Form 1120 H 2014

What is the Form 1120 H

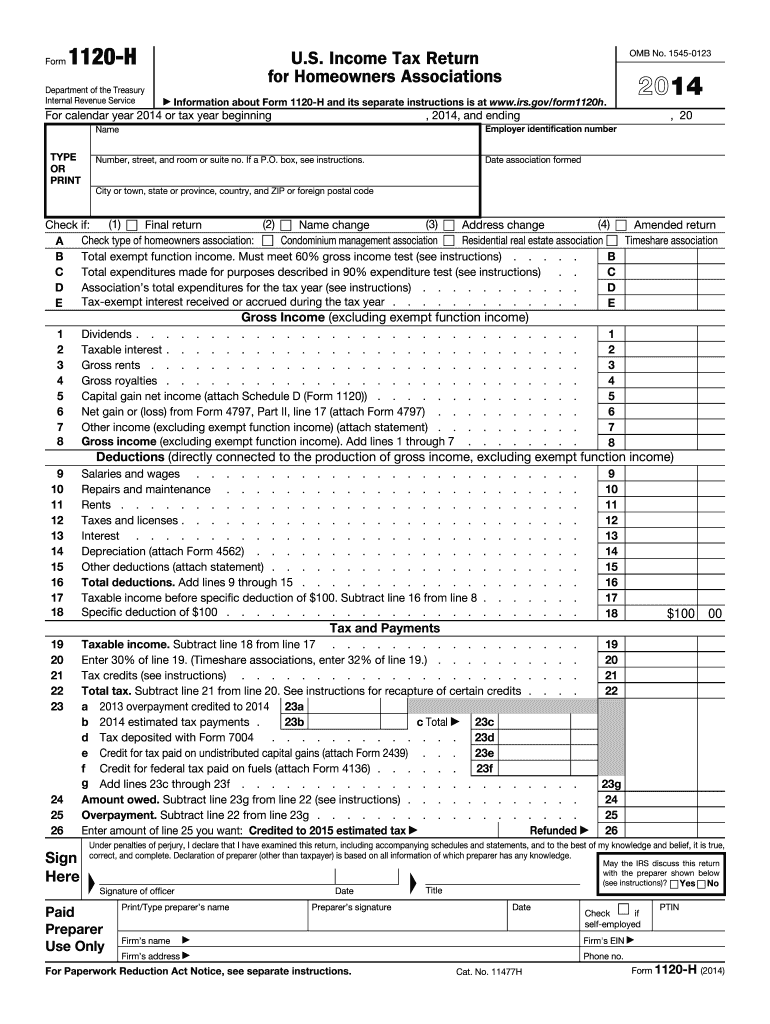

The Form 1120 H is a tax return specifically designed for homeowners associations (HOAs) in the United States. This form allows these organizations to report their income, deductions, and credits to the Internal Revenue Service (IRS). Unlike traditional corporate tax returns, Form 1120 H simplifies the reporting process for HOAs, which typically operate on a non-profit basis. This form is essential for ensuring compliance with federal tax regulations while allowing associations to maintain their tax-exempt status under Section 528 of the Internal Revenue Code.

How to use the Form 1120 H

Using Form 1120 H involves several steps to ensure accurate reporting of financial activities. First, gather all relevant financial documents, including income statements and expense reports. Next, complete the form by entering the HOA's total income, allowable deductions, and credits. It is crucial to follow the instructions provided by the IRS carefully to avoid errors. Once completed, the form must be submitted to the IRS by the designated deadline, typically the 15th day of the fourth month after the end of the HOA's tax year.

Steps to complete the Form 1120 H

Completing Form 1120 H requires attention to detail. Start by identifying the HOA’s tax year and filling in the basic information, such as the organization’s name and address. Next, report total income, which may include membership fees and other revenue sources. After that, list allowable deductions, such as maintenance costs and administrative expenses. Ensure that all figures are accurate and supported by documentation. Finally, review the form for completeness before signing and dating it, as this confirms the accuracy of the information provided.

