Federal U S Income Tax Return for Homeowners Associations 2021

What is the Federal U S Income Tax Return For Homeowners Associations

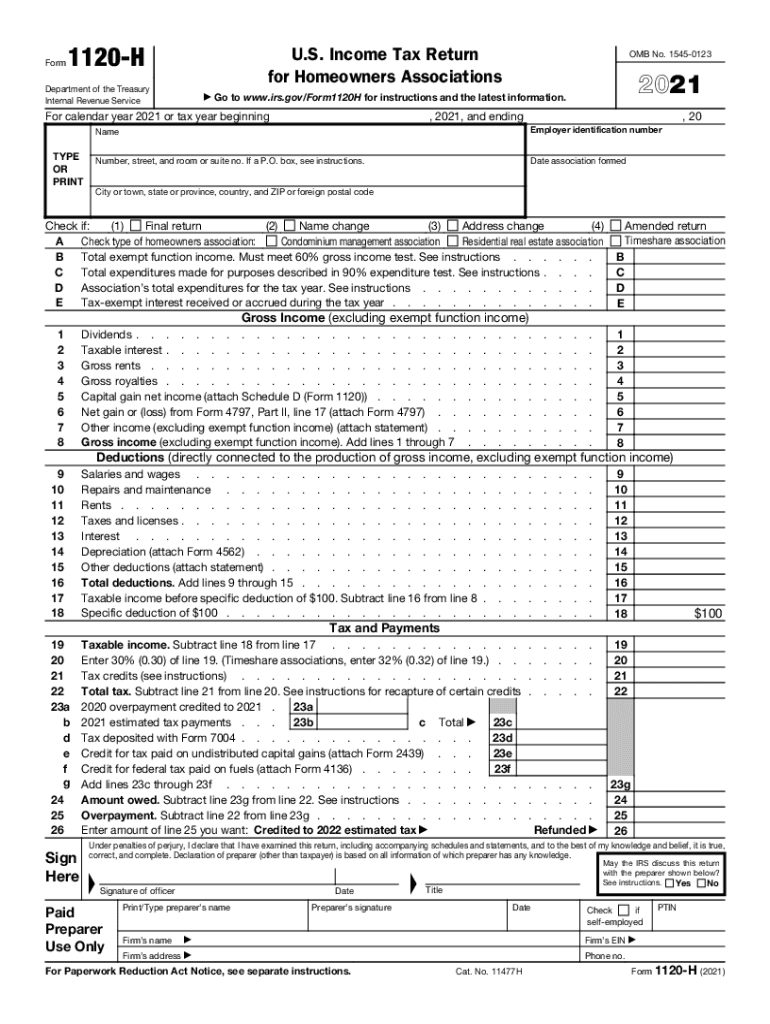

The 2-H form is specifically designed for homeowners associations (HOAs) in the United States to report their income, deductions, and tax liabilities. This form is a simplified version of the standard corporate tax return and is tailored for associations that meet certain criteria. Homeowners associations typically manage common areas and amenities within residential communities, and they often collect dues from members to fund these activities. The 1120-H form allows these organizations to report their financial activities and ensure compliance with federal tax regulations.

How to use the Federal U S Income Tax Return For Homeowners Associations

Using the 2-H form involves several steps to ensure accurate reporting. First, associations must gather all relevant financial information, including income from dues, assessments, and any other revenue sources. Next, they should compile a list of allowable deductions, which may include maintenance costs, utilities, and administrative expenses. Once this information is collected, associations can fill out the form, ensuring that all figures are accurate and reflect their financial activities for the tax year. After completing the form, it must be submitted to the IRS by the designated deadline.

Steps to complete the Federal U S Income Tax Return For Homeowners Associations

Completing the 2-H form requires a systematic approach:

- Gather financial records, including income statements and expense reports.

- Calculate total income from all sources, including member dues and fees.

- Identify and document allowable deductions, such as maintenance and operational costs.

- Fill out the 1120-H form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the appropriate deadline.

Filing Deadlines / Important Dates

For homeowners associations using the 2-H form, it is essential to be aware of filing deadlines. Typically, the form is due on the fifteenth day of the third month after the end of the association's tax year. For associations operating on a calendar year, this means the form must be filed by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Associations may also request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To accurately complete the 2-H form, homeowners associations need to gather specific documents:

- Income statements detailing revenue from member dues and other sources.

- Expense reports documenting allowable deductions.

- Previous tax returns, if applicable, for reference.

- Bank statements to verify income and expenses.

IRS Guidelines

The IRS provides specific guidelines for completing the 2-H form. Associations must ensure they meet the eligibility criteria, which includes being organized as a homeowners association and primarily collecting dues for the maintenance of common areas. The IRS also outlines the types of income that can be reported and the deductions that can be claimed. Adhering to these guidelines is crucial for compliance and to avoid potential audits or penalties.

Quick guide on how to complete federal us income tax return for homeowners associations

Prepare Federal U S Income Tax Return For Homeowners Associations with ease on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Manage Federal U S Income Tax Return For Homeowners Associations on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Federal U S Income Tax Return For Homeowners Associations effortlessly

- Find Federal U S Income Tax Return For Homeowners Associations and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Federal U S Income Tax Return For Homeowners Associations to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal us income tax return for homeowners associations

Create this form in 5 minutes!

How to create an eSignature for the federal us income tax return for homeowners associations

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2012 1120 h form and why is it important?

The 2012 1120 h form is the tax form used by homeowners associations to report their income, expenses, and specific financial conditions. It's essential for compliance with IRS regulations, ensuring that your association is recognized as a tax-exempt entity. Understanding how to accurately fill out this form helps maintain your association's financial health.

-

How can airSlate SignNow assist with filling out the 2012 1120 h?

airSlate SignNow streamlines the process of completing the 2012 1120 h by allowing users to fill out forms electronically and save them securely. With our intuitive interface and easy-to-use tools, you can efficiently edit, sign, and share your forms, ensuring a smoother filing process with less paperwork.

-

What features does airSlate SignNow offer for managing the 2012 1120 h form?

airSlate SignNow offers features like templates, cloud storage, and electronic signatures to simplify managing the 2012 1120 h form. You can customize templates to fit your association's specific needs, ensuring that every detail is captured accurately. Additionally, the platform allows for real-time collaboration, enhancing the efficiency of document preparation.

-

Is airSlate SignNow a cost-effective solution for handling the 2012 1120 h?

Yes, airSlate SignNow is known for being a cost-effective solution for document management, including the 2012 1120 h form. Our flexible pricing plans cater to businesses of all sizes, making it easy for associations to access powerful tools without stretching their budgets. This results in long-term savings for your organization.

-

Can I integrate airSlate SignNow with other accounting software for filing the 2012 1120 h?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, enhancing your experience while working on the 2012 1120 h form. This integration allows for direct data import and export, minimizing manual input and reducing errors, which streamlines your financial reporting process.

-

What are the benefits of using airSlate SignNow for the 2012 1120 h compared to traditional methods?

Using airSlate SignNow for the 2012 1120 h provides numerous benefits compared to traditional paper methods, including speed, accuracy, and convenience. Digital signatures eliminate the need for physical printing and mailing, making the process faster and more efficient. Furthermore, our platform helps ensure that all documents are securely stored and easily accessible.

-

How secure is airSlate SignNow when handling sensitive information related to the 2012 1120 h?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information such as the 2012 1120 h form. Our platform employs advanced encryption and security protocols to protect your data while in transit and at rest, ensuring that your documents remain confidential and compliant with various regulations.

Get more for Federal U S Income Tax Return For Homeowners Associations

Find out other Federal U S Income Tax Return For Homeowners Associations

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple