Fillable Form W 2G 2023-2026

What is the Fillable Form W-2G

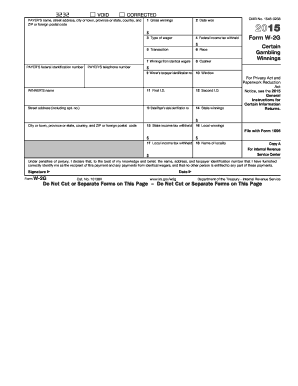

The Fillable Form W-2G is an official document used in the United States to report gambling winnings. This form is issued by the Internal Revenue Service (IRS) and is required for reporting certain types of gambling income, including winnings from lotteries, horse races, and casinos. The form also captures information about the amount won, the type of gambling activity, and any federal income tax withheld. It is essential for taxpayers to accurately report this income as part of their annual tax return.

How to use the Fillable Form W-2G

Using the Fillable Form W-2G involves several straightforward steps. First, obtain the form from the IRS website or through a tax professional. Once you have the form, you will need to fill in your personal information, including your name, address, and Social Security number. Next, provide details about your gambling winnings, including the amount won and any taxes withheld. After completing the form, ensure that all information is accurate before submitting it to the IRS, typically along with your tax return.

Steps to complete the Fillable Form W-2G

Completing the Fillable Form W-2G requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or access it through compatible software.

- Enter your personal information in the designated fields, including your name and Social Security number.

- Specify the type of gambling activity and the amount of winnings.

- Indicate any federal income tax withheld from your winnings.

- Review the completed form for accuracy.

- Submit the form along with your tax return or directly to the IRS, as required.

Key elements of the Fillable Form W-2G

The Fillable Form W-2G includes several key elements that are essential for accurate reporting. These elements comprise:

- Taxpayer Information: This section captures the name, address, and Social Security number of the taxpayer.

- Gambling Information: Details about the type of gambling, the amount won, and the date of the winnings.

- Tax Withholding: Information regarding any federal income tax that has been withheld from the winnings.

- Issuer Information: The name and address of the entity that issued the form.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Fillable Form W-2G. According to IRS regulations, taxpayers must report gambling winnings if the amount exceeds a certain threshold, which varies depending on the type of gambling. Additionally, the IRS requires that any federal income tax withheld must be reported accurately. It is important for taxpayers to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Form W-2G align with the general tax filing deadlines in the United States. Typically, the form must be submitted by April fifteenth of the following year after the winnings were received. If you are filing your tax return electronically, ensure that the W-2G is included in your submission. It is advisable to keep track of any updates from the IRS regarding changes to deadlines or filing procedures.

Create this form in 5 minutes or less

Find and fill out the correct fillable form w 2g

Create this form in 5 minutes!

How to create an eSignature for the fillable form w 2g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fillable Form W 2G?

A Fillable Form W 2G is a tax form used to report gambling winnings and any federal income tax withheld on those winnings. This form allows users to easily input their information and submit it electronically, streamlining the tax reporting process.

-

How can I create a Fillable Form W 2G using airSlate SignNow?

Creating a Fillable Form W 2G with airSlate SignNow is simple. You can start by selecting the template for the W 2G form, fill in the required fields, and customize it as needed. Once completed, you can save and share the form for eSigning.

-

Is there a cost associated with using the Fillable Form W 2G feature?

Yes, airSlate SignNow offers various pricing plans that include access to the Fillable Form W 2G feature. The cost depends on the plan you choose, which can accommodate different business needs and sizes, ensuring a cost-effective solution.

-

What are the benefits of using a Fillable Form W 2G?

Using a Fillable Form W 2G simplifies the process of reporting gambling winnings. It reduces errors, saves time, and ensures compliance with tax regulations. Additionally, it allows for easy electronic submission, making tax season less stressful.

-

Can I integrate the Fillable Form W 2G with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications. This means you can easily connect your Fillable Form W 2G with accounting software or other tools to streamline your workflow and enhance productivity.

-

Is the Fillable Form W 2G secure?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Fillable Form W 2G and all documents are protected with advanced encryption and secure storage. You can confidently manage sensitive information without worrying about data bsignNowes.

-

Can I track the status of my Fillable Form W 2G?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Fillable Form W 2G. You will receive notifications when the form is viewed, signed, or completed, keeping you informed throughout the process.

Get more for Fillable Form W 2G

- Pdf royal oak dog park application downtown royal oak form

- Vp 249 affidavit of acknowlegement for a power of attorney form

- Vp 015 vehicle inspection certificate 650585839 form

- Nevada residency certification form

- 555 wright way carson city nv 897110700 renospar form

- Copy request form

- Www longisland combusinessgarden city policegarden city police department long island form

- City planning commission disposition sheet sara av form

Find out other Fillable Form W 2G

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free