Legal use of the Form 1120 H

The legal use of Form 1120 H is governed by IRS regulations. Homeowners associations must file this form to maintain their tax-exempt status under Section 528. This status allows them to avoid taxation on certain types of income, provided they adhere to specific guidelines. It is important for HOAs to understand the legal implications of filing this form, as failure to do so can result in penalties or loss of tax-exempt status. Compliance with all IRS requirements ensures that the organization operates within the law and maintains its financial integrity.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120 H are crucial for homeowners associations to avoid penalties. The form is generally due on the 15th day of the fourth month following the end of the HOA's tax year. For associations operating on a calendar year, this typically means the deadline is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is advisable for HOAs to mark their calendars and prepare the form in advance to ensure timely submission.

Required Documents

To complete Form 1120 H accurately, several documents are required. These include financial statements that detail the HOA's income and expenses, bank statements, and any relevant receipts for expenditures. Additionally, documentation supporting any deductions claimed on the form is essential. Keeping organized records throughout the year simplifies the process of gathering these documents at tax time, ensuring that the form is completed accurately and efficiently.

Eligibility Criteria

Eligibility to file Form 1120 H is limited to homeowners associations that meet specific criteria. The organization must be a non-profit entity primarily focused on managing residential properties. Additionally, at least ninety percent of the HOA's gross income must be derived from member fees and assessments related to the maintenance of common areas. Understanding these eligibility requirements is vital for associations to ensure compliance and maintain their tax-exempt status.

Quick guide on how to complete 2014 form 1120 h

Complete Form 1120 H effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers a superb environmentally friendly substitute to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Form 1120 H on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

The easiest way to modify and electronically sign Form 1120 H without hassle

- Locate Form 1120 H and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1120 H and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1120 h

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1120 h

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 1120 H and who needs to file it?

Form 1120 H is a tax form used by homeowners associations to report their income, expenses, and taxes owed to the IRS. It is essential for all homeowners associations that meet specific criteria, such as being organized as a corporation and having annual gross receipts of $100,000 or less. Filing Form 1120 H ensures compliance with federal tax laws and helps associations maintain their tax-exempt status.

-

How can airSlate SignNow help with filing Form 1120 H?

AirSlate SignNow simplifies the process of filing Form 1120 H by allowing users to create, send, and eSign documents securely. With our easy-to-use platform, you can prepare your tax forms efficiently, ensuring all necessary signatures are collected electronically. This streamlines the filing process, helping you meet deadlines without hassle.

-

What features does airSlate SignNow offer for managing Form 1120 H documents?

AirSlate SignNow offers a range of features tailored for managing Form 1120 H documents, including customizable templates, document tracking, and secure storage. These features enable users to create accurate and compliant tax forms while keeping all related documents organized. Additionally, the platform supports eSignature capabilities, ensuring quick approval from necessary parties.

-

Is there a cost associated with using airSlate SignNow for Form 1120 H filings?

Yes, there is a cost associated with using airSlate SignNow for handling Form 1120 H filings, but we offer various pricing plans to fit different needs and budgets. Our plans are designed to be cost-effective, providing excellent value for businesses looking to streamline their document management processes. You can choose a plan based on your usage and access additional features as needed.

-

Can I integrate airSlate SignNow with other software for Form 1120 H management?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to manage your Form 1120 H filings. These integrations allow for automated data transfer, reducing the risk of errors and saving you valuable time. With our API, you can connect to various platforms, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for electronic signatures on Form 1120 H?

Using airSlate SignNow for electronic signatures on Form 1120 H offers several benefits, including faster turnaround times, enhanced security, and improved compliance. Electronic signatures are legally recognized and help expedite the approval process, ensuring timely filing of your tax forms. Plus, our platform provides a secure environment for sensitive documents, giving you peace of mind.

-

How does airSlate SignNow ensure the security of Form 1120 H documents?

AirSlate SignNow prioritizes the security of your Form 1120 H documents by employing advanced encryption protocols and secure data storage solutions. Our platform complies with industry standards for data protection, ensuring that your sensitive information remains confidential and secure. Additionally, we offer features like audit trails and user authentication to further enhance document security.

Get more for Form 1120 H

- Mod sponsored cadet forces application for the award of cadet forces medal or clasps this form supersedes all previous versions

- Mod form 1950

- Character reference form uk

- Mod form 1950 380833890

- Form rcoa

- Infection prevention and control care checklist pulmonary form

- The pensions trust opt out notice tpt org form

- Mod form

Find out other Form 1120 H

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free