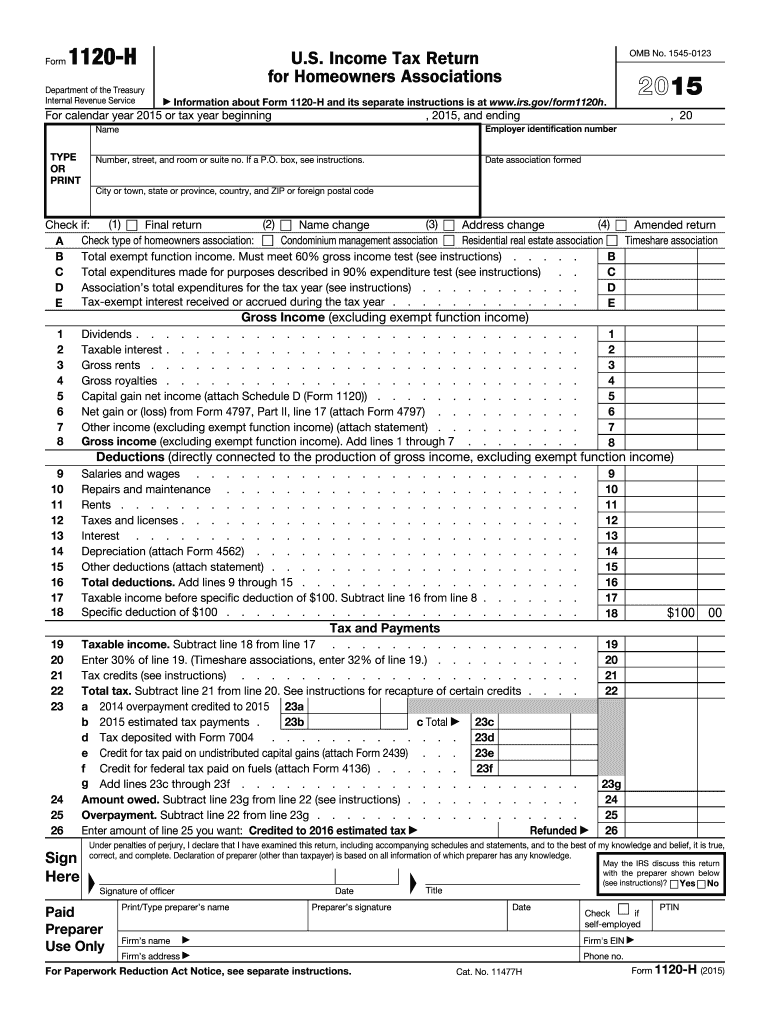

Irs 1120 Form 2015

What is the Irs 1120 Form

The Irs 1120 Form is a federal tax return form used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners, and must file it annually with the Internal Revenue Service (IRS). The information provided on this form helps determine the corporation's tax liability. It is important for businesses to accurately complete the Irs 1120 Form to ensure compliance with tax regulations and avoid potential penalties.

How to use the Irs 1120 Form

To use the Irs 1120 Form effectively, corporations need to gather all relevant financial information for the tax year. This includes income statements, balance sheets, and records of expenses. The form consists of several sections, including income, deductions, and tax computation. Corporations must fill out each section accurately, ensuring that all figures are supported by proper documentation. After completing the form, it should be reviewed for accuracy before submission to the IRS.

Steps to complete the Irs 1120 Form

Completing the Irs 1120 Form involves several key steps:

- Gather financial documents, including income statements and balance sheets.

- Fill out the income section, reporting all revenue earned during the tax year.

- Complete the deductions section, listing all allowable business expenses.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability using the applicable corporate tax rates.

- Sign and date the form, ensuring it is submitted by the deadline.

Legal use of the Irs 1120 Form

The Irs 1120 Form must be used in accordance with IRS regulations to ensure its legal validity. This includes providing accurate and truthful information, as any discrepancies can lead to audits or penalties. Corporations are required to maintain records that support the information reported on the form. Additionally, electronic filing of the Irs 1120 Form is permitted, provided that it complies with the IRS e-filing guidelines, ensuring that the submission is secure and legally binding.

Filing Deadlines / Important Dates

The filing deadline for the Irs 1120 Form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can apply for an extension, allowing an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Irs 1120 Form on time can result in significant penalties. The IRS imposes a late filing penalty based on the number of months the return is overdue. Additionally, if the corporation owes taxes and fails to pay them by the due date, interest will accrue on the unpaid amount. Persistent non-compliance can lead to further legal repercussions, including audits and enforcement actions by the IRS.

Quick guide on how to complete 2015 irs 1120 form

Complete Irs 1120 Form effortlessly on any device

Digital document handling has become increasingly popular among organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Irs 1120 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Irs 1120 Form with ease

- Find Irs 1120 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Irs 1120 Form to guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs 1120 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs 1120 form

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the IRS 1120 Form and why do I need it?

The IRS 1120 Form is a corporate income tax return used by C corporations to report their income, gains, losses, and tax liability. Filing this form is essential for compliance with federal tax regulations, and using airSlate SignNow can streamline the process of signing and submitting your IRS 1120 Form securely and efficiently.

-

How can airSlate SignNow help with filing the IRS 1120 Form?

airSlate SignNow provides an easy-to-use platform that allows you to prepare, sign, and send your IRS 1120 Form electronically. Our service simplifies the document management process, ensuring that you can quickly gather signatures and submit your forms without delays.

-

Is airSlate SignNow a cost-effective solution for managing the IRS 1120 Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a budget-friendly option for managing your IRS 1120 Form. Our pricing includes unlimited document signing, making it convenient for your corporate tax needs.

-

What features does airSlate SignNow offer for IRS 1120 Form management?

With airSlate SignNow, you can enjoy features like customizable templates, in-document signing, and real-time tracking of your IRS 1120 Form. These functionalities enhance your workflow, making it easier to manage tax documents efficiently.

-

Can I integrate airSlate SignNow with my accounting software for IRS 1120 Form preparation?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, allowing you to import data directly into your IRS 1120 Form. This integration minimizes errors and saves time during tax season.

-

Is it safe to use airSlate SignNow for my IRS 1120 Form?

Yes, airSlate SignNow prioritizes your security with advanced encryption and compliance with industry regulations. You can confidently prepare and sign your IRS 1120 Form, knowing that your sensitive information is protected.

-

How does eSigning an IRS 1120 Form with airSlate SignNow work?

eSigning your IRS 1120 Form with airSlate SignNow is quick and straightforward. Simply upload your form, add recipient emails, and send it for signature—recipients will receive a secure link to sign electronically, making the process fast and efficient.

Get more for Irs 1120 Form

Find out other Irs 1120 Form

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template