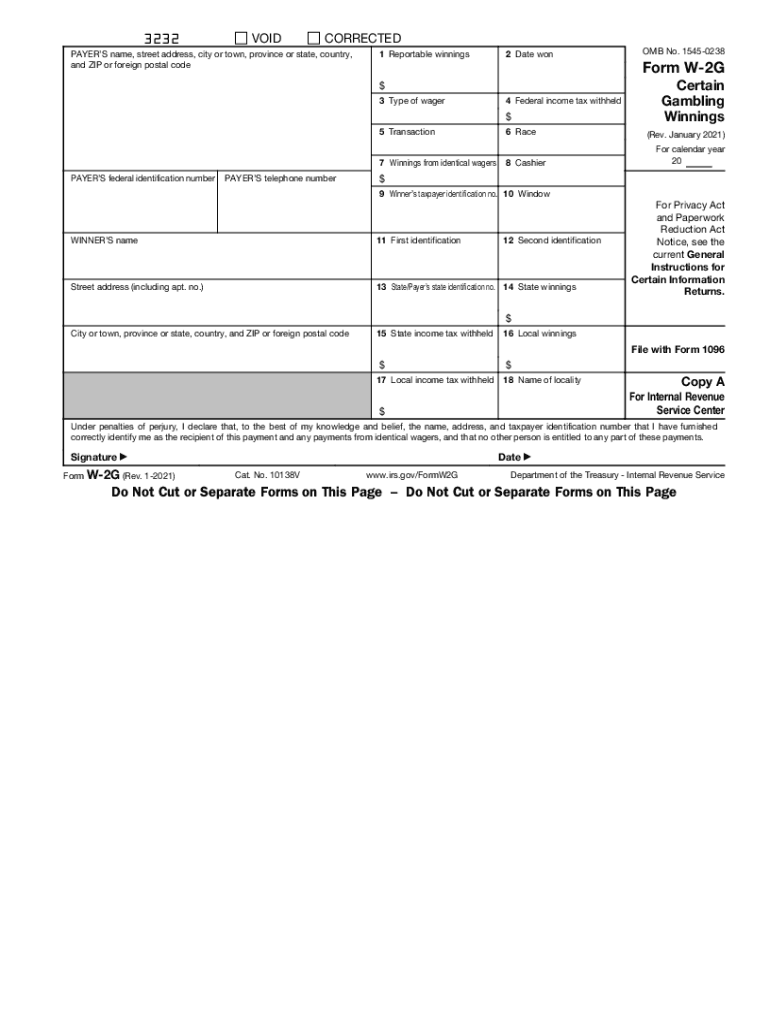

W2g Form 2021

What is the W-2G Form

The W-2G form, officially known as the "Certain Gambling Winnings" form, is used in the United States to report gambling winnings to the Internal Revenue Service (IRS). This form is typically issued by casinos, racetracks, and other gambling establishments when a player wins a certain amount of money, which is generally $600 or more, and the winnings are at least 300 times the amount of the wager. The W-2G form provides essential information for both the taxpayer and the IRS regarding the amount won and any taxes withheld. It is crucial for individuals to report their gambling winnings accurately to avoid penalties and ensure compliance with tax regulations.

How to Obtain the W-2G Form

Individuals can obtain the W-2G form directly from the gambling establishment where they won the money. Most casinos and racetracks provide this form at the time of payout for qualifying winnings. Additionally, taxpayers can download a blank W-2G form from the IRS website or request a copy from their tax preparer. It is essential to ensure that the form is filled out correctly and completely to avoid any issues during tax filing.

Steps to Complete the W-2G Form

Completing the W-2G form involves several key steps:

- Gather Information: Collect all relevant details, including the date of the winnings, the type of gambling, and the total amount won.

- Fill Out the Form: Enter your name, address, and Social Security number. Also, provide the gambling establishment's name and address, along with the amount won and any taxes withheld.

- Review for Accuracy: Double-check all entries for accuracy to ensure compliance with IRS regulations.

- Submit the Form: Depending on your situation, you may need to submit the W-2G form along with your tax return or keep it for your records.

Legal Use of the W-2G Form

The W-2G form serves a vital legal purpose in the realm of taxation. It is used to report gambling winnings, which are considered taxable income. By law, any gambling winnings that meet the reporting threshold must be reported to the IRS. Failure to report these winnings can lead to penalties and interest on unpaid taxes. Additionally, the form helps establish a record of income for the taxpayer, which is important for accurate tax filing and compliance with federal regulations.

IRS Guidelines

The IRS has specific guidelines regarding the reporting of gambling winnings. According to IRS regulations, all gambling winnings must be reported on your tax return, even if you do not receive a W-2G form. This includes winnings from lotteries, raffles, and other gambling activities. The IRS also allows taxpayers to deduct gambling losses, but only to the extent of their gambling winnings. It is important to maintain accurate records of both winnings and losses to support your claims during tax filing.

Filing Deadlines / Important Dates

When it comes to filing taxes that include gambling winnings reported on the W-2G form, it is important to adhere to IRS deadlines. Generally, the tax filing deadline for individuals is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for additional time. Keeping track of these dates is crucial to avoid late fees and penalties.

Quick guide on how to complete w2g form 2021

Effortlessly complete W2g Form on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, enabling you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage W2g Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest method to modify and electronically sign W2g Form with ease

- Obtain W2g Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow portions of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign W2g Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w2g form 2021

Create this form in 5 minutes!

How to create an eSignature for the w2g form 2021

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the form W2G 2018 and why is it important?

The form W2G 2018 is used to report gambling winnings to the IRS. Understanding this form is crucial for both taxpayers and businesses, as it ensures correct tax reporting and compliance with federal regulations.

-

How can airSlate SignNow help with eSigning the form W2G 2018?

airSlate SignNow provides a seamless platform for eSigning the form W2G 2018. With our intuitive interface, users can quickly upload, sign, and send their documents securely and efficiently, streamlining the entire process.

-

What features does airSlate SignNow offer for managing the form W2G 2018?

airSlate SignNow offers several features tailored for managing the form W2G 2018, including customizable templates, automated workflows, and secure storage. These features help users complete their tax documentation efficiently and without hassle.

-

Is there a free trial available for airSlate SignNow when handling form W2G 2018?

Yes, airSlate SignNow offers a free trial that allows users to explore its features when handling the form W2G 2018. This is a great opportunity for potential customers to test the platform's capabilities before committing to a subscription.

-

Can I integrate airSlate SignNow with other applications for the form W2G 2018?

Absolutely! airSlate SignNow readily integrates with various applications, such as Google Drive and Dropbox, making it easier to manage and share your form W2G 2018. These integrations enhance productivity and ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for form W2G 2018 management?

Using airSlate SignNow for form W2G 2018 management offers numerous benefits, including enhanced security, time savings, and improved accuracy. Our platform helps users minimize the risk of error and ensure their filings comply with IRS requirements.

-

How secure is airSlate SignNow when dealing with sensitive information like form W2G 2018?

airSlate SignNow prioritizes security, employing advanced encryption methods and secure cloud storage, ensuring sensitive information, such as the form W2G 2018, is protected. This gives users peace of mind when managing their important documents.

Get more for W2g Form

- Financial account transfer to living trust idaho form

- Assignment to living trust idaho form

- Notice of assignment to living trust idaho form

- Idaho trust form

- Letter to lienholder to notify of trust idaho form

- Idaho timber sale contract idaho form

- Idaho forest products timber sale contract idaho form

- Right of way 497305725 form

Find out other W2g Form

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form