Form 1120 H U S Income Tax Return for Homeowners Associations 2024

What is the Form 1120 H U S Income Tax Return For Homeowners Associations

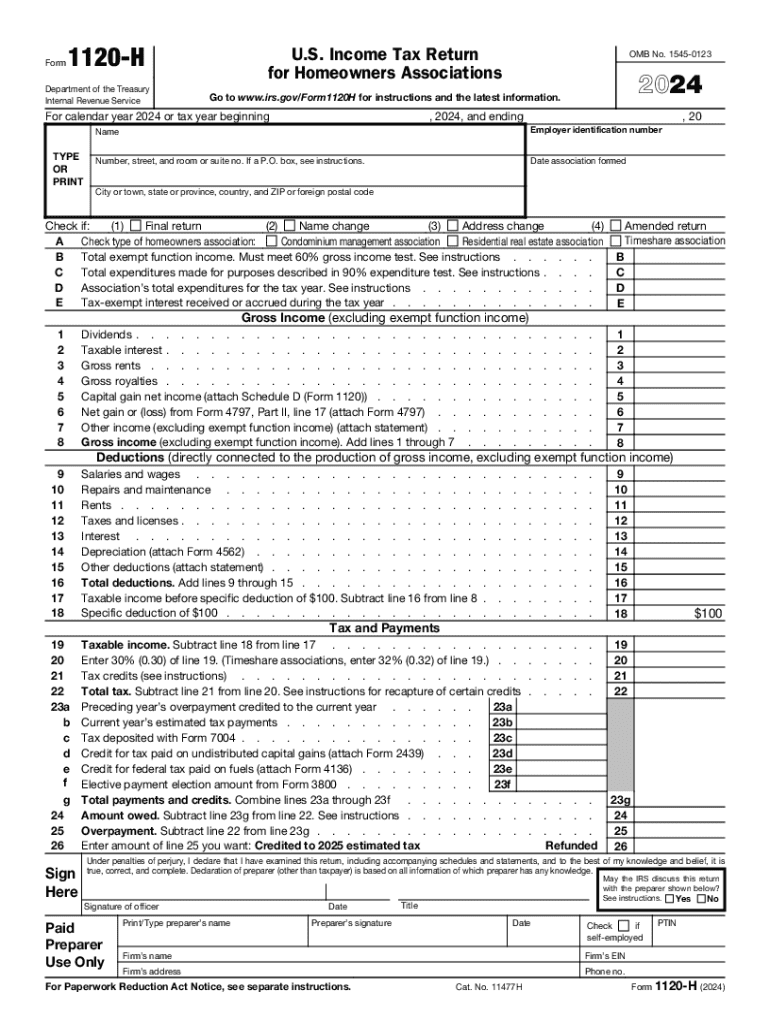

The Form 1120 H is a U.S. income tax return specifically designed for homeowners associations (HOAs) that meet certain criteria. This form allows qualifying associations to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). Unlike other tax forms, Form 1120 H simplifies the filing process for associations that do not engage in significant commercial activities. It is essential for associations seeking to maintain their tax-exempt status under section 528 of the Internal Revenue Code.

How to use the Form 1120 H U S Income Tax Return For Homeowners Associations

To effectively use Form 1120 H, homeowners associations must first determine their eligibility. The form is intended for associations that primarily collect fees from members to maintain common areas and provide services. Once eligibility is confirmed, associations can download the form from the IRS website or obtain a physical copy. It is important to fill out the form accurately, reporting all relevant income and allowable deductions. After completing the form, associations must submit it to the IRS by the designated deadline to avoid penalties.

Steps to complete the Form 1120 H U S Income Tax Return For Homeowners Associations

Completing Form 1120 H involves several key steps:

- Gather financial records: Collect all necessary documentation, including income statements and expense receipts.

- Fill out the form: Begin with basic information about the association, followed by income and deductions. Ensure all entries are accurate and complete.

- Calculate tax liability: Use the information provided to determine the association's tax liability, if applicable.

- Review and sign: Carefully review the completed form for accuracy before signing it. An authorized officer of the association must sign the form.

- Submit the form: File the completed Form 1120 H with the IRS by the due date, either electronically or via mail.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1120 H. Associations must adhere to these guidelines to ensure compliance with tax laws. Key points include maintaining accurate records of income and expenses, understanding the eligibility criteria for filing, and being aware of the deadlines for submission. The IRS also outlines acceptable methods for filing, including electronic submission and paper filing, which associations should follow to avoid delays or penalties.

Filing Deadlines / Important Dates

Homeowners associations must be aware of the filing deadlines for Form 1120 H to avoid penalties. Generally, the form is due on the fifteenth day of the third month following the end of the association’s tax year. For associations operating on a calendar year, this typically means a due date of March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Associations may also request an extension to file, but any taxes owed must still be paid by the original deadline.

Eligibility Criteria

To qualify for filing Form 1120 H, homeowners associations must meet specific eligibility criteria set by the IRS. Primarily, the association must be organized and operated exclusively for the purpose of providing a benefit to its members, such as maintaining common areas. Additionally, the association's income must primarily come from member fees and not from unrelated business activities. Associations that exceed certain income thresholds or engage in substantial commercial activities may need to file a different tax form.

Handy tips for filling out Form 1120 H U S Income Tax Return For Homeowners Associations online

Quick steps to complete and e-sign Form 1120 H U S Income Tax Return For Homeowners Associations online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for optimum straightforwardness. Use signNow to electronically sign and share Form 1120 H U S Income Tax Return For Homeowners Associations for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 h u s income tax return for homeowners associations

Create this form in 5 minutes!

How to create an eSignature for the form 1120 h u s income tax return for homeowners associations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1120 h and who needs it?

Form 1120 H is a tax form specifically designed for homeowners associations (HOAs) to report their income and expenses. If your organization qualifies as a homeowners association under IRS guidelines, you will need to file this form to ensure compliance with tax regulations.

-

How can airSlate SignNow help with filing form 1120 h?

airSlate SignNow streamlines the process of preparing and submitting form 1120 H by allowing users to easily fill out, sign, and send the document electronically. This not only saves time but also reduces the risk of errors, ensuring that your form is submitted accurately and on time.

-

What are the pricing options for using airSlate SignNow for form 1120 h?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan provides access to features that simplify the eSigning process for documents like form 1120 H, making it a cost-effective solution for organizations of all sizes.

-

What features does airSlate SignNow offer for managing form 1120 h?

With airSlate SignNow, users can take advantage of features such as customizable templates, secure eSigning, and document tracking. These tools enhance the efficiency of managing form 1120 H, ensuring that all necessary signatures are collected promptly and securely.

-

Is airSlate SignNow compliant with IRS regulations for form 1120 h?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that your form 1120 H is handled securely and in accordance with legal standards. This compliance gives users peace of mind when submitting sensitive tax documents electronically.

-

Can I integrate airSlate SignNow with other software for filing form 1120 h?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your form 1120 H alongside your other financial documents. This seamless integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for form 1120 h?

Using airSlate SignNow for form 1120 H provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, allowing you to focus on your organization's financial health rather than administrative tasks.

Get more for Form 1120 H U S Income Tax Return For Homeowners Associations

Find out other Form 1120 H U S Income Tax Return For Homeowners Associations

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer