Form 14039 Rev 12 Identity Theft Affidavit 2020

What is the IRS Form 14039 Identity Theft Affidavit?

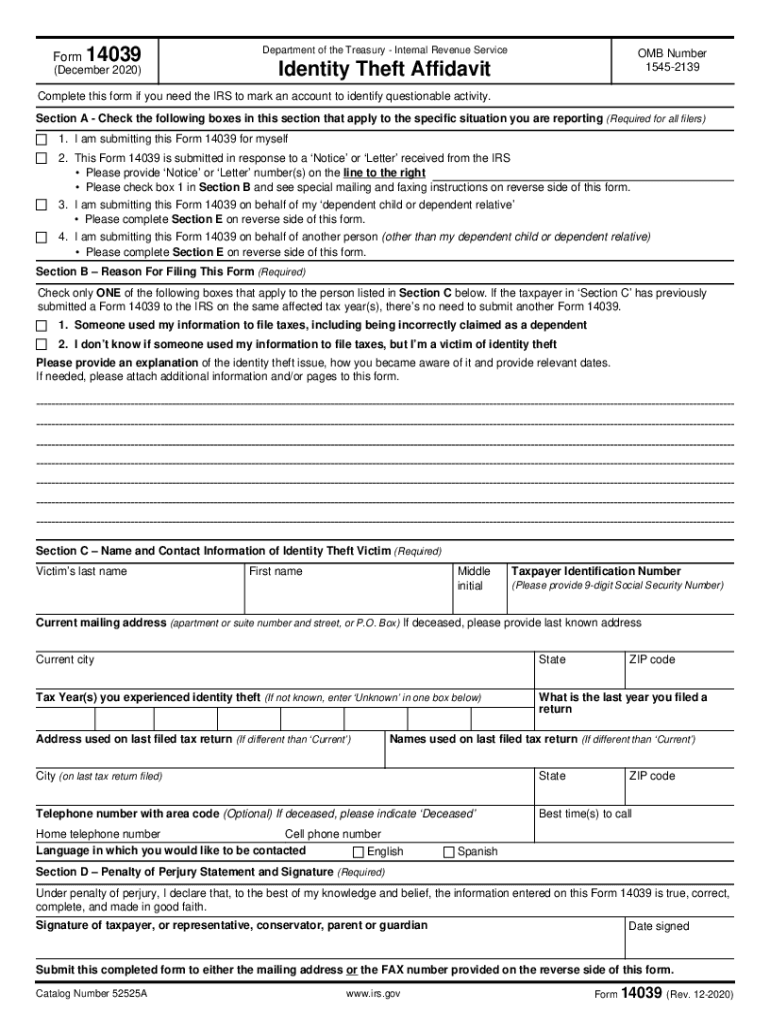

The IRS Form 14039, known as the Identity Theft Affidavit, is a crucial document designed to assist taxpayers who believe they have been victims of identity theft. This form allows individuals to report instances where their personal information has been used fraudulently to file tax returns or obtain refunds. By submitting this affidavit, taxpayers can alert the IRS about the misuse of their identity and help protect themselves from further financial harm.

How to Use the IRS Form 14039 Identity Theft Affidavit

Using the IRS Form 14039 is a straightforward process. Taxpayers should first confirm that they are indeed victims of identity theft. Once confirmed, they can obtain the form from the IRS website or other official sources. After filling out the necessary information, the completed form should be submitted to the IRS alongside any supporting documentation that can verify the identity theft claim. This may include police reports or other relevant evidence. It's essential to keep copies of all submitted documents for personal records.

Steps to Complete the IRS Form 14039 Identity Theft Affidavit

Completing the IRS Form 14039 involves several key steps:

- Begin by downloading the form from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding the identity theft, including how you discovered it and any fraudulent activity associated with your identity.

- Sign and date the affidavit to certify that the information provided is accurate.

- Submit the completed form to the IRS, along with any required documentation.

Legal Use of the IRS Form 14039 Identity Theft Affidavit

The IRS Form 14039 is legally recognized as a valid means of reporting identity theft to the IRS. When filled out correctly, it serves as an official declaration of identity theft, which can help protect taxpayers from liability for fraudulent tax returns filed in their name. The form must be submitted in accordance with IRS guidelines to ensure that it is processed effectively. Compliance with these guidelines is essential for the affidavit to be considered valid and actionable.

Filing Deadlines / Important Dates

When dealing with identity theft and the IRS Form 14039, it is crucial to be aware of any filing deadlines. Generally, taxpayers should submit the form as soon as they suspect identity theft has occurred. Delaying the submission may complicate the resolution process. Additionally, it is important to monitor any IRS communications regarding the status of the affidavit and any further actions required to protect one’s identity.

Required Documents

To support the IRS Form 14039, taxpayers may need to provide several documents. These can include:

- A copy of the police report documenting the identity theft.

- Any correspondence from the IRS regarding fraudulent activity.

- Proof of identity, such as a driver’s license or Social Security card.

Having these documents ready can expedite the process and enhance the credibility of the identity theft claim.

Who Issues the IRS Form 14039?

The IRS Form 14039 is issued by the Internal Revenue Service, the U.S. government agency responsible for tax collection and tax law enforcement. The form is specifically designed to help taxpayers report identity theft incidents, ensuring that the IRS can take appropriate measures to investigate and resolve these issues. It is important for taxpayers to use the official form directly from the IRS to ensure compliance with legal requirements.

Quick guide on how to complete form 14039 rev 12 2020 identity theft affidavit

Prepare Form 14039 Rev 12 Identity Theft Affidavit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Handle Form 14039 Rev 12 Identity Theft Affidavit on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form 14039 Rev 12 Identity Theft Affidavit with ease

- Obtain Form 14039 Rev 12 Identity Theft Affidavit and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 14039 Rev 12 Identity Theft Affidavit and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14039 rev 12 2020 identity theft affidavit

Create this form in 5 minutes!

How to create an eSignature for the form 14039 rev 12 2020 identity theft affidavit

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is IRS form 10439, and why do I need it?

IRS form 10439 is a document used for various tax-related purposes, primarily involving reports and statements required by the IRS. Understanding this form is essential for businesses and individuals who wish to remain compliant with tax regulations. airSlate SignNow simplifies the process of signing and submitting IRS form 10439 electronically.

-

How does airSlate SignNow help with IRS form 10439?

airSlate SignNow allows users to easily eSign and manage IRS form 10439 along with other essential tax documents. Our platform streamlines the document workflow, ensuring that you can quickly and securely send IRS form 10439 to clients or partners. With our user-friendly interface, managing this form has never been easier.

-

What is the pricing model for airSlate SignNow, especially for IRS form 10439?

airSlate SignNow offers flexible pricing plans, allowing users to select the option that best fits their needs. Our pricing ensures that you can efficiently manage IRS form 10439 and other documents at a cost-effective rate. We also provide discounts for annual subscriptions, making it budget-friendly for regular users.

-

Are there any integrations available for IRS form 10439?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing the ability to manage IRS form 10439 and other documents. Popular integrations include CRM systems, cloud storage solutions, and project management tools. These integrations help you streamline your workflow and keep everything organized in one place.

-

Can I customize the templates for IRS form 10439 in airSlate SignNow?

Absolutely! airSlate SignNow offers customizable templates that allow you to modify IRS form 10439 to fit your specific needs. You can add your branding, adjust the fields, and include any necessary instructions for signers. This feature ensures that your documents maintain professionalism while meeting compliance requirements.

-

What security measures are in place when using airSlate SignNow for IRS form 10439?

Security is a top priority at airSlate SignNow. When managing IRS form 10439, your data is protected with bank-level encryption, secure access controls, and regular security audits. This robust protection ensures that your sensitive information remains confidential and secure during the signing process.

-

Is it easy to track the status of IRS form 10439 in airSlate SignNow?

Yes, tracking the status of IRS form 10439 is straightforward with airSlate SignNow. Our platform provides real-time updates and notifications, so you can always know where your document stands in the signing process. This feature helps businesses keep their workflow efficient and ensures that important deadlines are met.

Get more for Form 14039 Rev 12 Identity Theft Affidavit

- Upsc daf sample pdf download form

- Covering letter for caste validity form

- Birth certificate application form pdf

- Budget planner spreadsheet form

- Apply canada child benefit ccb canadaca form

- Ani at kita rsbsa enrollment form 607697154

- Civ 792 request for hearing to vacate ex parte order form

- Dl 135 disposition order institutional commitment form

Find out other Form 14039 Rev 12 Identity Theft Affidavit

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online