this form includes submitting it promptly after discovering identity theft and providing accurate information to facilitate the IRS's response.

Key elements of the Irs Form 14039

Several key elements are essential when filling out the IRS Form 14039:

- Personal Information: Accurate details about the taxpayer, including name, address, and Social Security number.

- Details of Identity Theft: A description of how the identity theft occurred and any supporting documentation.

- Signature: The form must be signed by the individual reporting the identity theft to validate the claim.

- Submission Method: Clear instructions on how to submit the form, either by mail or electronically.

Form Submission Methods

The IRS Form 14039 can be submitted through various methods. Taxpayers can mail the completed form to the address specified in the form instructions. Alternatively, if filing electronically, individuals may need to follow specific procedures outlined by the IRS for secure submission. It is important to ensure that the form is sent to the correct address or submitted through the appropriate electronic channels to avoid delays in processing.

Quick guide on how to complete irs form 14039 2016

Effortlessly Prepare Irs Form 14039 on Any Device

Digital document management has gained popularity among companies and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Irs Form 14039 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Irs Form 14039 Smoothly

- Obtain Irs Form 14039 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, monotonous form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Irs Form 14039 and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 14039 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form 14039 2016

How to create an electronic signature for your Irs Form 14039 2016 in the online mode

How to generate an electronic signature for the Irs Form 14039 2016 in Google Chrome

How to make an electronic signature for putting it on the Irs Form 14039 2016 in Gmail

How to make an electronic signature for the Irs Form 14039 2016 straight from your smart phone

How to generate an electronic signature for the Irs Form 14039 2016 on iOS

How to make an electronic signature for the Irs Form 14039 2016 on Android

People also ask

-

What is IRS Form 14039 and when should I use it?

IRS Form 14039, also known as the Identity Theft Affidavit, is used to report cases of identity theft related to tax matters. If you believe your personal information has been compromised and is being used to file fraudulent tax returns, you should complete IRS Form 14039. Submitting this form can help protect you from further identity theft issues and assist the IRS in resolving your tax account.

-

How can airSlate SignNow help with the filing of IRS Form 14039?

With airSlate SignNow, you can easily create, send, and eSign IRS Form 14039. Our platform streamlines the document management process, making it simple to fill out the form digitally and securely send it to the IRS or relevant parties. This saves you time and ensures that your information is handled efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Form 14039?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. Our plans are cost-effective and designed to provide value, especially for those frequently handling documents such as IRS Form 14039. Check our website for detailed pricing information and choose the plan that fits your requirements.

-

What features does airSlate SignNow offer for eSigning IRS Form 14039?

airSlate SignNow provides a robust set of features for eSigning IRS Form 14039, including a user-friendly interface, secure signing options, and real-time tracking. You can invite others to sign the form electronically, ensuring a quick turnaround while maintaining compliance with legal standards. This makes managing tax-related documents much easier.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 14039?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage IRS Form 14039 alongside other essential business tools. Whether you're using CRM systems or cloud storage services, our platform can connect with them to enhance your document workflow.

-

What are the benefits of using airSlate SignNow for IRS Form 14039 compared to traditional methods?

Using airSlate SignNow for IRS Form 14039 offers signNow advantages over traditional methods, including improved efficiency and security. You can complete and send the form digitally, reducing the risk of lost documents and minimizing processing time. Additionally, the platform ensures that your data is protected with advanced security features.

-

Is airSlate SignNow compliant with IRS standards for eSigning IRS Form 14039?

Yes, airSlate SignNow is fully compliant with IRS standards for electronic signatures, ensuring that your eSigned IRS Form 14039 meets all necessary legal requirements. Our platform uses industry-standard encryption and authentication methods to provide a secure signing experience that you can trust.

Get more for Irs Form 14039

Find out other Irs Form 14039

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast