W 2g Form 2017

What is the W-2G Form

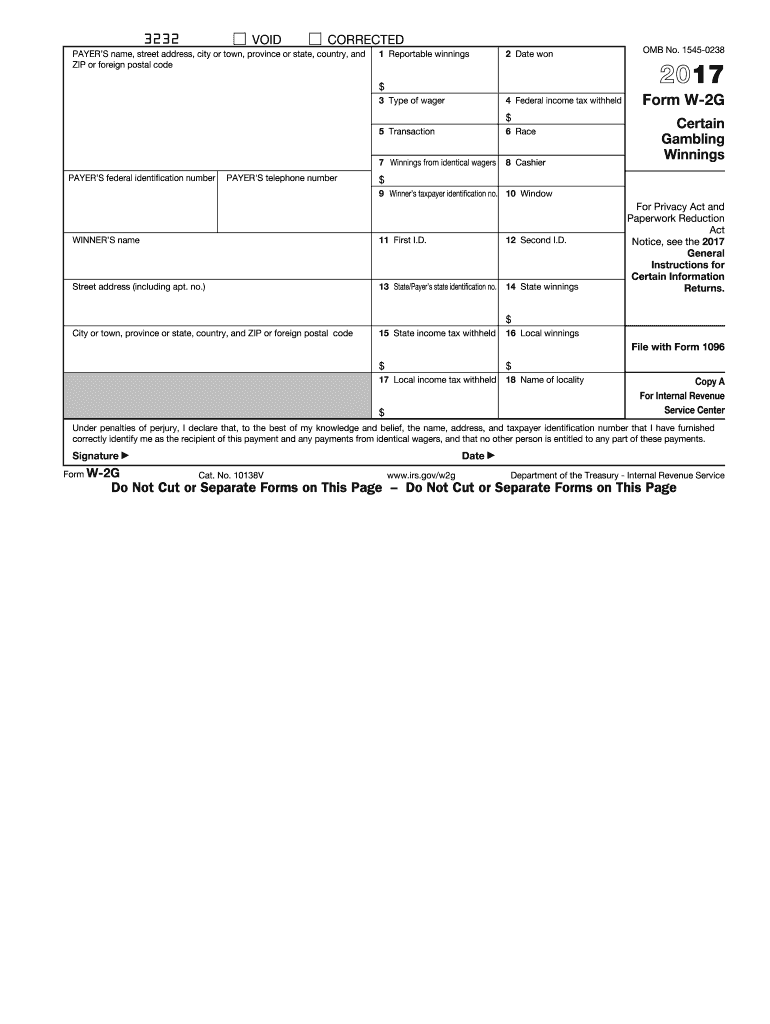

The W-2G Form is an official document used in the United States to report gambling winnings to the Internal Revenue Service (IRS). This form is required when a player wins a certain amount of money from gambling activities, including lotteries, raffles, and other games of chance. Specifically, the W-2G is issued when winnings exceed specific thresholds, which can vary based on the type of gambling. The form provides essential details about the winnings, including the amount won, the type of gambling, and any taxes withheld.

How to use the W-2G Form

Using the W-2G Form involves several steps. First, ensure that you receive the form from the gambling establishment if your winnings meet the reporting threshold. Once you have the form, review the information for accuracy, including your name, Social Security number, and the amount won. You will need to report this information on your tax return. If taxes were withheld from your winnings, this will also be indicated on the form, which can affect your overall tax liability.

Steps to complete the W-2G Form

Completing the W-2G Form requires careful attention to detail. Here are the steps to follow:

- Gather information: Collect your personal details, including your name, address, and Social Security number.

- Check the form: Ensure that the gambling establishment has filled out the form correctly, including the amount won and any taxes withheld.

- Report your winnings: When filing your tax return, report the winnings as indicated on the W-2G Form.

- Keep a copy: Retain a copy of the W-2G Form for your records, as you may need it for future reference or audits.

Legal use of the W-2G Form

The W-2G Form is legally binding and must be used according to IRS regulations. It serves as a formal record of gambling winnings and is essential for accurate tax reporting. Failure to report winnings as indicated on the W-2G can lead to penalties and interest charges from the IRS. It is important to understand the legal implications of this form and ensure that all information is reported accurately during tax season.

Filing Deadlines / Important Dates

Filing deadlines for the W-2G Form align with the general tax filing deadlines in the United States. Typically, taxpayers must file their federal income tax returns by April 15 of each year. If you received a W-2G Form, it is important to include it with your tax return by this deadline to avoid any penalties. Additionally, if you need to file for an extension, ensure that you still report any gambling winnings as required.

Who Issues the Form

The W-2G Form is issued by the gambling establishment where the winnings occurred. This could include casinos, racetracks, or lottery organizations. These entities are responsible for providing the form to winners when their winnings exceed the reporting threshold. It is essential to ensure that you receive the W-2G Form from the issuer, as it is necessary for accurate tax reporting.

Quick guide on how to complete w 2g 2017 form

Complete W 2g Form effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle W 2g Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign W 2g Form without effort

- Find W 2g Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign W 2g Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 2g 2017 form

Create this form in 5 minutes!

How to create an eSignature for the w 2g 2017 form

How to make an eSignature for your W 2g 2017 Form online

How to create an electronic signature for your W 2g 2017 Form in Chrome

How to generate an electronic signature for putting it on the W 2g 2017 Form in Gmail

How to make an electronic signature for the W 2g 2017 Form straight from your smart phone

How to generate an eSignature for the W 2g 2017 Form on iOS devices

How to create an eSignature for the W 2g 2017 Form on Android devices

People also ask

-

What is a W 2g Form and why is it important?

The W 2g Form is a tax document used to report gambling winnings and any federal income tax withheld on those winnings. It's important for individuals who have received gambling winnings to accurately file this form to comply with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help with the W 2g Form?

With airSlate SignNow, you can easily create, send, and eSign your W 2g Form electronically. This streamlines the process, ensuring that your tax documents are completed accurately and submitted on time, all while maintaining a secure and user-friendly experience.

-

Is there a cost associated with using airSlate SignNow for the W 2g Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses. Our cost-effective solutions ensure that you can manage your W 2g Form efficiently without breaking the bank, with options for both small businesses and larger enterprises.

-

Can I integrate airSlate SignNow with other applications for my W 2g Form management?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to manage your W 2g Form alongside your existing workflows. This integration capability enhances your productivity by connecting your document signing process with your preferred tools.

-

What features does airSlate SignNow offer for managing the W 2g Form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSignature functionality for your W 2g Form. These features make it easy to create, edit, and send your tax documents while ensuring compliance and security.

-

How secure is the eSigning process for the W 2g Form with airSlate SignNow?

The eSigning process for the W 2g Form with airSlate SignNow is highly secure, utilizing encryption and compliance with industry standards. This ensures that your sensitive tax information remains protected throughout the signing process, giving you peace of mind.

-

What benefits does airSlate SignNow provide for businesses handling W 2g Forms?

Using airSlate SignNow to handle your W 2g Forms offers numerous benefits, including reduced turnaround times, improved accuracy, and enhanced security. By digitizing the process, businesses can save time and resources while ensuring that their tax documents are managed efficiently.

Get more for W 2g Form

- 2012 form 4548

- Src proposal form 2000 san francisco bay area science fair sfbasf

- Phs 1637 form

- Printable nursing home evaluation form legacy lawyers

- Home loan form nri_a42_210607qxd

- Grant application da davidson amp co form

- Application for graduate assistantships fordham form

- Lost stolen county property report name department form

Find out other W 2g Form

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT