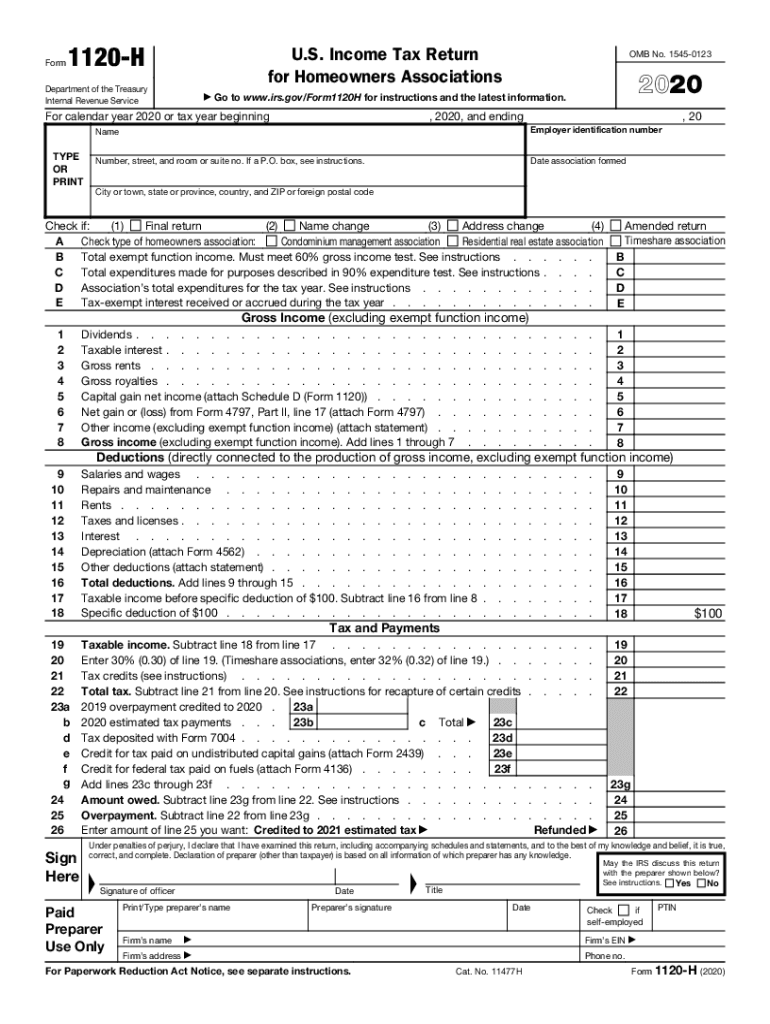

Instructions for Form 1120 H Internal Revenue Service 2020

What is the 1120 Form for Year 2019?

The 1120 form for year 2019 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are taxed separately from their owners. The 1120 form helps the Internal Revenue Service (IRS) assess the corporation's tax liability based on its financial activities during the tax year. Corporations must accurately complete this form to comply with federal tax regulations and avoid penalties.

Steps to Complete the 1120 Form for Year 2019

Completing the 1120 form for year 2019 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income by detailing gross receipts or sales, cost of goods sold, and other income sources.

- Calculate deductions, including operating expenses, salaries, and other allowable costs.

- Determine the taxable income by subtracting total deductions from total income.

- Complete the tax computation section to find the total tax liability.

- Sign and date the form, ensuring that all information is accurate and complete.

Filing Deadlines for the 1120 Form

The deadline for filing the 1120 form for year 2019 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April fifteen, 2020. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can apply for an automatic six-month extension, but they must pay any taxes owed by the original due date to avoid penalties.

Required Documents for the 1120 Form

To complete the 1120 form for year 2019, corporations need to gather various documents, including:

- Financial statements, such as profit and loss statements and balance sheets.

- Records of all income sources, including sales receipts and investment income.

- Documentation of deductions, including payroll records and expense receipts.

- Previous tax returns for reference and accuracy.

Penalties for Non-Compliance with the 1120 Form

Failure to file the 1120 form for year 2019 on time can result in significant penalties. The IRS imposes a penalty for late filing, which is generally calculated based on the number of months the return is overdue. Additionally, if a corporation fails to pay the taxes owed by the due date, interest will accrue on the unpaid amount. This can lead to increased financial liability and potential legal consequences for the corporation.

Digital vs. Paper Version of the 1120 Form

Corporations have the option to file the 1120 form for year 2019 either digitally or via paper submission. Filing electronically can streamline the process, reduce errors, and provide immediate confirmation of receipt by the IRS. Conversely, paper filing may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, it is crucial to ensure that all information is accurate and submitted by the deadline to avoid penalties.

Quick guide on how to complete 2020 instructions for form 1120 h internal revenue service

Prepare Instructions For Form 1120 H Internal Revenue Service effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form 1120 H Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Instructions For Form 1120 H Internal Revenue Service without any hassle

- Locate Instructions For Form 1120 H Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal weight as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Instructions For Form 1120 H Internal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 1120 h internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 1120 h internal revenue service

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the 1120 form for year 2019?

The 1120 form for year 2019 is used by corporations to report their income, gains, losses, and deductions to the IRS. This form captures vital financial information and ensures that corporations comply with federal tax regulations. It's essential for businesses to accurately complete the 1120 form for year 2019 to avoid penalties and to maintain good standing with the IRS.

-

How can airSlate SignNow help with filing the 1120 form for year 2019?

airSlate SignNow simplifies the process of signing and sending the 1120 form for year 2019 electronically. Our platform allows you to easily gather signatures from stakeholders, making it more efficient to submit your form on time. This streamlined process helps ensure that your tax documents are accurately filled out and submitted without unnecessary delays.

-

What features does airSlate SignNow offer for handling the 1120 form for year 2019?

airSlate SignNow provides a user-friendly interface, customizable templates, and robust eSignature capabilities specifically for the 1120 form for year 2019. Additionally, the platform features cloud storage and document tracking, allowing users to manage their tax forms securely and efficiently. These features help ensure that your tax processes run smoothly.

-

Are there any costs associated with using airSlate SignNow for the 1120 form for year 2019?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs regarding the 1120 form for year 2019. Our packages range from basic to premium options, allowing businesses to choose a plan that best fits their budget and requirements. We also provide a free trial to help potential customers assess our services before committing.

-

Can I integrate airSlate SignNow with other software for filing the 1120 form for year 2019?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it ideal for managing the 1120 form for year 2019. You can connect with platforms such as QuickBooks, Xero, and other accounting tools to streamline your workflow. This integration enhances productivity by eliminating redundant tasks.

-

What are the benefits of using airSlate SignNow for the 1120 form for year 2019?

Using airSlate SignNow for the 1120 form for year 2019 offers numerous benefits, including enhanced security, time savings, and improved compliance. Our eSignature solution ensures that all signatures are legally binding, which provides peace of mind for business owners. Additionally, our user-friendly technology allows for faster turnaround times when preparing critical tax documents.

-

Is there customer support available for assistance with the 1120 form for year 2019?

Yes, airSlate SignNow provides excellent customer support to assist users with any questions regarding the 1120 form for year 2019. Our support team is available via chat, email, and phone to help troubleshoot issues or guide you through the process. We're committed to ensuring a smooth experience for all of our users.

Get more for Instructions For Form 1120 H Internal Revenue Service

Find out other Instructions For Form 1120 H Internal Revenue Service

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word