Form W2g 2016

What is the Form W-2G

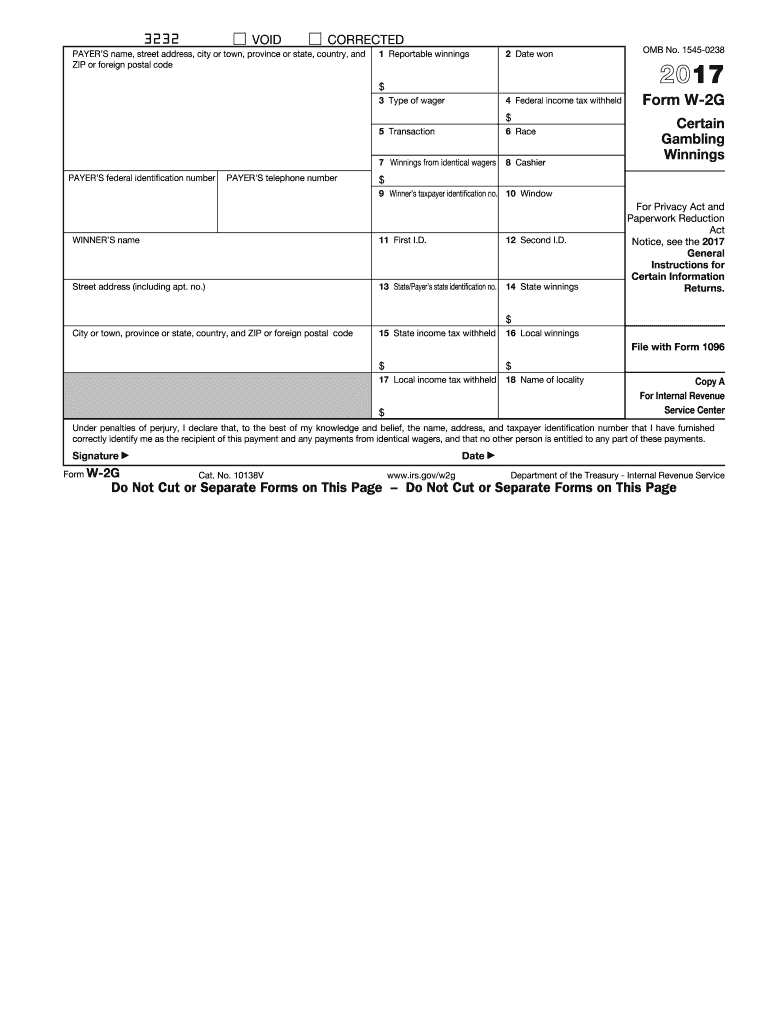

The Form W-2G is a tax form used in the United States to report gambling winnings. This form is required to be filed by casinos and other gambling establishments when a player wins a certain amount of money. Specifically, the form is issued when winnings exceed $600 and are at least 300 times the amount of the wager. The Form W-2G provides important information for both the taxpayer and the IRS, ensuring that gambling income is accurately reported and taxed appropriately.

How to use the Form W-2G

To use the Form W-2G, individuals must first receive it from the gambling establishment where they won money. This form includes details such as the amount won, the type of gambling, and any federal income tax withheld. Taxpayers should include the information from the W-2G when preparing their income tax returns. It is essential to keep this form for record-keeping purposes, as it serves as proof of gambling income and any taxes that may have been withheld.

Steps to complete the Form W-2G

Completing the Form W-2G involves several straightforward steps:

- Obtain the form from the gambling establishment or download it from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the details of your winnings, including the amount won and the type of gambling.

- Indicate any federal income tax withheld from your winnings.

- Review the form for accuracy and ensure all required fields are completed.

Legal use of the Form W-2G

The legal use of the Form W-2G is crucial for compliance with IRS regulations. Gambling establishments are legally obligated to issue this form when certain thresholds are met. Taxpayers must report their winnings as income on their tax returns, and failing to do so can lead to penalties. Additionally, the form serves as documentation for any taxes withheld, which can be claimed as a credit on the taxpayer's return. Understanding the legal implications of the W-2G is essential for ensuring accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines related to the Form W-2G are important for taxpayers to keep in mind. Generally, gambling establishments must provide the W-2G to winners by January 31 of the year following the winnings. Taxpayers should include the information from the W-2G when filing their federal income tax returns, which are typically due by April 15. It is advisable to keep track of these dates to avoid any late filing penalties.

Who Issues the Form W-2G

The Form W-2G is issued by gambling establishments, including casinos, racetracks, and lottery organizations. These entities are responsible for reporting winnings to both the IRS and the winners themselves. It is important for players to ensure they receive this form if their winnings meet the reporting thresholds, as it is essential for accurate tax reporting.

Quick guide on how to complete 2016 form w2g

Effortlessly Prepare Form W2g on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form W2g on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and Electronically Sign Form W2g with Ease

- Find Form W2g and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Adjust and eSign Form W2g and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form w2g

Create this form in 5 minutes!

How to create an eSignature for the 2016 form w2g

How to create an electronic signature for the 2016 Form W2g in the online mode

How to make an electronic signature for the 2016 Form W2g in Chrome

How to make an electronic signature for signing the 2016 Form W2g in Gmail

How to make an eSignature for the 2016 Form W2g right from your mobile device

How to make an eSignature for the 2016 Form W2g on iOS devices

How to make an electronic signature for the 2016 Form W2g on Android OS

People also ask

-

What is Form W2g?

Form W2g is a tax form used to report gambling winnings to the IRS. If you receive $600 or more in winnings, it's essential to submit Form W2g when filing your taxes. Utilizing airSlate SignNow can help streamline the process of sending and eSigning this form securely.

-

How do I fill out Form W2g using airSlate SignNow?

Filling out Form W2g using airSlate SignNow is straightforward. You can upload the form, fill in the necessary details, and then send it for eSignature. Our user-friendly platform ensures you can manage your forms efficiently and accurately.

-

Are there any costs associated with using airSlate SignNow for Form W2g?

airSlate SignNow offers a cost-effective pricing model that suits various business needs. There are plans available that provide unlimited eSignatures, making it affordable to manage multiple Form W2g submissions throughout the tax year. You can explore our pricing options to find the best fit for your organization.

-

Is airSlate SignNow compliant with tax regulations when using Form W2g?

Yes, airSlate SignNow is designed to be compliant with various regulatory standards, including those related to tax documentation like Form W2g. Our platform uses secure encryption technologies to protect sensitive information, ensuring your compliance and peace of mind when submitting tax forms.

-

What features does airSlate SignNow offer for managing Form W2g?

airSlate SignNow provides a robust set of features tailored for managing Form W2g. These include easy document upload, seamless eSigning, tracking options, and customizable templates. Additionally, the platform allows you to manage multiple users and permissions for added convenience.

-

Can I integrate airSlate SignNow with other tools for Form W2g management?

Yes, airSlate SignNow integrates seamlessly with a variety of tools, enhancing your Form W2g management process. You can connect it with popular applications like Salesforce, Google Drive, and more, allowing for efficient document flow and collaboration. These integrations help streamline your workflow and save time.

-

How secure is the submission of Form W2g through airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting Form W2g, all data is encrypted, and we comply with industry standards to protect your information. You can rest assured that your tax documents remain confidential and secure during the eSignature process.

Get more for Form W2g

Find out other Form W2g

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT