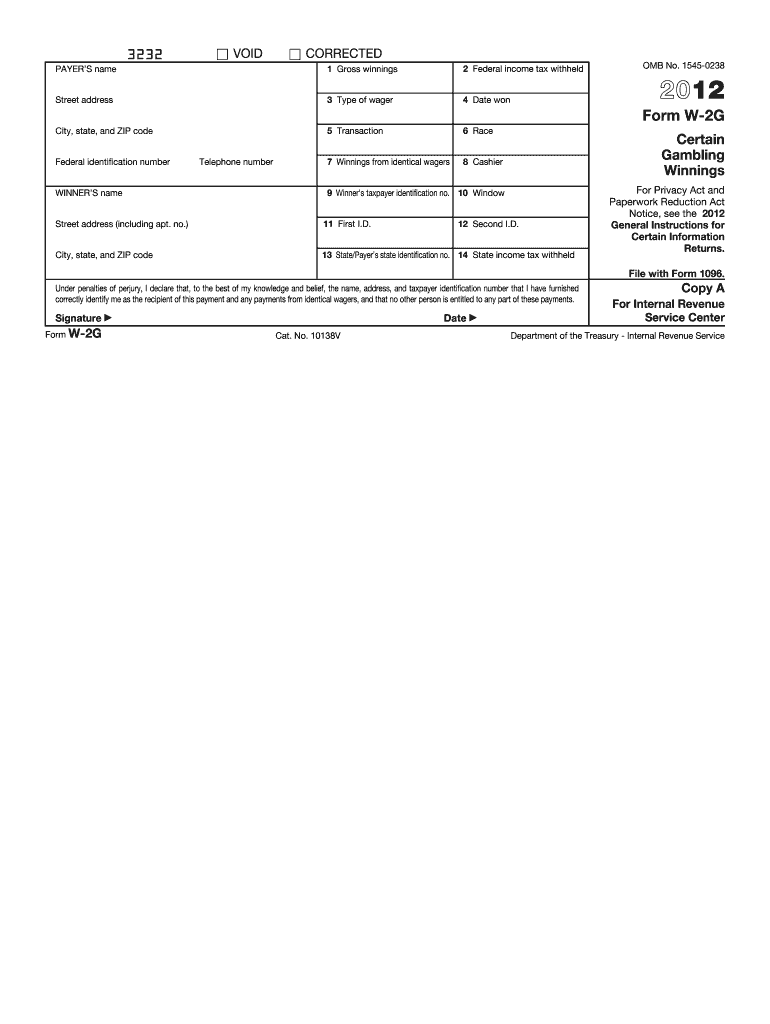

W2g Form 2012

What is the W2g Form

The W2g Form is a tax document used in the United States to report gambling winnings. It is issued by casinos, racetracks, and other gambling establishments when a player wins a substantial amount, typically over a certain threshold. The form includes details such as the winner's name, address, Social Security number, and the amount won. It is essential for tax purposes, as gambling winnings are considered taxable income by the Internal Revenue Service (IRS).

How to use the W2g Form

To utilize the W2g Form effectively, recipients must first ensure they receive it from the gambling establishment after winning. Once obtained, the form should be carefully reviewed for accuracy. Players must then report the winnings on their tax return, typically using Form 1040. It is crucial to keep a copy of the W2g Form for personal records, as it may be required for future reference or audits by the IRS.

Steps to complete the W2g Form

Completing the W2g Form involves several straightforward steps:

- Obtain the form from the gambling establishment.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the amount won and any applicable withholding amounts.

- Review the form for accuracy before submission.

It is advisable to consult a tax professional if there are any uncertainties regarding the completion of the form.

Legal use of the W2g Form

The W2g Form serves a legal purpose by ensuring that gambling winnings are reported to the IRS. It is important to understand that failing to report these winnings can lead to penalties and interest charges. The form must be filed accurately and on time to comply with federal tax laws. Additionally, the form provides documentation that can be crucial in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the W2g Form align with the annual tax return deadlines. Generally, taxpayers must file their tax returns by April 15 of the following year. It is important to keep track of any changes in deadlines, as they may vary based on specific circumstances, such as weekends or holidays. Ensuring timely filing helps avoid penalties and interest on unpaid taxes.

Who Issues the Form

The W2g Form is issued by gambling establishments, including casinos, racetracks, and online gambling sites. These entities are required to provide the form to winners when their winnings exceed the established reporting thresholds. Players should ensure they receive this form promptly after their win, as it is essential for accurate tax reporting.

Penalties for Non-Compliance

Failure to report gambling winnings using the W2g Form can result in significant penalties. The IRS may impose fines for underreporting income or failing to file altogether. Additionally, interest may accrue on any unpaid taxes related to unreported winnings. To avoid these consequences, it is crucial to accurately report all gambling income on tax returns.

Quick guide on how to complete 2012 w2g form

Manage W2g Form seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as it allows you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle W2g Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign W2g Form effortlessly

- Locate W2g Form and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to apply your changes.

- Select your preferred method of delivering your form, via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign W2g Form and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 w2g form

Create this form in 5 minutes!

How to create an eSignature for the 2012 w2g form

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is a W2g Form?

A W2g Form is a tax document used to report gambling winnings and any tax withheld on those winnings. It's essential for taxpayers to ensure they report this income accurately. Using airSlate SignNow, you can easily eSign your W2g Form and expedite your tax filing process.

-

How does airSlate SignNow simplify the W2g Form signing process?

airSlate SignNow allows users to eSign the W2g Form electronically, eliminating the need for printing, signing, and scanning. This makes the signing process faster and more efficient. Our platform is user-friendly, ensuring you can complete your W2g Form without hassle.

-

Are there any costs associated with using airSlate SignNow for the W2g Form?

airSlate SignNow offers various pricing plans to cater to different business needs. You can choose a plan that suits your requirements for managing documents such as the W2g Form. Check our website for specific pricing details and potential free trial options.

-

What features does airSlate SignNow offer for managing the W2g Form?

With airSlate SignNow, you can enjoy features like document templates, automatic reminders, and real-time tracking when managing the W2g Form. These features help streamline the signing process, ensuring that all parties can complete the form efficiently.

-

Can I integrate airSlate SignNow with other applications when handling the W2g Form?

Yes, airSlate SignNow offers various integrations with popular applications, enhancing your workflow for the W2g Form. You can connect it with CRMs, cloud storage services, and more to facilitate easy document management. This ensures that your eSigning experience is seamless.

-

What are the benefits of using airSlate SignNow for eSigning the W2g Form?

The primary benefits of using airSlate SignNow for eSigning the W2g Form include time-saving, cost-effectiveness, and enhanced security. You can sign documents from anywhere, ensuring you don’t delay your tax filings while maintaining compliance and security.

-

Is airSlate SignNow secure for signing sensitive documents like the W2g Form?

Absolutely! airSlate SignNow employs industry-standard security measures, including encryption and secure cloud storage, to protect sensitive documents like the W2g Form. You can trust that your information is safe while using our platform for electronic signatures.

Get more for W2g Form

Find out other W2g Form

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online